- 📈👀 CEO Watcher

- Posts

- Top insider trades (Fri, Feb 6)

Top insider trades (Fri, Feb 6)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

There were 184 new insider trades filed, and we had a lot of very interesting trades/dip buys come in.

Four insider trades were flagged as High Signal, and two new stocks were added to the CEO Watcher Portfolio. CEO Watcher Premium subs can see those in the Trade Notes section of this email or the CEO Watcher Premium Dashboard that is linked in the Data Dump section.

As a reminder, if you upgrade to CEO Watcher Premium (link) and find that it isn’t for you, I’ll give you a refund.

A director at Galaxy Digital (GLXY) bought $520k of the stock. This was their 3rd purchase since November.

The CEO at Lumen Technologies (LUMN) bought $500k of the stock after the post-earnings dip. Only increased their holdings by 0.66%, but the stock is down 30% in the last week.

The CEO and a Director bought the post-earnings dip at Cavco Industries (CVCO). It’s the first purchase ever for both, and another director bought the stock yesterday.

A Director at The Bancorp (TBBK) bought $300k of the stock (largest purchase ever, out of 7). The stock is down ~15% after earnings, but it’s still trading at its highest ever P/TBV.

The EVP of GBUL Borrow at SoFi (SOFI) bought $100k of the stock. The stock is down 30% in the last month.

A director at Paychex (PAYX) bought $100k of the stock. This is a reversal from three straight sales since 2020. A second director also bought the stock. The stock is down 30% in the last six months.

Saba Capital continues buying ASA Gold and Precious Metals (ASA)

SGF FANG Holdings sold $332M of Diamondback Energy (FANG). Looks like this was scheduled at the end of last year.

AE Red Holdings continues to sell Redwire (RDW). Now $435M in sales in 2026

Susan Ocampo sells $23M of MACOM Technology (MTSI). It’s not part of a 10b5-1 plan, but she has been consistently selling for years.

The CEO at HCA Healthcare (HCA) sold $21.5M of the stock . It’s his first sale since 2021

The Chief Business Officer at Micron (MU) sold $10.75M

The SVP of Global Sales at Viavi Solutions (VIAV) sold $580k.

and more…

Commentary

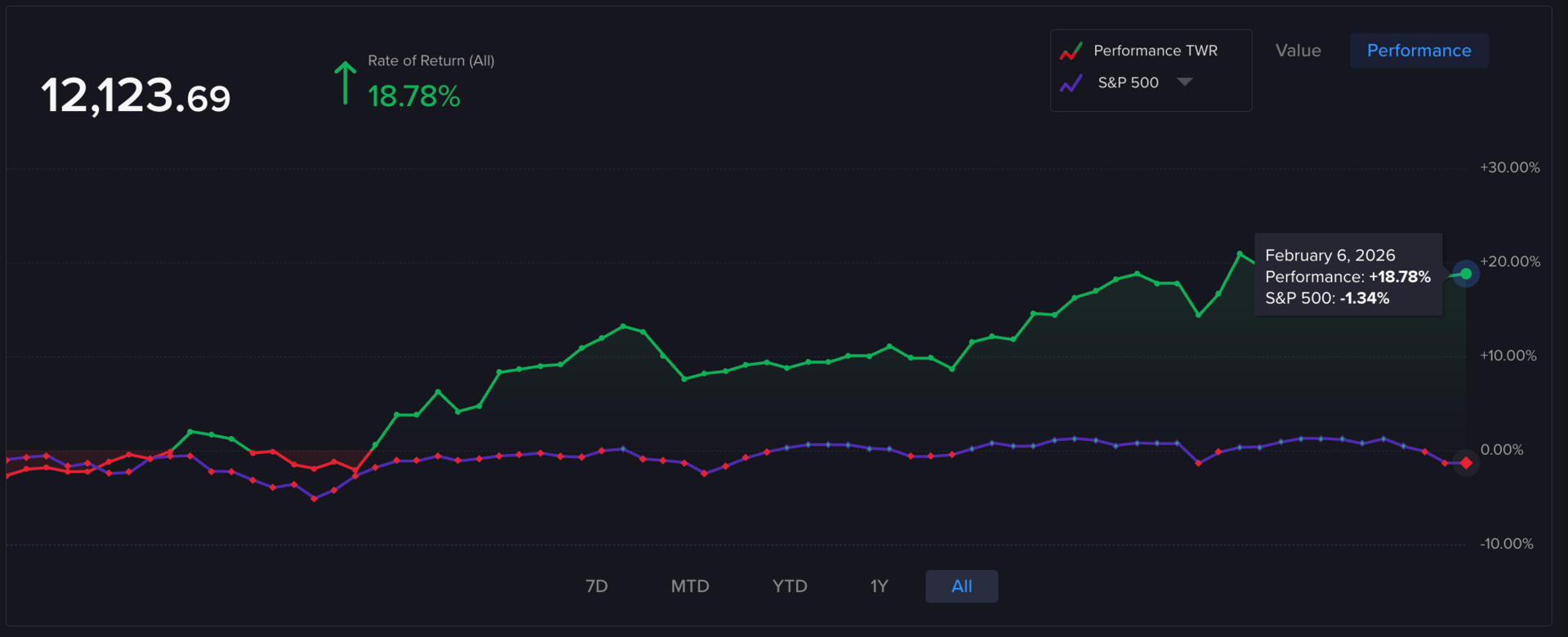

This week was one of the better weeks of outperformance for the CEO Watcher Portfolio that we’ll see.

We are currently up 3.29% v -2.03% for the S&P.

We talked about this in yesterday’s email (link), but this week really demonstrated some of the benefits of copying High Signal Insider Trades.

Insiders are value investors who rarely buy tech stocks, so you end up with a portfolio of value stocks that the insiders believe are undervalued in sectors like industrials, basic materials, medical devices, consumer, financials, etc.

And the best part is, insiders still outperform the S&P on average even without buying tech stocks!

The CEO Watcher Portfolio is now back above 20 points of outperformance versus the S&P since we started it at the end of October.

As a reminder, CEO Watcher Premium subscribers can always see the portfolio holdings in the Data Dump section at the bottom of this email. If you upgrade to CEO Watcher Premium (link) and find that it isn’t for you, I’ll give you a refund.

—

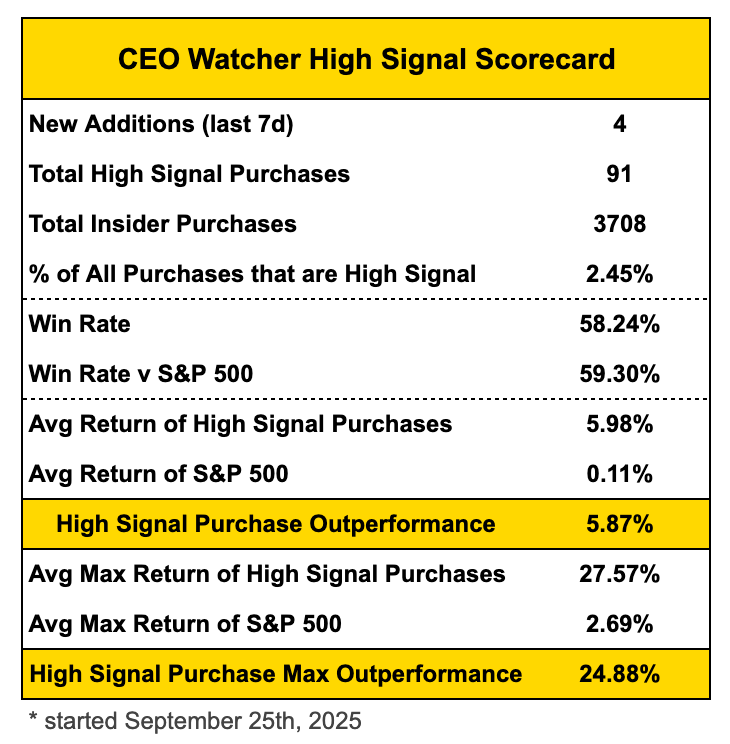

The High Signal Watchlist crossed 90 insider purchases this week (less than 3% of the nearly 4,000 total insider purchases).

The S&P has been nearly flat since we started the Watchlist, but the average stock on the watchlist is up nearly 6%.

CEO Watcher Premium subs can also always see the stocks on the Watchlist by visiting the CEO Watcher Premium Dashboard, which is linked at the top of the Data Dump section.

-

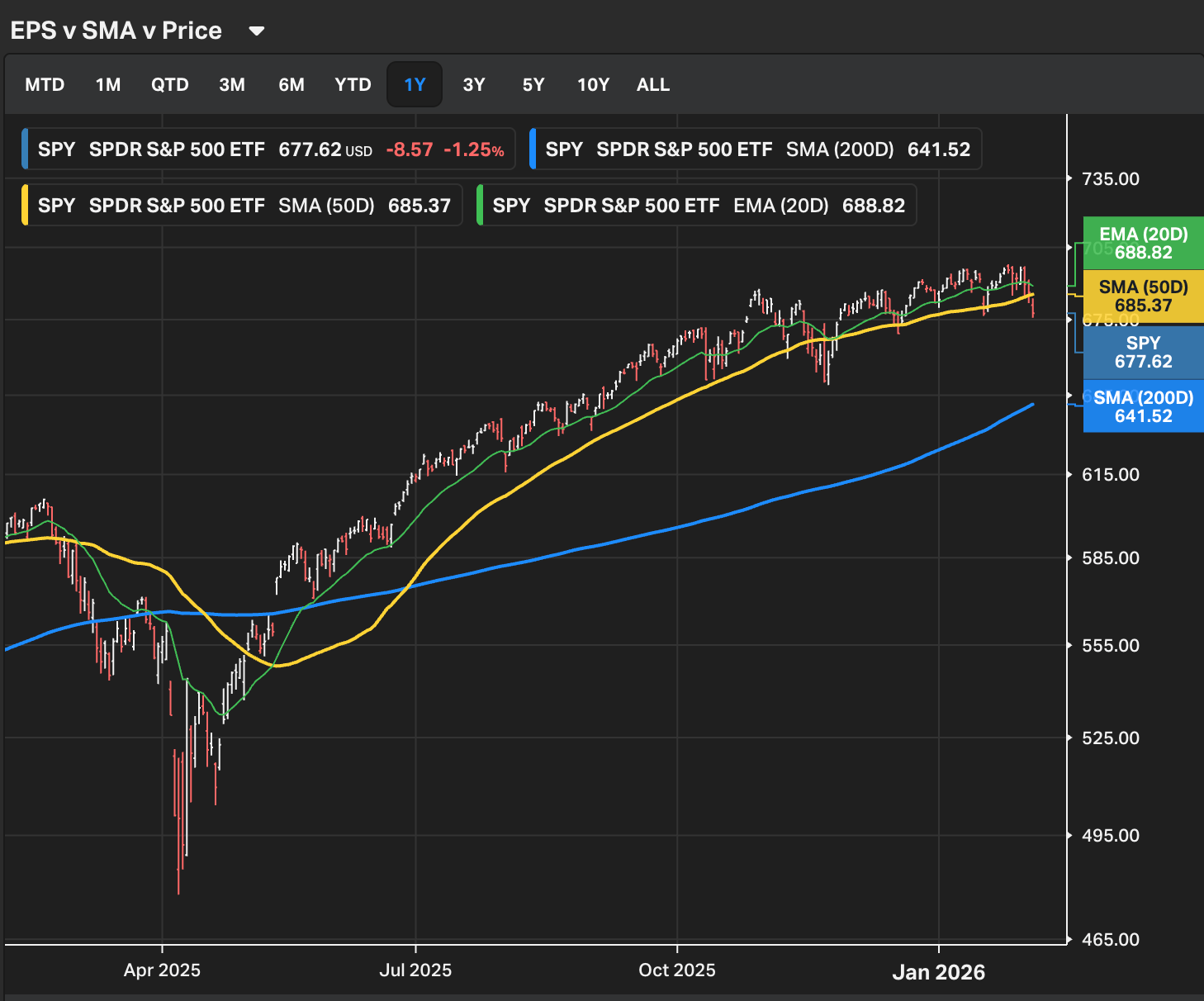

This was a very tough week in the markets, and the charts are certainly starting to look worse.

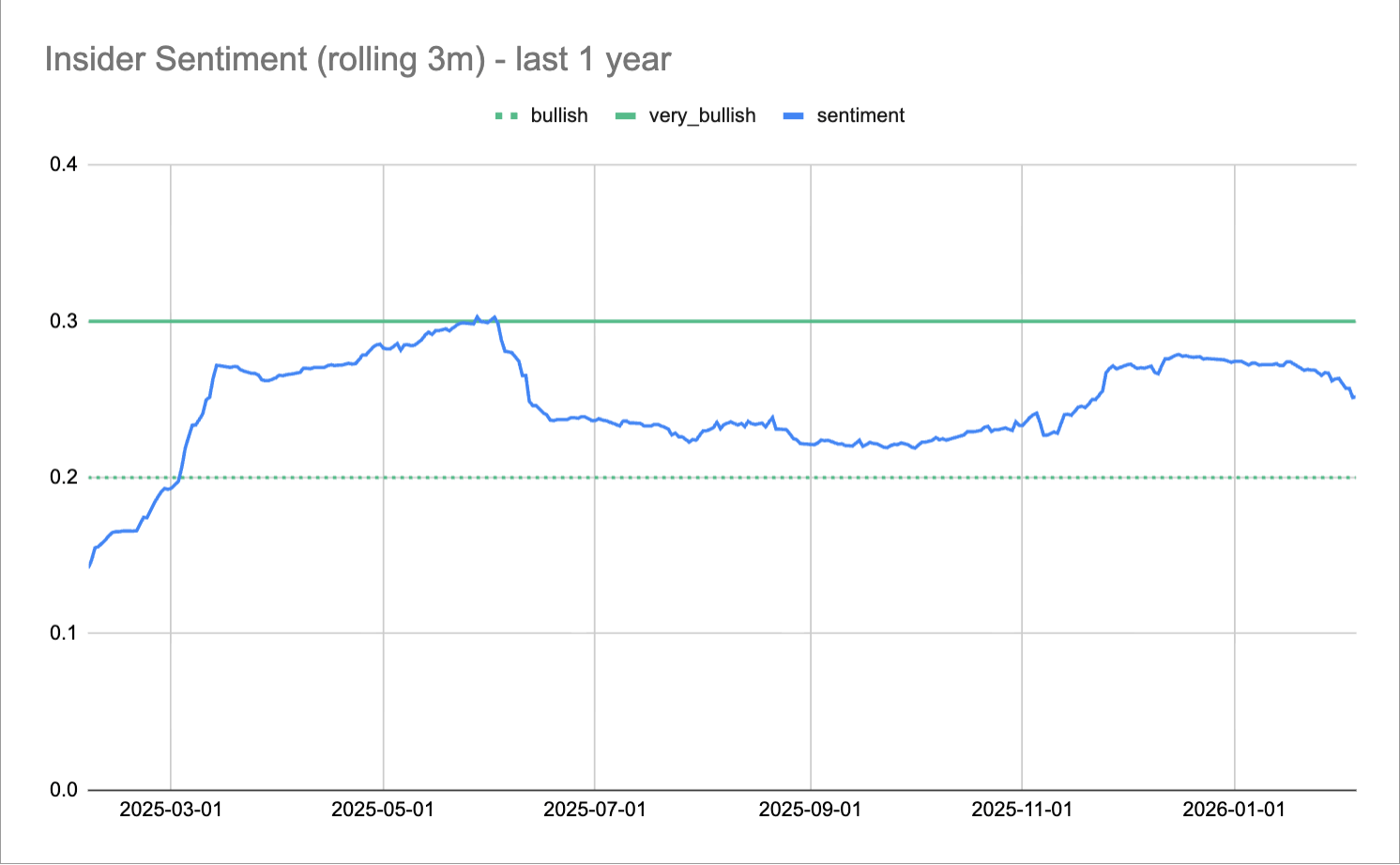

Our favorite insider sentiment chart is in a strong downward trend now (though still well above the Bullish threshold).

The S&P is still in a positive trend, but it is really flattening out now. In the last four months, we’ve barely been able to get above the highs from October.

We’ve also fallen below the 50d, but the market has recovered quickly the last few times it has done that.

I don’t expect the floor to fall out, but we are getting much closer to the S&P rolling over.

However, the one bright side is that there were a ton of very interesting insider buys that came in today.

I shared four High Signal Insider Purchases with Premium subscribers in the Trade Notes section of this email and added two new stocks to the CEO Watcher Portfolio.

Have a great weekend!

As a reminder, if you sign up for CEO Watcher Premium and decide it isn’t for you, I’ll give you a refund if you ask.

keep scrolling. top trades + all of the charts and data below

CEO Watcher Premium

The rest of this email (including today’s top insider trades + all the charts and data) is for CEO Watcher Premium subscribers only. To see an example of the Premium email, click here.

Upgrade to CEO Watcher Premium at ceowatcher.com to unlock:

The Premium daily emails

Full access to the website, which has all insider trades back to 2009. It includes search/filters and the returns of every trade and every insider to help you find the top insider trades

Full access to the CEO Watcher Premium Discord where I share my notes and holdings in the CEO Watcher Portfolio

The Premium Dashboard, which has a bunch of charts/tables with insider trading data that is updated each day

If CEO Watcher Premium is not for you, I give full refunds with no questions asked.

Reply