- 📈👀 CEO Watcher

- Pages

- CEO Watcher Premium example email

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

NOTE: this is an example of the CEO Watcher Premium emails. This top section (“Connor’s Commentary”) is always free for everyone, and the following sections (with the 🔒) are locked for Premium subscribers. Premium subscribers also unlock access to the Dashboard with all of the data, the website, and the Discord.

There were 229 insider trades filed. Only 25% of the unscheduled trades were buys, which is our first big dip in insider buying in like 6 weeks. We’ll see if it was just a blip over the next couple of weeks.

First group insider buying at Lument Finance Trust $LFT in over two years, with the stock down nearly 40% in 6 months. CEO, CFO, and a director all sold

The CFO and CLO at Fiserv (FISV) both bought the stock for the first time

A Director at Elastic (ESTC) bought $710k of the stock after it fell 20% in the last month

The new CEO at SmartRent (SMRT) continues buying the stock. He’s now bought 7 times since becoming CEO in August.

The Presidents of the ISS Division and CS Division at Amphenol (APH) sold $18.7M and $11.36M of the stock

The COO and Chief HR Officer at Celestica (CLS) combine to sell $3.99M. The stock is up 300% in the last year

The CEO at Viavi Solutions (VIAV) sells $2.77M (first sale since 2022)

The Chief Development Officer at The Metals Co (TMC) sells $664k. The stock is up almost 700% in the last month.

and more…

I go into more depth on these companies in the CEO Watcher Premium sections below.

Commentary

One of the highest signal insider purchase types is insiders buying the dip.

[academic research]

Seyhun wrote a few papers + a book called “Investment Intelligence from Insider Trading” in the 90s that found that insiders are contrarian investors (buy low, sell high) and that insiders outperform.

Jenter (2003), “Market Timing and Managerial Portfolio Decisions” found that insiders buy when they believe the market is fundamentally undervaluing their company

Lasfer (2024) - "Corporate insiders' exploitation of investors' anchoring bias at the 52-week high and low" found that insiders do significantly more buying at 52-week lows and way more selling at 52-week highs, but their purchases at both the 52-week high and low significantly outperform

[CEO Watcher research]

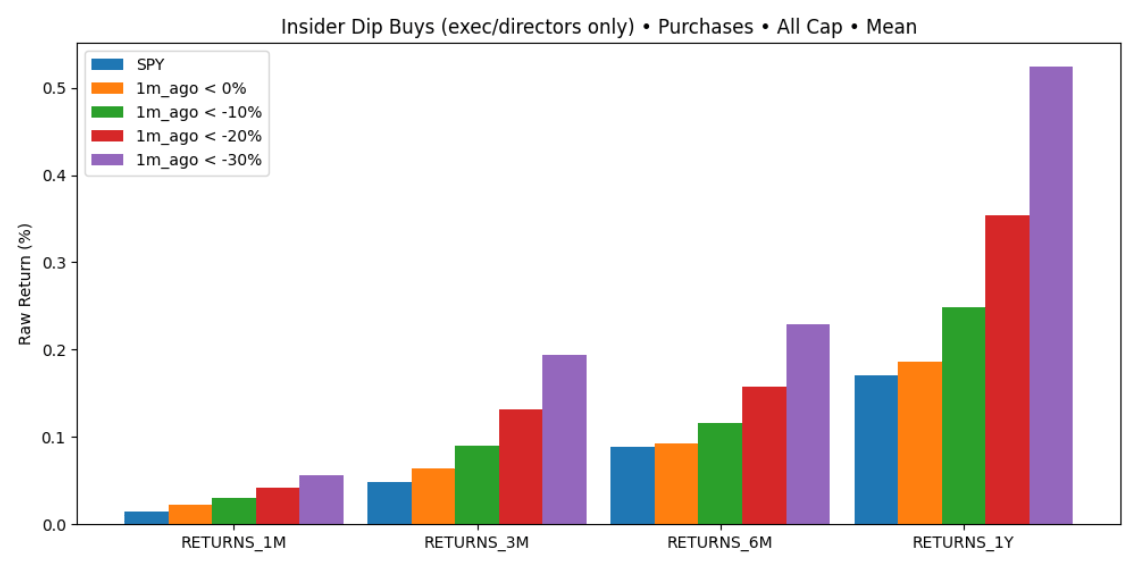

The CEO Watcher database has all insider trades back to 2009, and our data matches the research and finds that insider dip buys outperform the market.

Looking at insider purchases after one-month stock price dips, you’ll see that dip buys outperform the S&P across all timeframes (next 1M/3M/6M/1Y) with improving performance as the dip size increases.

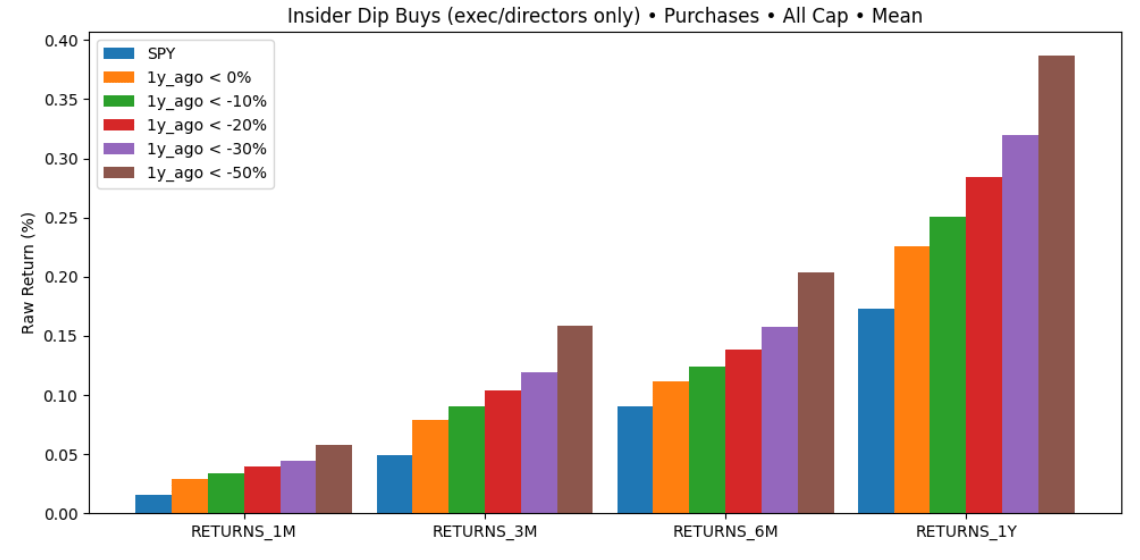

We also find significant outperformance when insiders are buying long-term dips (what we call “turnaround purchases”). The chart below shows that stocks significantly outperform when they have negative returns over the previous year.

We track every insider dip buy in both the CEO Watcher Premium Dashboard and the Data Dump section at the bottom of the email.

keep scrolling. the most important trades and data below

🔒 Trade Notes

I’ve done a pass on these potentially high-signal trades (mostly dip buys and/or insiders with a good track record). I look at the insider trade signal, stock price action, and company valuation. These are not recommendations, even though I’ll mention if I add them to the CEO Watcher Portfolio. (The most compelling trades are first)

Fiserv (FISV)

Description: payments and financial services technology solutions provider ($35.8B mkt cap)

Conclusion: buy for CEO Watcher

CFO and CLO bought $1M and $500k, respectively, their first purchases ever for both. Insider signal: 4/5. Stock returns of -6% 1m / -55% 3m / -62% 6m / -72% 1y, trading below all moving averages. Currently at lowest P/E ever. Classic insider dip buy pattern which historically performs well. Buy for CEO Watcher with stop at the low (~$60).

-

Marvell Technology (MRVL)

Description: provides data infrastructure semiconductor solutions, spanning the data center core to network edge ($71B mkt cap)

Conclusion: buy for CEO Watcher

Four executives (including CEO) all just bought the stock. It’s the first-ever group purchase at Marvell, and the first purchase for all of the execs (except the CEO). The CEO has only bought once before (in October 2024), and the stock was up 50% in the next 6 months. The stock is heavily lagging the semiconductor/AI sectors, but did just cross above the 200d SMA. They announced a $5B share buyback + an accelerated share repurchase agreement of $1B while still having $2B on left on the previous buyback. The CEO also just hosted an investor call to tell investors their revenue concerns are unfounded, and data center growth will accelerate into 2028. We rarely see compelling insider buying in the hot sectors, so this is a buy for CEO Watcher.

-

MBX Biosciences (MBX)

Description: clinical stage biotech developing precision peptide therapies ($467M mkt cap)

Conclusion: buy for CEO Watcher

CEO bought $272k following a director's $264k purchase (first-ever buy). The stock popped 100% a month ago on positive phase 2 results, but has since fallen 40%. Currently trading below short-term MAs but above 200d. Earnings are coming on November 7th. While earnings for clinical-stage biotech companies aren’t typically notable (and MBX doesn’t host calls), it is at least a chance for management to put out some updates. The stock also jumped yesterday after the director’s purchase, and I’m sure this CEO purchase will cause some more buying. Obviously, the insiders think this sell-off is overdone, and the stock appears to have some momentum, so we’ll buy this dip and see if we can’t get a nice recovery.

🔒 Need More Research

I’ve done a quick pass on these to verify the trades are unscheduled, and the insiders have a good track record, but I haven’t had time to dive in deeper. They are worth a closer look.

Director at Expensify, Inc. ($EXFY)

Christen Timothy L (Director) at Expensify, Inc. ($EXFY) purchased 40,000 shares at $1.43 ($57.20K total), which increased their listed holdings by 16.02%. The current price is $1.40 (-2.10%). This is their 8th largest purchase out of 10 all time. link

Historic Returns

1m returns: 0.26% weighted | 56% win rate (5/9)

3m returns: -1.63% weighted | 33% win rate (3/9)

6m returns: 2.82% weighted | 44% win rate (4/9)

1y returns: 56.27% weighted | 78% win rate (7/9)

Buying the dip (stock was down -50.0% in the one year before the purchase).

-

[SALE] Director at INCYTE CORP ($INCY)

Hoppenot Herve (Director) at INCYTE CORP ($INCY) sold 187,500 shares at $105.46 ($19.77M total), which decreased their listed holdings by -36.26%. The current price is $106.00 (+0.51%). This is their 1st largest sale out of 4 all time. link

Historic Returns

1m returns: 6.14% weighted | 100% win rate (3/3)

3m returns: 16.43% weighted | 100% win rate (3/3)

6m returns: 20.44% weighted | 100% win rate (3/3)

1y returns: 26.08% weighted | 100% win rate (3/3)

Selling the rip (stock was up 24.69% in the month before the sale). 4 insiders have made 5 total sales at this company in the last 30 days.

🔒 Data Dump

Click here [removed url for this example] for the CEO Watcher Premium Dashboard with all of our charts and tables!

Largest Unscheduled Purchases (excluding 10% Owners)

Largest Unscheduled Sales (excluding 10% Owners)

Largest Unscheduled Purchases by Holdings Increase (excluding 10% Owners)

Largest Unscheduled Sales by Holdings Decrease (excluding 10% Owners)

Companies with Most Unscheduled Insider Buying (last 3m)

Companies with Most Unscheduled Insider Selling (last 3m)

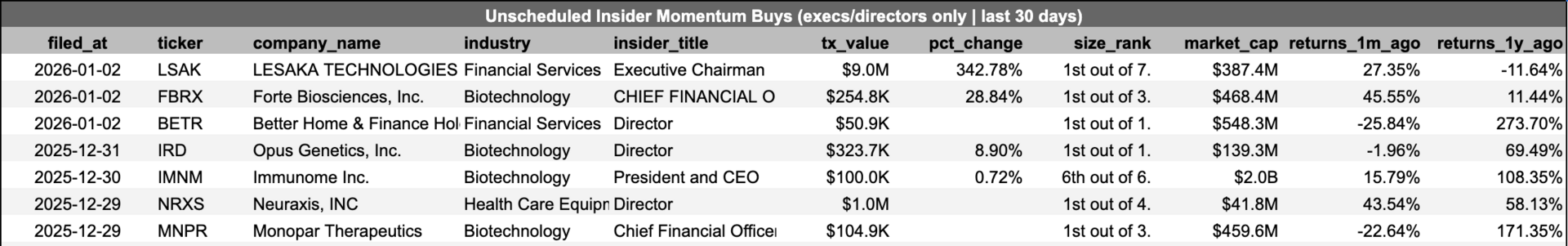

Unscheduled Momentum Buys (last 7d)

See all insider dip buys here

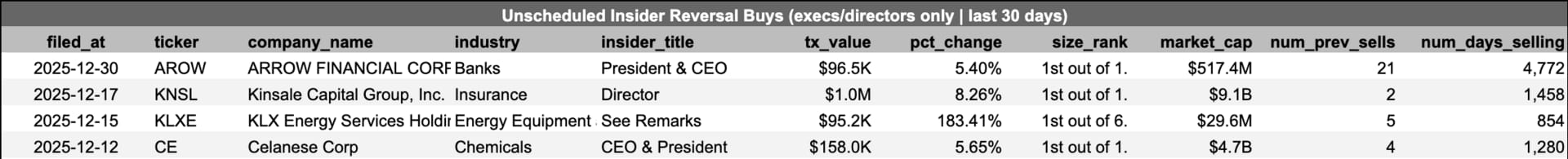

Unscheduled Reversal Buys (last 30d)

See all insider dip buys here

Unscheduled Dip Buys (last 1m)

Industries Ranked by Unscheduled Insider Buying (last 3m)

Percent of insider trades that are buys (daily)

Insider Sentiment Score (rolling 3m)

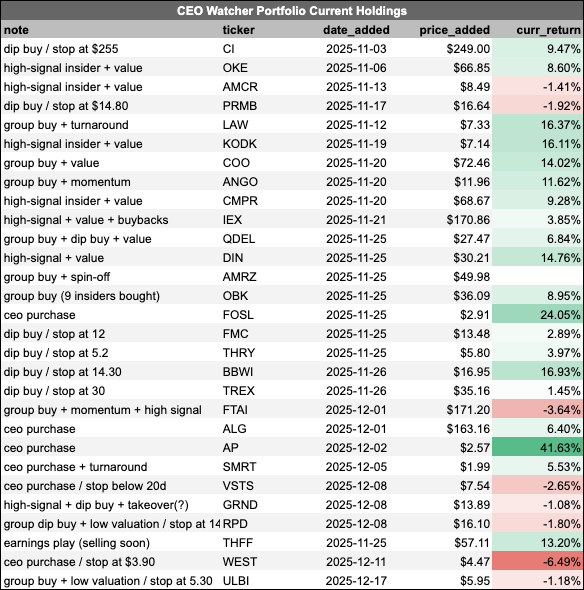

CEO Watcher Portfolio

Upgrade to CEO Watcher Premium

Head over to ceowatcher.com if you’d like to try out CEO Watcher Premium.

If it is not for you, I always give full refunds with no questions asked.

What CEO Watcher Premium includes:

The Premium daily emails

Full access to the website, which has all insider trades back to 2009. It includes search/filters and the returns of every trade and every insider to help you find the top insider trades

Full access to the CEO Watcher Premium Discord where I share my notes and holdings in the CEO Watcher Portfolio

The Premium Dashboard, which has a bunch of charts/tables with insider trading data that is updated each day