- 📈👀 CEO Watcher

- Posts

- Top insider trades (Thu, Feb 5)

Top insider trades (Thu, Feb 5)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

There were 236 new insider trades filed.

Two insider trades were flagged as High Signal, and one was added to the CEO Watcher Portfolio. CEO Watcher Premium subs can see those in the Trade Notes section of this email or the CEO Watcher Premium Dashboard that is linked in the Data Dump section.

As a reminder, if you upgrade to CEO Watcher Premium (link) and find that it isn’t for you, I’ll give you a refund.

A director at Cavco Industries (CVCO) bought $136k of the stock after its 30% dip in the last few (partially due to poor earnings).

A 10% Owner, along with the CEO and CFO, bought 5E Advanced Materials (FEAM) as part of a public offering. The stock has been smoked recently (along with many mineral stocks). They were able to buy at $2 ($2.25 now)

A 10% Owner has been buying Peoples Financial Corp (PFBX) non-stop since 2022 and just made his 5th largest purchase (out of 300)

An insider bought $490k of Standex International Corp (SXI). It's only the 2nd insider purchase at the company in the last 5 years

Warburg Pincus appears to be dumping Banc of California (BANC) stock

A few Caterpiller (CAT) execs have now sold $45M of the stock this week. It’s up 20% in the last three months and 90% in the last year

EVP at Nucor (NUE) exercised and sold $2.78M of stock options that don't expire until 2030. The stock is up 40% in the last year

A couple of insiders have returned to selling Grindr (GRND) stock

A bunch of execs at PACCAR (PCAR) are cashing in their stock options after the 30% rise in the last 3 months. 6 insiders have sold $18.5M this week

Vice Chairman at Teledyne (TDY) exercises and sells $4.73M of the stock. The options didn't expire until next year

and more…

Commentary

Two of the most compelling aspects of insider trading are:

Insiders are value investors. They typically buy the stock when they believe it is undervalued (I’ll share more research on this later)

There is very little tech exposure

This is especially beneficial in a week like this, where tech and momentum are being crushed.

On Tuesday, only 7 of our 27 holdings were down, and we outperformed the S&P by over 1 point.

You can see the returns below (the positions are roughly equally weighted).

Tickers are available only to CEO Watcher Premium members. A screenshot of the holdings is always available in the Data Dump section of the email and in the CEO Watcher Premium Dashboard, which is linked at the top of the Data Dump Section. You can upgrade to CEO Watcher Premium at ceowatcher.com. If it’s not for you, just email me, and I’ll give you a refund.

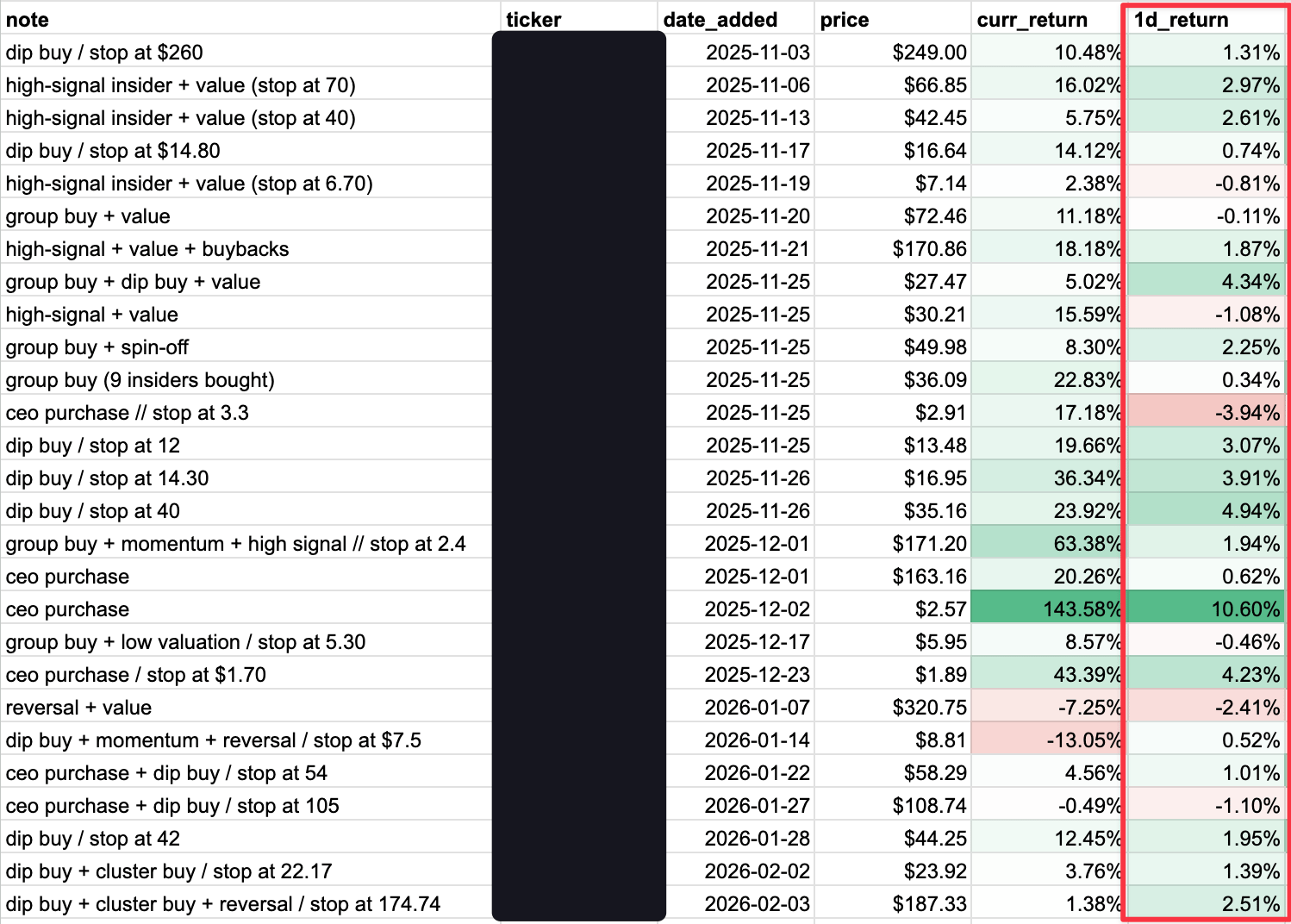

Tuesday Holdings

We did get stopped out of the stock that was down 13% in the above screenshot (though I still think it’s compelling if the price action improves).

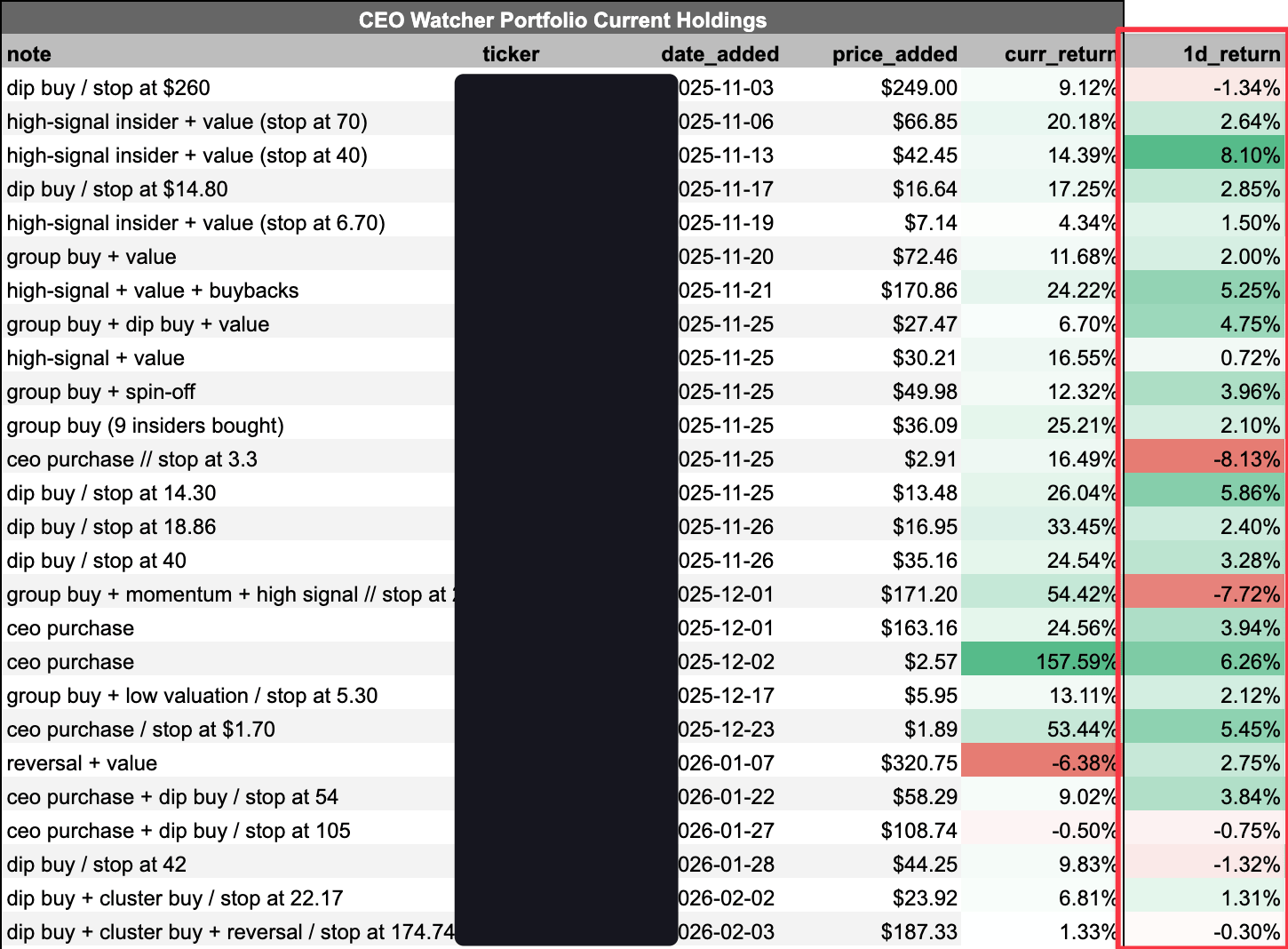

Then yesterday, only 6 of the 26 holdings were down, and we beat the market by over 1 point again.

Wednesday Holdings

The CEO Watcher Portfolio is up over 3% this week while the market is down more than 1% (and that -6% position in the screenshot above is now green after reporting positive earnings).

Obviously, when sentiment around tech rebounds, the CEO Watcher Portfolio will lag the tech indexes, but we also avoided a massive drawdown and are unlikely to experience one when tech rebounds, as we are diversified across many industries (each with lower volatility than tech).

You’ll need to get your tech exposure elsewhere, but utilizing the CEO Watcher High Signal Stocks to build out the lower volatility, value sleeve of your portfolio (that should still outperform the S&P meaningfully) is a no-brainer.

keep scrolling. top trades + all of the charts and data below

CEO Watcher Premium

The rest of this email (including today’s top insider trades + all the charts and data) is for CEO Watcher Premium subscribers only. To see an example of the Premium email, click here.

Upgrade to CEO Watcher Premium at ceowatcher.com to unlock:

The Premium daily emails

Full access to the website, which has all insider trades back to 2009. It includes search/filters and the returns of every trade and every insider to help you find the top insider trades

Full access to the CEO Watcher Premium Discord where I share my notes and holdings in the CEO Watcher Portfolio

The Premium Dashboard, which has a bunch of charts/tables with insider trading data that is updated each day

If CEO Watcher Premium is not for you, I give full refunds with no questions asked.

Reply