- 📈👀 CEO Watcher

- Posts

- Top insider trades (Fri, Dec 5)

Top insider trades (Fri, Dec 5)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

Grindr (GRND) director buys another $2.65M after buying 3.87M yesterday

Exec Chairman at Bridger Aerospace (BAER) buys $540k of the stock. First-ever purchase by any insider at the company

SmartRent (SMRT) CEO continues to buy the stock

Another Fossil Group (FOSL) director joins in on buying the stock

Four insiders, including CEO and COO, at Las Vegas Sands (LVS) sold $29M

COO at Thermo Fisher (TMO) sold $36M (largest sale ever)

The Chief People Officer at Guardant Health (GH) sold $5.85M of the stock in first sale ever

Figure Technology (FIGR) CEO sells $5.28M

and much more…

I go into more depth on these companies in the CEO Watcher Premium sections below.

Commentary

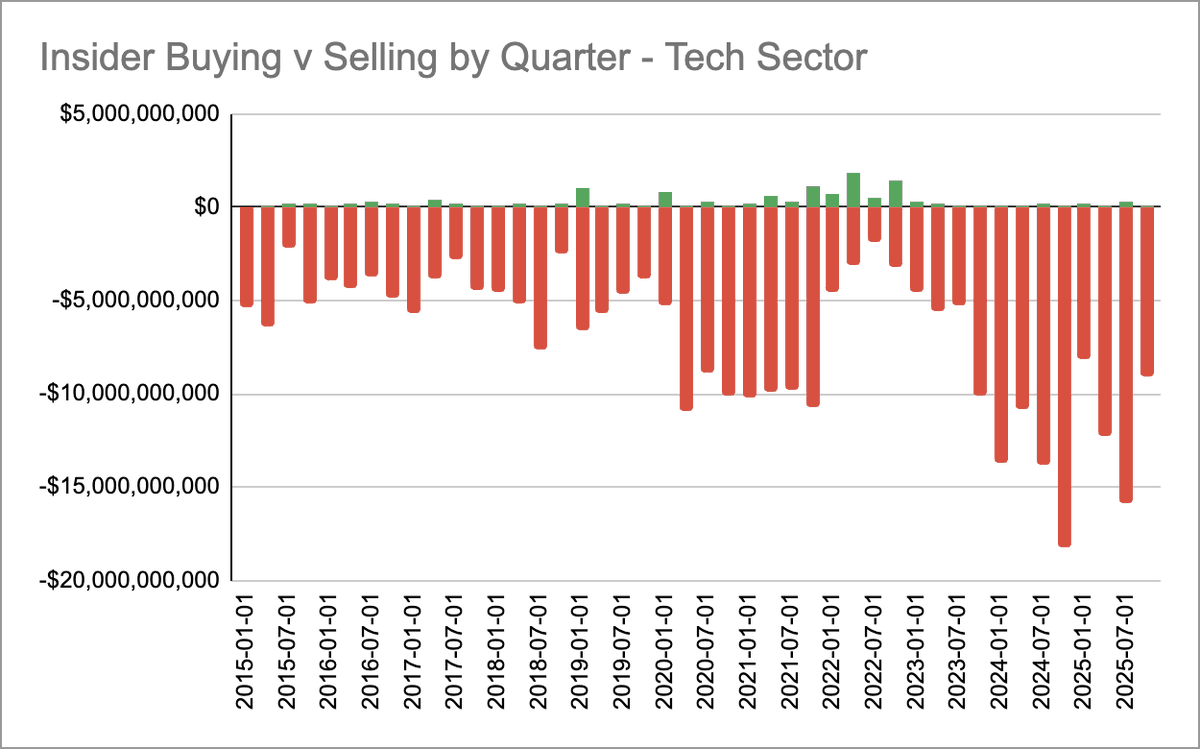

If you trade tech stocks and pay attention to insider trading, then you know that insiders are rarely buying and always selling.

The only periods with significant insider buying were Q1 2019, COVID, and Q3 2021 - Q4 2022. 2022 was also the only extended period of depressed selling, which makes sense as the Nasdaq was down 30% that year, and insiders tend to buy when stock prices are low/falling and sell when prices are high/rising.

This lack of insider buying in tech companies is another reason the insider buying we found at Marvell (MRVL) in September was so appealing (read more about that here).

But this lack of insider buying / massive amount of insider selling in tech companies also has a couple of other important effects.

The average insider purchase at large-cap stocks has underperformed the S&P over the last ten years because tech stocks have accounted for a large percentage of the S&P’s gains, but insiders are rarely buying tech stocks. Note: there are still plenty of high-signal insider buy types (like unscheduled dip buys) in large-cap stocks that do significantly outperform the S&P, which we will talk about in future emails

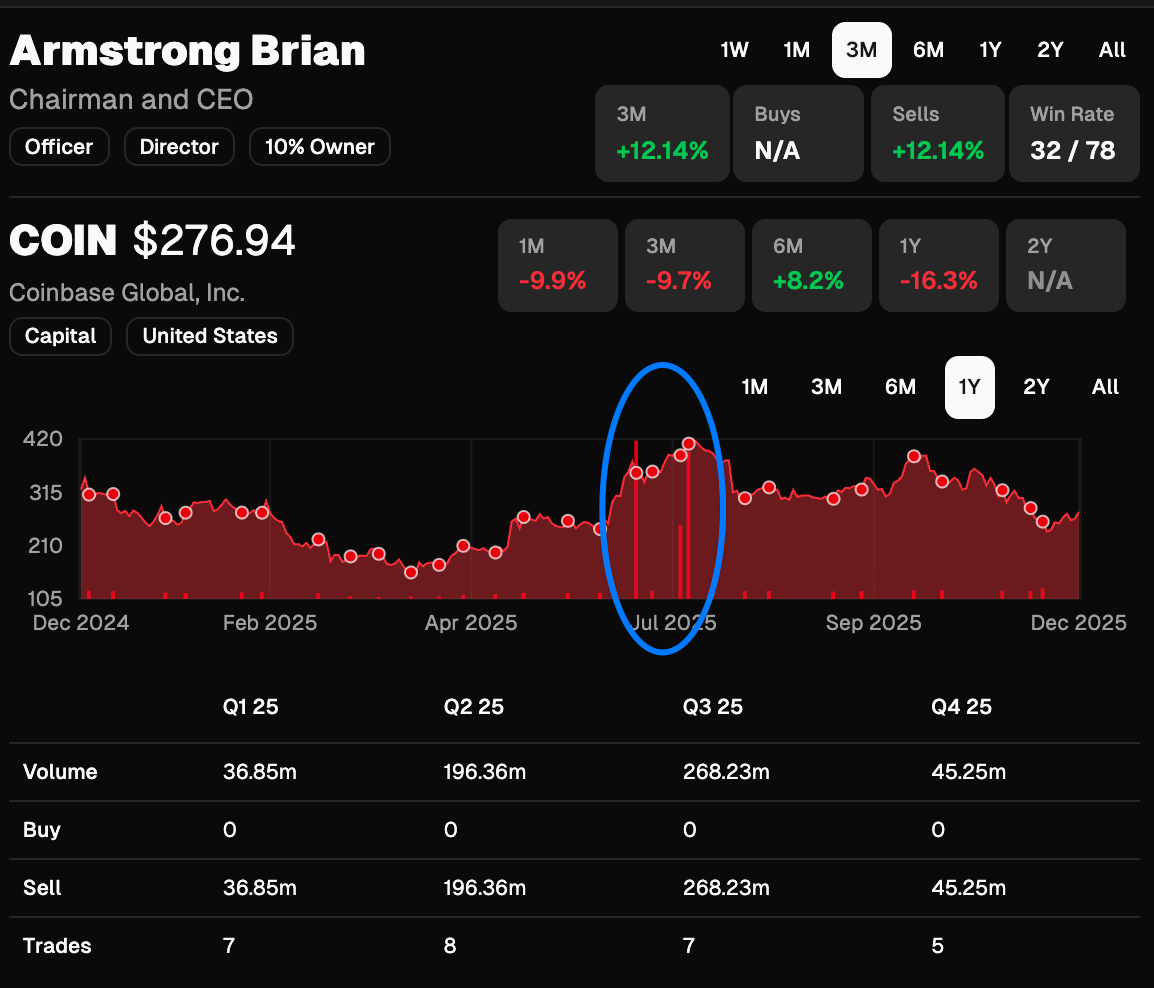

Insider selling in tech stocks is nearly useless. Nearly every insider at every tech company is constantly selling stock. It’s mostly noise. There are a few outlier cases, like when Brian Armstrong suddenly jumps from selling $8M of the stock per sale to $160M while the stock is at all-time highs (image below).

It makes the insider buying strategies in large-cap stocks that do outperform the S&P even more compelling because they include very few tech stocks

keep scrolling. top trades + all of the charts and data below

🔒 CEO Watcher Premium

The rest of this email is for CEO Watcher Premium subscribers only. To see an example of the Premium email, click here.

Upgrade to CEO Watcher Premium at ceowatcher.com to unlock:

The Premium daily emails

Full access to the website, which has all insider trades back to 2009. It includes search/filters and the returns of every trade and every insider to help you find the top insider trades

Full access to the CEO Watcher Premium Discord where I share my notes and holdings in the CEO Watcher Portfolio

The Premium Dashboard, which has a bunch of charts/tables with insider trading data that is updated each day

If CEO Watcher Premium is not for you, I give full refunds with no questions asked.

Reply