- 📈👀 CEO Watcher

- Posts

- Top insider trades (Wed, Dec 3)

Top insider trades (Wed, Dec 3)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

There were 229 insider trades filed. Only 25% of the unscheduled trades were buys, which is our first big dip in insider buying in like 6 weeks. We’ll see if it was just a blip over the next couple of weeks.

First group insider buying at Lument Finance Trust $LFT in over two years, with the stock down nearly 40% in 6 months. CEO, CFO, and a director all sold

The CFO and CLO at Fiserv (FISV) both bought the stock for the first time

A Director at Elastic (ESTC) bought $710k of the stock after it fell 20% in the last month

The new CEO at SmartRent (SMRT) continues buying the stock. He’s now bought 7 times since becoming CEO in August.

The Presidents of the ISS Division and CS Division at Amphenol (APH) sold $18.7M and $11.36M of the stock

The COO and Chief HR Officer at Celestica (CLS) combine to sell $3.99M. The stock is up 300% in the last year

The CEO at Viavi Solutions (VIAV) sells $2.77M (first sale since 2022)

The Chief Development Officer at The Metals Co (TMC) sells $664k. The stock is up almost 700% in the last month.

and more…

I go into more depth on these companies in the CEO Watcher Premium sections below.

Commentary

I was actually going to get this email out on time, but then got caught up following Shkreli’s blowup on $CAPR and subsequent pump of a tiny stock to try to make his money back. Looks like his followers are now underwater on both of them lol.

Marvell (MRVL) reported solid earnings last night and was up 12% after hours. All of the good earnings plays we’ve had so far have faded hard, so we’ll see how this holds up.

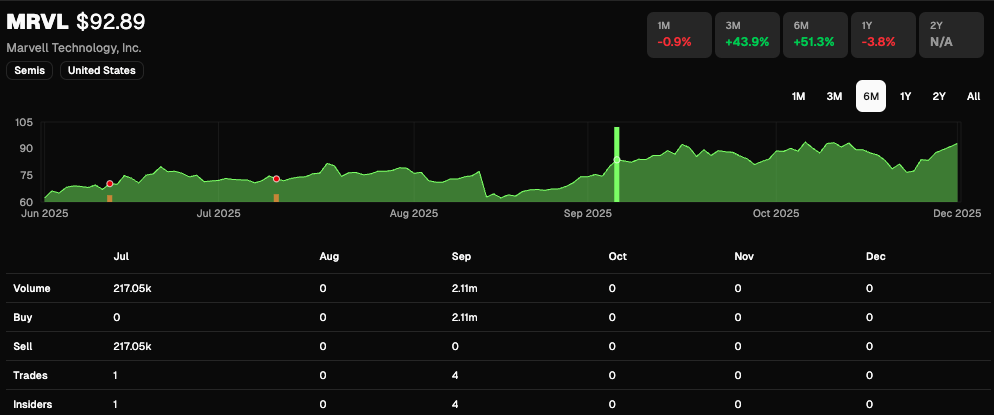

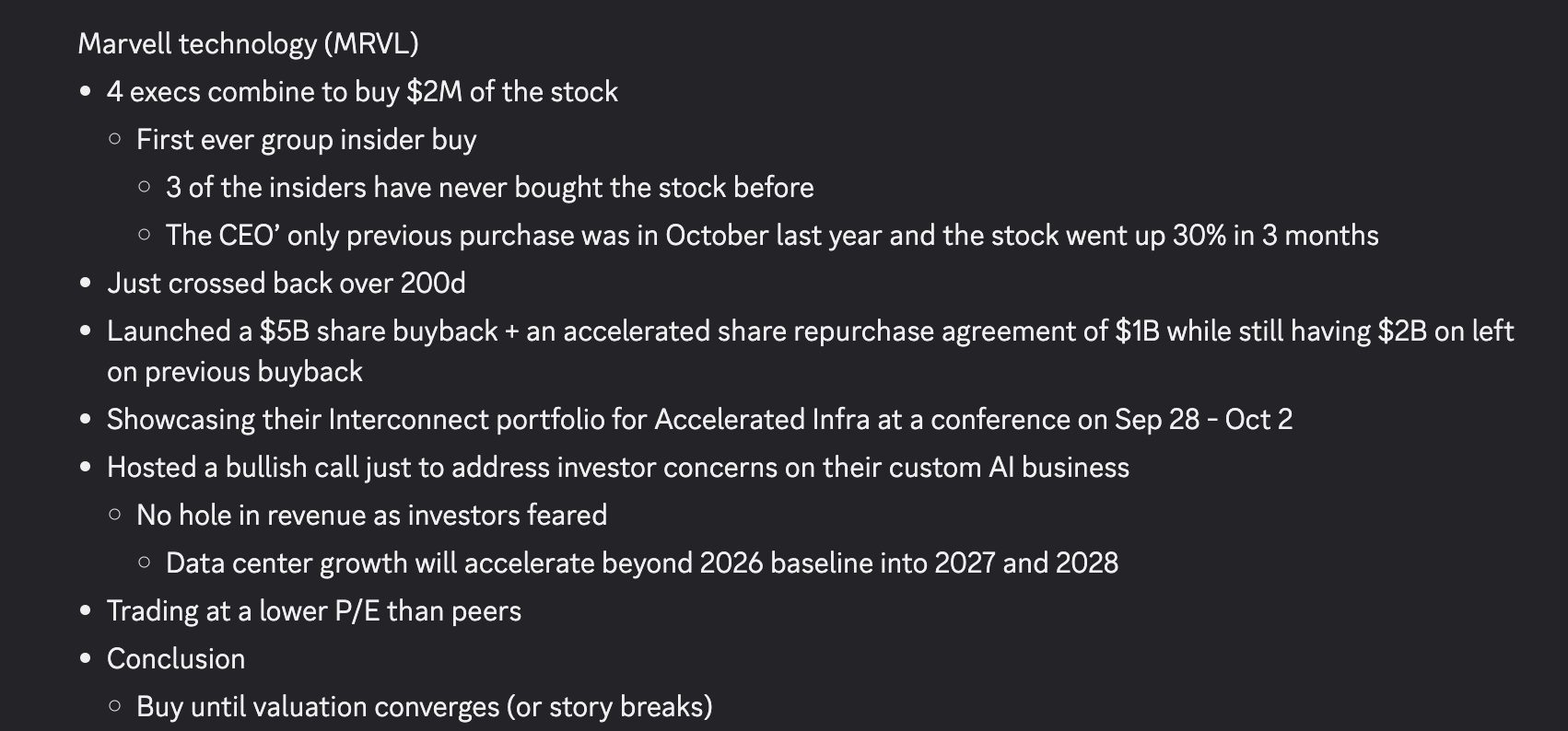

Marvell (MRVL) is a stock we’ve now owned twice in the CEO Watcher portfolio, and I’ve owned in my personal portfolio since we found four insiders (including the CEO) buying $2.11M of the stock back in September.

I’ve attached my quick notes from the Discord below, but these purchases were interesting because most of the insiders had never bought the stock before + insider buying in hot sectors is quite rare + the company launched an accelerated share buyback program + the CEO hosted a call basically just to tell investors their business was in good shape.

Just a couple of days ago, the price action strengthened as the stock got above all of the moving averages.

So everything was looking good heading into earnings, and they reported a solid beat and raise quarter, which caused the stock to jump up 12% after hours. Now let’s hope it stays there!

keep scrolling. the most important trades and data below

🔒 Trade Notes

I’ve done a pass on these potentially high-signal trades (mostly dip buys and/or insiders with a good track record). I look at the insider trade signal, stock price action, and company valuation. These are not recommendations, even though I’ll mention if I add them to the CEO Watcher Portfolio. (The most compelling trades are first)

This section is for premium subscribers only. Upgrade at ceowatcher.com to unlock all of the premium sections + full access to the CEO Watcher website + access to the CEO Watcher Discord.

🔒 Need More Research

I’ve done a quick pass on these to verify the trades are unscheduled, and the insiders have a good track record, but I haven’t had time to dive in deeper. They are worth a closer look.

This section is for premium subscribers only. Upgrade at ceowatcher.com to unlock all of the premium sections + full access to the CEO Watcher website + access to the CEO Watcher Discord.

🔒 Data Dump

This section is for premium subscribers only. Upgrade at ceowatcher.com to unlock all of the premium sections + full access to the CEO Watcher website + access to the CEO Watcher Discord.

Reply