- 📈👀 CEO Watcher

- Posts

- Top insider trades (Wed, Jan 21)

Top insider trades (Wed, Jan 21)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

There were 101 new insider trades filed.

Three insider trades were flagged as High Signal. CEO Watcher Premium subs can see those in the Trade Notes section of this email or the CEO Watcher Premium Dashboard that is linked in the Data Dump section.

We also added two insider dip buys to the CEO Watcher Portfolio, which Premium subs can see in the Trade Notes and Data Dump sections.

As a reminder, if you upgrade to CEO Watcher Premium (link) and find that it isn’t for you, I’ll give you a refund.

Another director at Immuneering Corp (IMRX) joins 3 other insiders in buying the dip

The 10% Owner at Sequans Communications (SQNS) continues buying the dip

CEO, Exec Chairman, and a director bought $775k of AirJoule Technologies (AIRJ) in a public offering. Three insiders also bought the stock last month. Stock is down 40% in the last 3 months

Another Sr VP at AutoZone (AZO) has exercised and sold his options. $11M worth, and the options didn't expire until September.

Exec Chairman and a Sr VP at Jabil (JBL) sold $4.7M of the stock. Now 5 insider sales in January for $15M

CFO at Darden Restaurants (DRI) trying to be tricky by exercising and selling $681k worth of options (which didn't expire until 2029) and then sneaking in another $769k of sales on the same filing

Co-President and CEO at Urban Outfitters (URBN) continue to sell

and more…

Commentary

I was asked yesterday if we saw an uplift in insider buying after Liberation Day when the markets crashed.

Yes. Big time.

We have a handful of Insider Sentiment charts that CEO Watcher Premium subs can see in the CEO Watcher Premium Dashboard (link is at the top of the Data Dump section in this email).

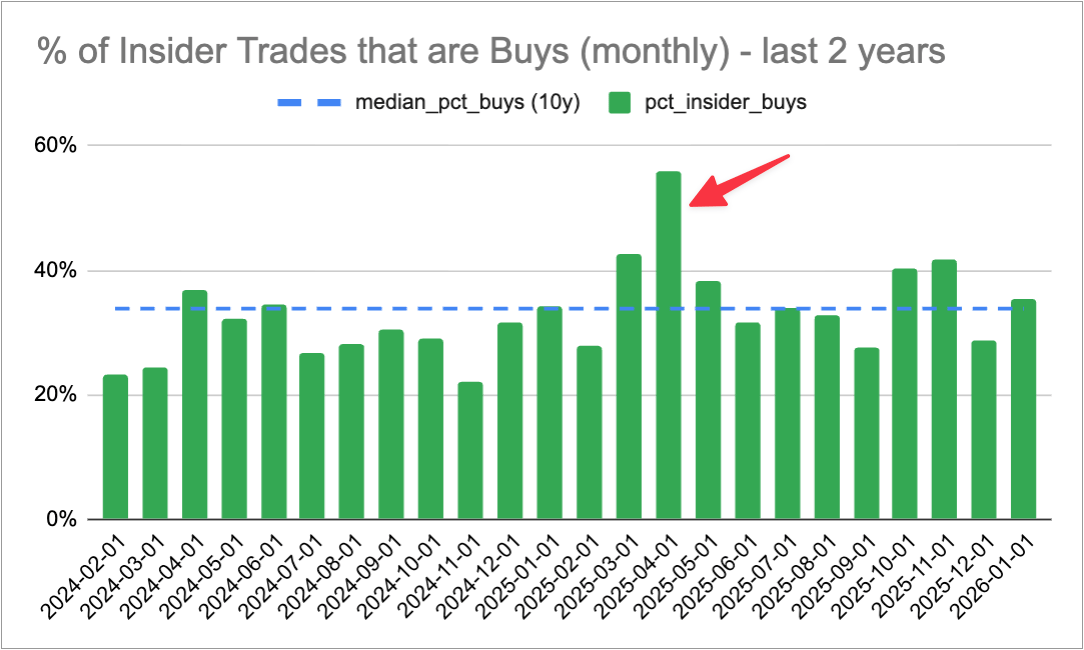

We saw a huge spike in insider buying in April after Liberation Day. In fact, it was by far the biggest spike in the last two years.

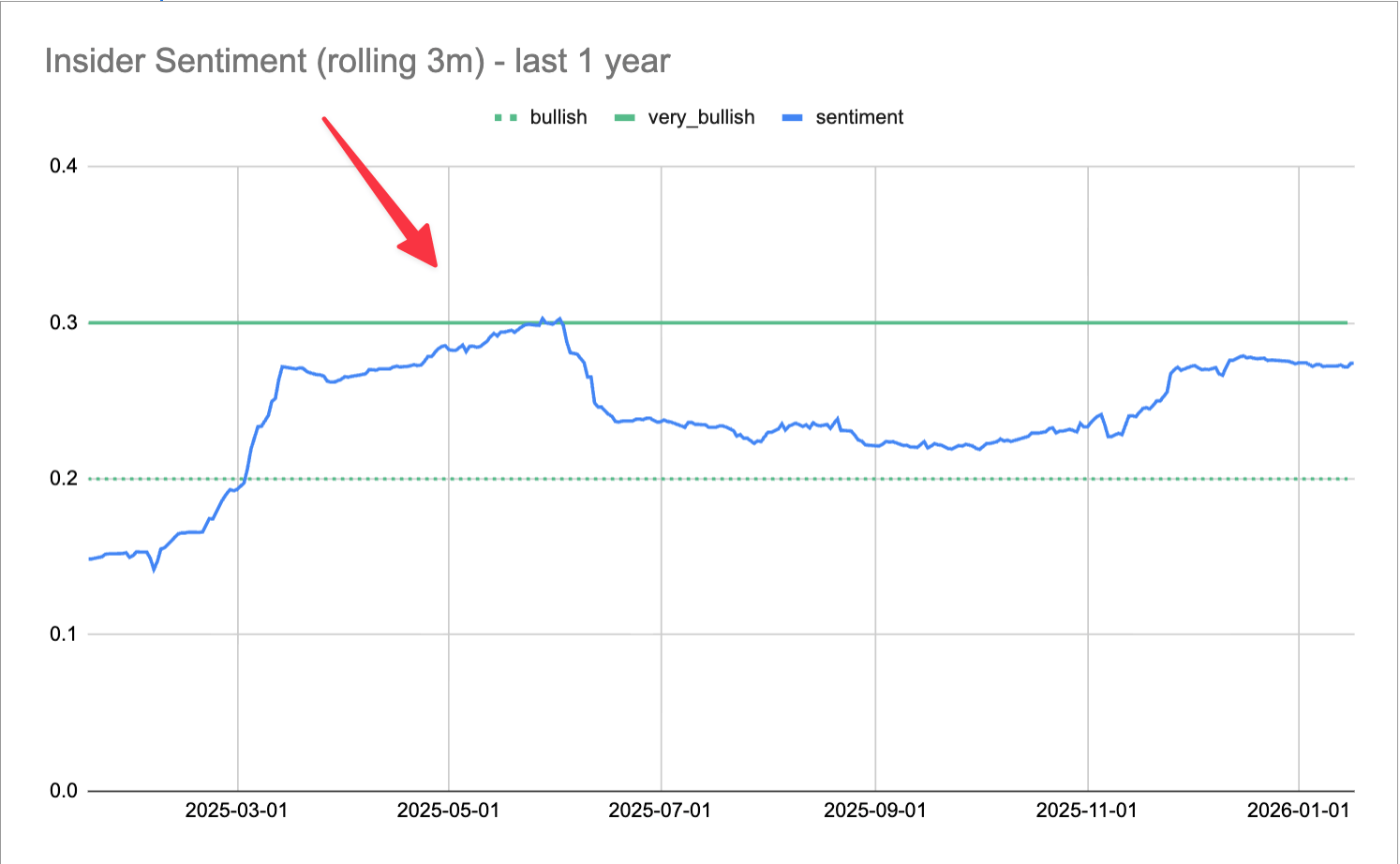

Long-time readers know that my favorite sentiment chart is the Rolling Insider Sentiment chart, as it smooths out the lumpiness of insider buying by looking at the aggregated data over the previous three months.

We actually saw the Rolling Insider Sentiment cross above our “Bullish” threshold in March, as the market had peaked in mid-February and basically went straight down for 6 weeks (with insiders increasing their buying the whole way).

It then peaked in June (because the rolling 3m value included March, April, and May data at that point) and remained above the “Bullish” threshold for the rest of the year.

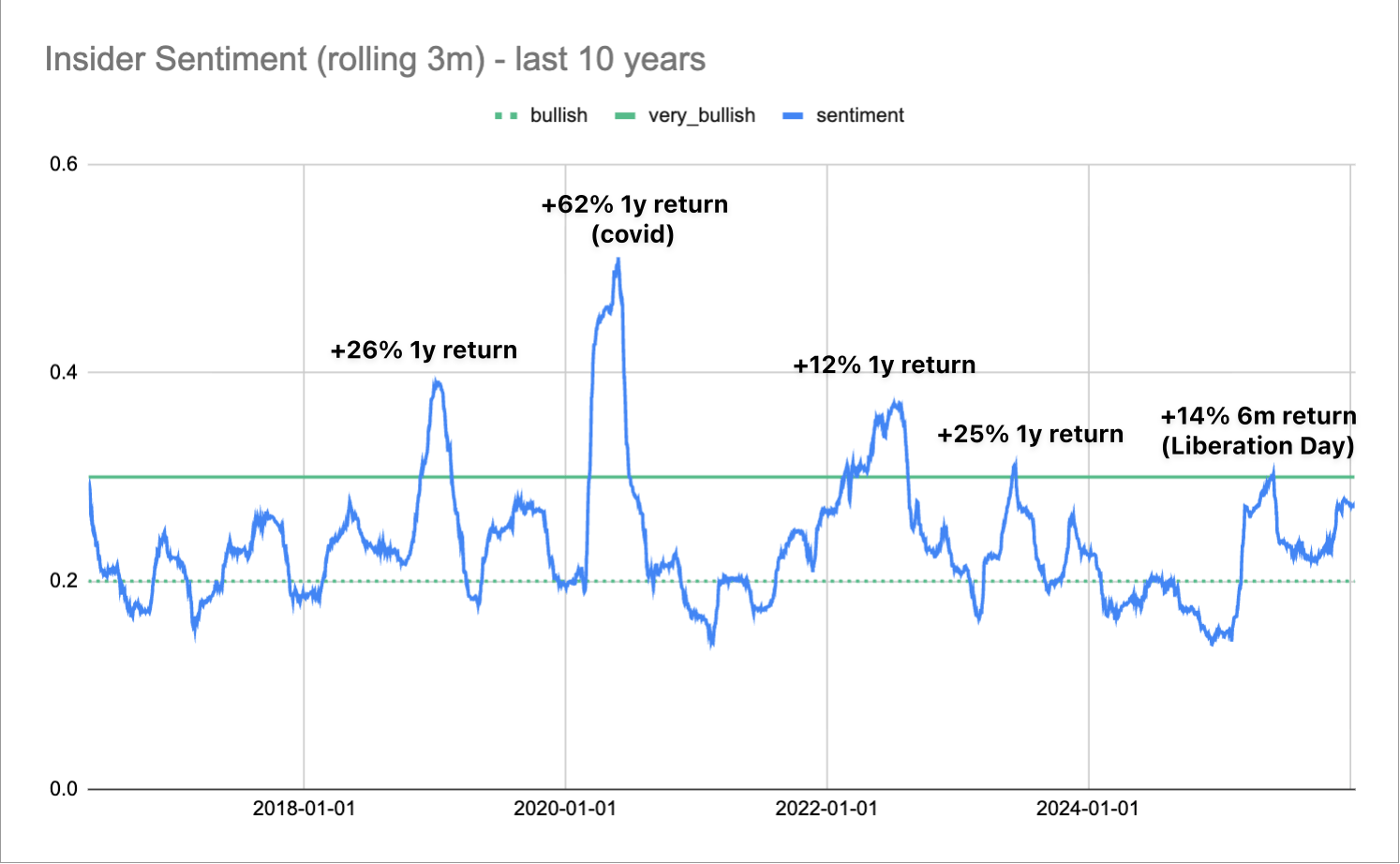

Zooming out, we see that the peak in June was only the 5th time in the last 10 years that our Insider Sentiment Score reached the “Very Bullish” threshold. The stock market has historically performed very well when it gets above that line.

As with all of our analyses, we calculate our Insider Sentiment Score (and the bar chart that shows the % of Insider Trades that are Buys) only after removing all of the low signal and scheduled insider trades (which account for ~70% of all insider trades).

As we’ve seen time and again in our research, insiders love buying the dip.

keep scrolling. top trades + all of the charts and data below

CEO Watcher Premium

The rest of this email (including today’s top insider trades + all the charts and data) is for CEO Watcher Premium subscribers only. To see an example of the Premium email, click here.

Upgrade to CEO Watcher Premium at ceowatcher.com to unlock:

The Premium daily emails

Full access to the website, which has all insider trades back to 2009. It includes search/filters and the returns of every trade and every insider to help you find the top insider trades

Full access to the CEO Watcher Premium Discord where I share my notes and holdings in the CEO Watcher Portfolio

The Premium Dashboard, which has a bunch of charts/tables with insider trading data that is updated each day

If CEO Watcher Premium is not for you, I give full refunds with no questions asked.

Reply