- 📈👀 CEO Watcher

- Posts

- Top insider trades (Tue, Jan 6)

Top insider trades (Tue, Jan 6)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

There were 140 new insider trades filed, including:

CFO at Hyperion Defi (HYPD) bought $100k of the stock. First-ever purchase and the stock is down 70% in the previous 3 months

$10M sale by the CFO at Broadcom (AVGO). It is their 2nd largest sale ever, out of 23. Not part of a 10b5-1 plan, but for some reason, Broadcom execs don’t use 10b5-1s as frequently as most of other tech companies.

The CFO at Caterpillar (CAT) sold $5.75M (2nd largest sale, out of 4).

Urban Outfitters (URBN) Co-Presidents continue to sell (closing in on $300M in sales since the pop last month)

Co-COO at TransDigm (TDG) sold $385k (3rd largest, out of 4). He is exercising options, but they don’t expire until the end of the year, so it appears to be a discretionary conversion and sale.

A couple of directors combined to sell $1.15M of AutoZone (AZO).

and much more…

Commentary

I’ve added a Momentum Purchases and Reversal Purchases page to the CEO Watcher Premium Dashboard (and I’ll share screenshots at the bottom of these daily emails in the Data Dump section).

As we discussed last week, Momentum Insider Purchases crushed it in 2025.

There were 558 insider momentum purchases, and those stocks are currently up 26% on average versus just 12% for their benchmarks (Russell 2000 for companies with a market cap below $2B and S&P for the rest).

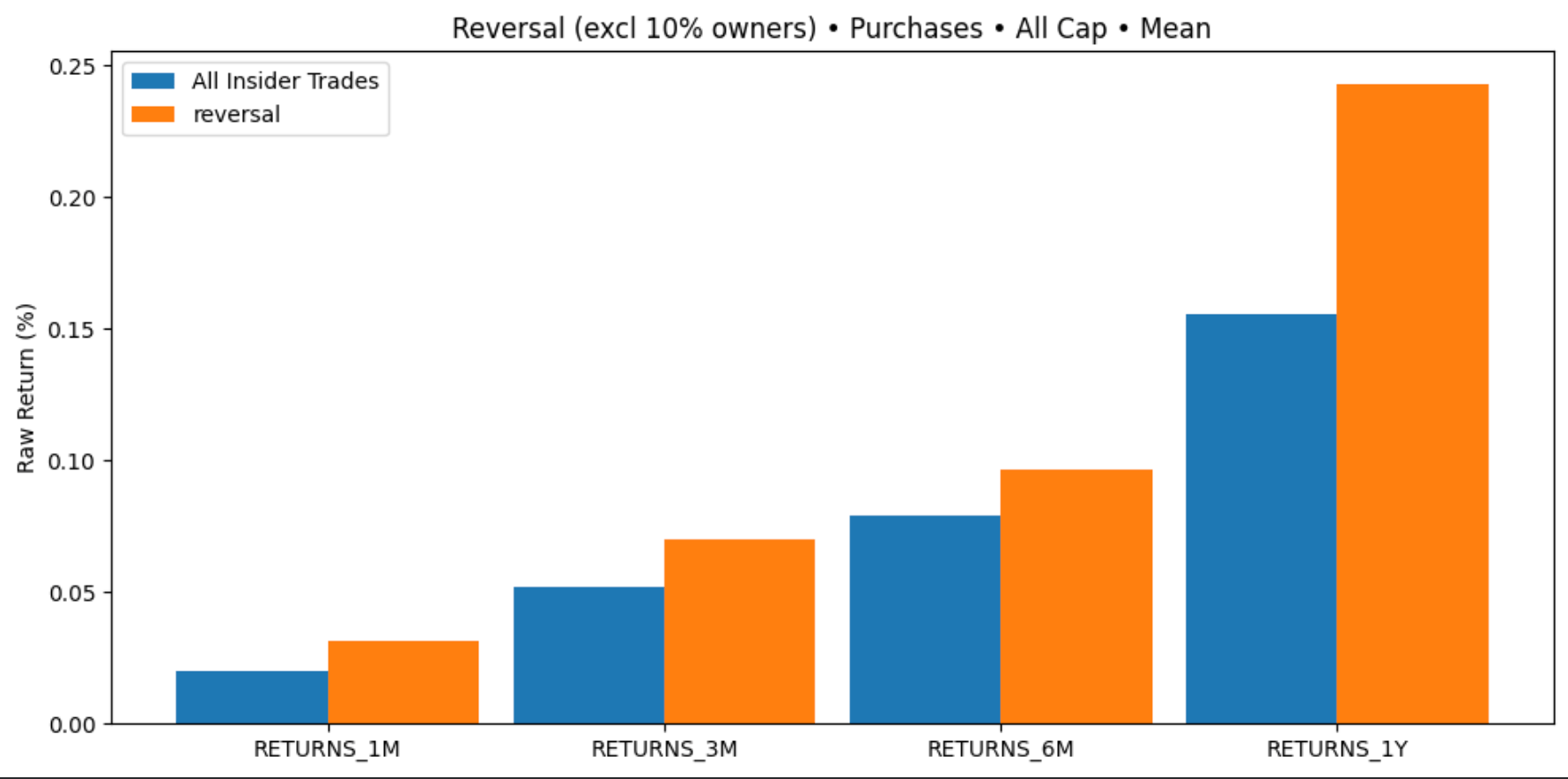

Reversals are rarer, but they also had a great 2025. There were 176 reversals (where an insider flipped from selling to buying), and those stocks are currently up 17.6%.

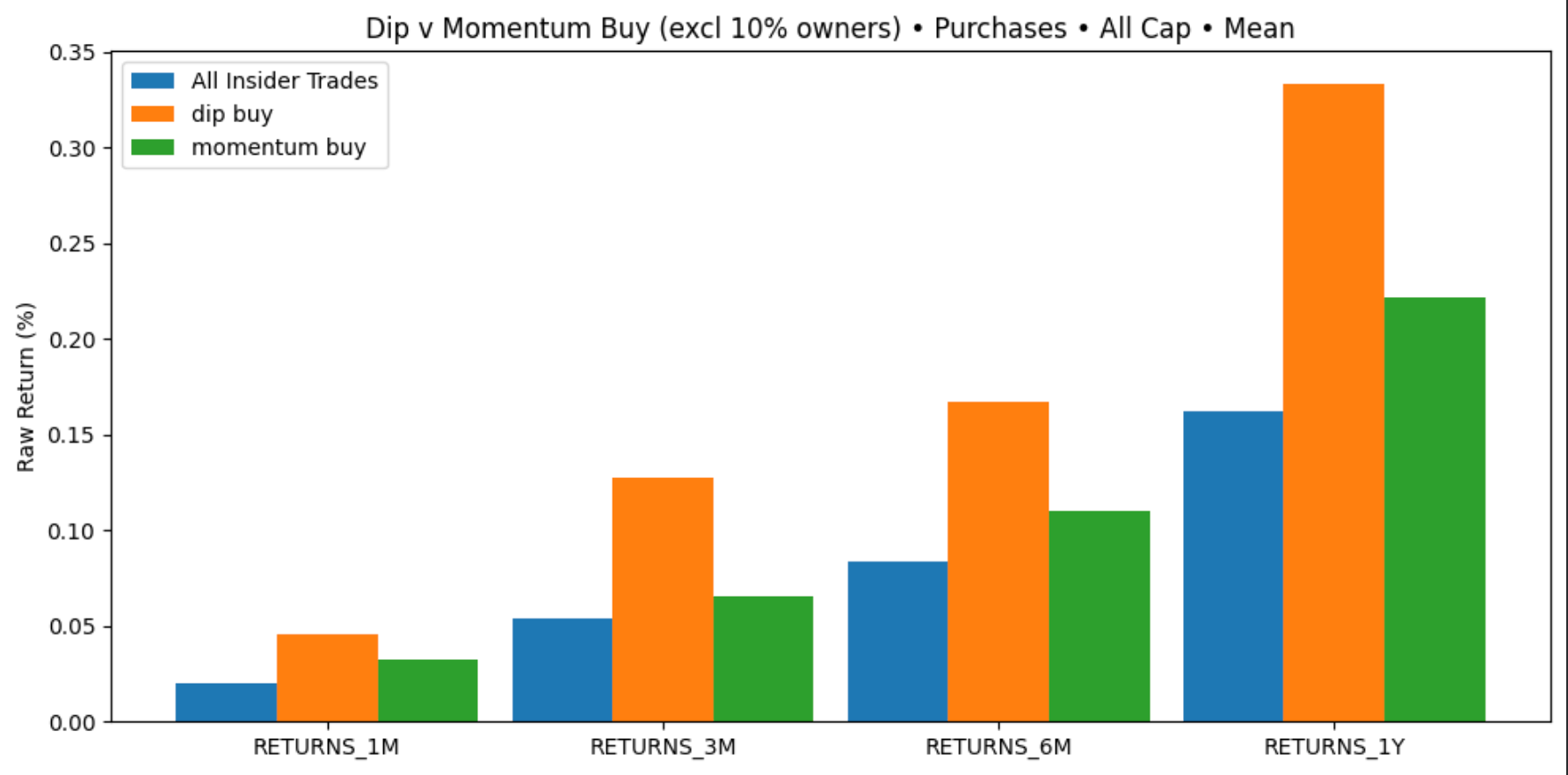

While dip buys underperformed both of these in 2025 (though still are crushing the benchmarks with 16.66% returns), over the last 15 years, dip buys have been by far the best signal.

I couldn’t put reversals on the same chart (database quirk), but they have slightly better returns than Momentum Buys, and also have a much better win rate and lower volatility.

Just like all momentum strategies, Momentum Insider Purchases thrive in periods of strong market momentum (like the middle 6 months of 2025), but get hit pretty hard when that momentum stops.

Reversals and Dip Buys are much more akin to a value strategy. With Reversals and Dip Buys, we are unlikely to find the quick 100%+ winners like we did with the KTOS, NEGG, and UAMY Momentum Purchases, but the path is much smoother and the overall, long-term returns much better.

I strongly recommend that all CEO Watcher Premium subscribers look at these three pages in the dashboard every day (or at least the screenshots in the Data Dump section), and at least do a quick look at every stock that appears in those lists (especially the Reversals and Dip Buys).

If you just randomly threw darts at Reversals and Dip Buys since 2009, you’d have smoked the S&P. And only a couple of stocks make those lists each day, so it will take you very little time.

If you aren’t a premium subscriber, you can upgrade at any time at ceowatcher.com. If you end up not finding it useful, I’ll refund you with no questions asked.

keep scrolling. top trades + all of the charts and data below

🔒 CEO Watcher Premium

The rest of this email (including today’s top insider trades + all the charts and data) is for CEO Watcher Premium subscribers only. To see an example of the Premium email, click here.

Upgrade to CEO Watcher Premium at ceowatcher.com to unlock:

The Premium daily emails

Full access to the website, which has all insider trades back to 2009. It includes search/filters and the returns of every trade and every insider to help you find the top insider trades

Full access to the CEO Watcher Premium Discord where I share my notes and holdings in the CEO Watcher Portfolio

The Premium Dashboard, which has a bunch of charts/tables with insider trading data that is updated each day

If CEO Watcher Premium is not for you, I give full refunds with no questions asked.

Reply