- 📈👀 CEO Watcher

- Posts

- Top insider trades (Tue, Jan 13)

Top insider trades (Tue, Jan 13)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

Only 76 new trades were filed, but we found a few very interesting ones. My notes on those are shared with CEO Watcher Premium subs in the Trade Notes section. We also added one stock to the CEO Watcher Premium Portfolio (also mentioned in the Trade Notes section).

As a reminder, you can always sign up for CEO Watcher Premium at ceowatcher.com. If you ever find that it isn’t for you, I will give a full refund with no questions asked.

Director at Microstrategy (MSTR) buys $770k of the stock for the first time after this 50% dip started. He was also selling near the top in June

Lakeland Industries (LAKE) insiders have been buying the dip (but in small sizes). Five insiders have bought nearly $70k.

Insiders at Butler National (BUKS) have been buying the stock, but they are all tiny $5k purchases.

CFO at IDT Corp (IDT) sells the stock for the first time since 2024. Only a $33k sale

Insiders at AAR Corp (AIR) are starting to sell this run-up. Almost $5M in sales in January

A couple of EVPs at Campbell's (CPB) are fleeing the ship. They sold $400k as the stock continues to fall.

A $761k insider sale at Factset (FDS) looks to just be some options that were expiring that were converted and sold. They could have converted and held the options, but I don't think it's a big deal

and more…

Commentary

We currently own two biotech stocks in the CEO Watcher portfolio after finding a director buying $1.4M of a biotech stock (I’m keeping this ticker private for CEO Watcher Premium subs for now) on Thursday, and finding a CEO buying $1.6M of Zenas Biopharma (ZBIO) yesterday.

Those two stocks were up 10% and 20% yesterday (while the XBI was red).

The first biotech stock also increased the director’s holdings by over 260%, was the first-ever purchase for the director, was a reversal (he sold the stock nine times in a row before the purchase), and was a dip buy (the stock was down 60% in the last 3 months).

Here is the note I shared with CEO Watcher Premium subs on Thursday (it was actually the only insider trade I highlighted that day).

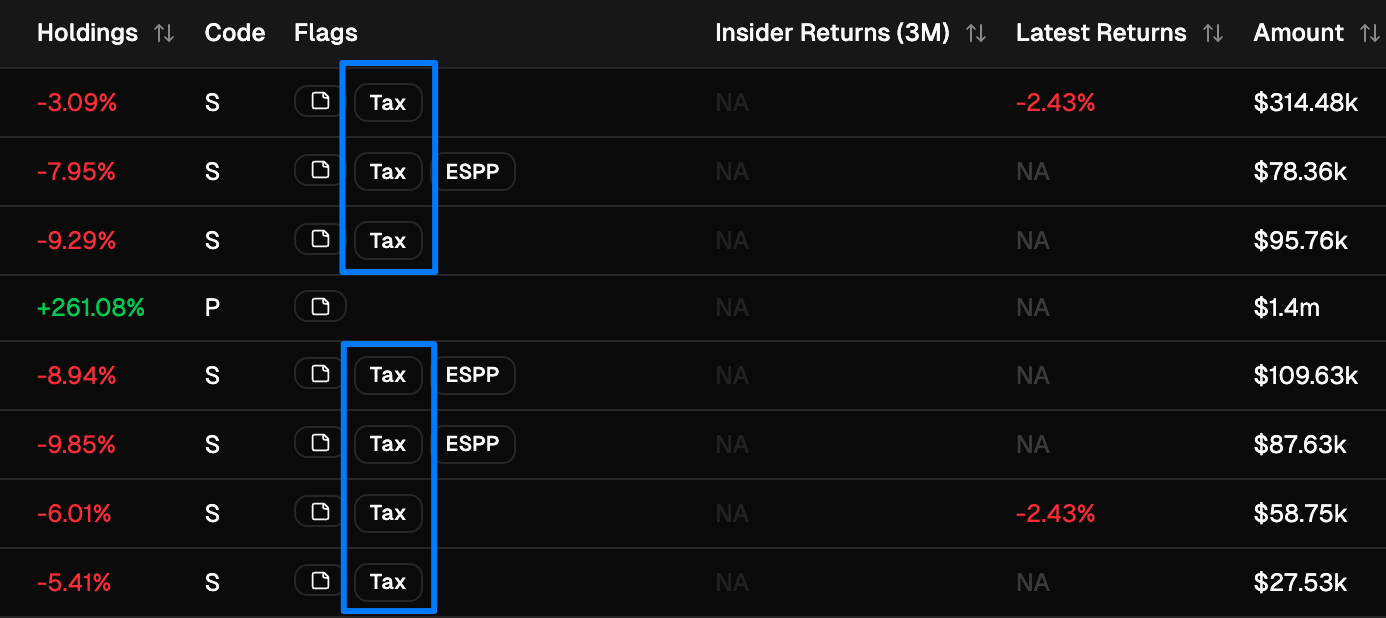

The tricky thing about this insider purchase was that seven insiders also sold the stock, which obviously appeared bearish. However, all seven of those sales were to cover taxes. They were not discretionary sales. With ceowatcher.com, we flag all tax sales, so you can easily see when a sale is for taxes and can be ignored.

Even national news outlets put out misleading stories about the insider sales without noting that they are just for taxes.

It appears that investors started to get the memo yesterday as the stock was up over 10%.

I’ll talk about why ZBIO was interesting tomorrow.

keep scrolling. top trades + all of the charts and data below

🔒 CEO Watcher Premium

The rest of this email (including today’s top insider trades + all the charts and data) is for CEO Watcher Premium subscribers only. To see an example of the Premium email, click here.

Upgrade to CEO Watcher Premium at ceowatcher.com to unlock:

The Premium daily emails

Full access to the website, which has all insider trades back to 2009. It includes search/filters and the returns of every trade and every insider to help you find the top insider trades

Full access to the CEO Watcher Premium Discord where I share my notes and holdings in the CEO Watcher Portfolio

The Premium Dashboard, which has a bunch of charts/tables with insider trading data that is updated each day

If CEO Watcher Premium is not for you, I give full refunds with no questions asked.

Reply