- 📈👀 CEO Watcher

- Posts

- Top insider trades (Tue, Feb 17)

Top insider trades (Tue, Feb 17)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

There were 203 new insider trades filed.

Two insider trades were flagged as High Signal, and one was added to the CEO Watcher Portfolio. CEO Watcher Premium subs can see those in the Trade Notes section of this email or the CEO Watcher Premium Dashboard that is linked in the Data Dump section.

As a reminder, if you upgrade to CEO Watcher Premium (link) and find that it isn’t for you, I’ll give you a refund.

COO at Prospect Capital (PSEC) bought $2.75M (largest purchase ever, out of 93).

Exec Chairman at Alexandria Real Estate (ARE) bought $1.35M (3rd largest, out of 5). They had sold the stock 105 times in a row before this purchase.

The CEO at Northpointe Bancshares (NPB) bought $635k (largest purchase ever, out of 2).

A couple of directors bought Zenas Bio (ZBIO). The CEO bought twice in 2026 as well. The stock is up over 20% in the last month, but still down 26% in the last 3 months.

The CEO and a director at QuidelOrtho (QDEL) both bought over $200k of the stock (and the CFO bought $80k). The stock is down 30% in the last month.

Director at PennyMac Financial (PFSI) bought $200k (largest purchase ever, out of 4). They made 3 sales in a row before this purchase.

The CEO and Chief Innovation Officer at C. H. Robinson (CHRW) bought over $100k of the stock. The stock fell 12% on the release of some AI tools (which feels like a ridiculous sentence to write).

A director at Molina Healthcare (MOH) bought $100k of the stock. The stock is down 50% in the last year.

A director at Air Products & Chemicals (APD) sold $20M (6th largest sale, out of 6)

The COO at BlackRock (BLK) sold $65M (largest sale ever, out of 13).

An EVP at Goldman Sachs (GS) sold $15M (largest sale ever, out of 18). The stock is up 47% in the last year.

A director at Cummins (CMI) sold $11M. The stock is up 66% in the last year.

Four insiders at Citigroup (C) combined to sell $15M of the stock. It’s the first insider sales at Citigroup since mid-2025

and more…

Commentary

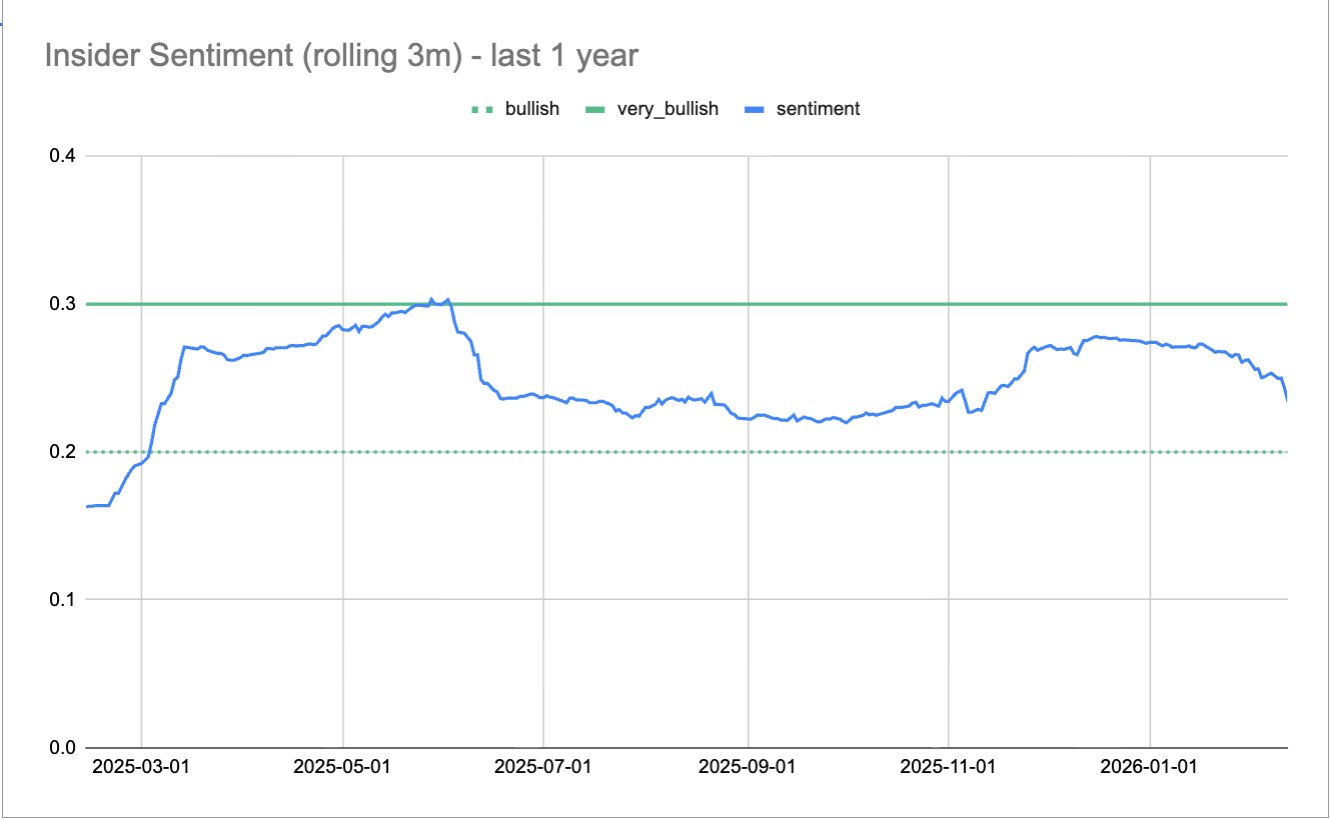

Our favorite insider sentiment indicator is this rolling 3m score that we calculate.

Essentially, we remove all of the low signal insider trades (tax sales, 10b5-1 plans, employee stock purchase plans, dividend reinvestments, private placements, public offerings, trades that are too small, etc) and then calculate the percentage of insiders who are buying.

Someone asked if a 3m rolling average is the best timeframe because it is a fairly long time period, and they’d seen some data that insider buying was starting to pick up.

The main reason that you need to use a 3m timeframe (or longer) is that insider trading is very cyclical.

Insiders enter a blackout period a few weeks before earnings, and it lasts until a few days after they report earnings.

This chart also demonstrates why you must always use a ratio of buys v sells and not just the absolute number.

The other reason we use the rolling 3m score is that we’ve found that when the ratio of insider buying over the previous three months gets above 30% (the “very bullish” threshold), the forward 1-year returns of the S&P are very good.

When we add the returns for when the score gets below 20% (the “bullish” threshold), the returns are substantially worse.

For the 10 years in the chart (2016-01-01 until 2026-01-01), the S&P increased an average of 13.5% per year. When the score exceeded 30%, it returned 26% the following year. When the score fell below 20%, it returned 9% the following year.

keep scrolling. top trades + all of the charts and data below

CEO Watcher Premium

The rest of this email (including today’s top insider trades + all the charts and data) is for CEO Watcher Premium subscribers only. To see an example of the Premium email, click here.

Upgrade to CEO Watcher Premium at ceowatcher.com to unlock:

The Premium daily emails

Full access to the website, which has all insider trades back to 2009. It includes search/filters and the returns of every trade and every insider to help you find the top insider trades

Full access to the CEO Watcher Premium Discord where I share my notes and holdings in the CEO Watcher Portfolio

The Premium Dashboard, which has a bunch of charts/tables with insider trading data that is updated each day

If CEO Watcher Premium is not for you, I give full refunds with no questions asked.

Reply