- 📈👀 CEO Watcher

- Posts

- Top insider trades (Tue, Dec 9)

Top insider trades (Tue, Dec 9)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

There were 186 new insider trades filed:

The CEO at Linde (LIN) is buying the dip after insiders were selling near the top

A director at Cartesian Therapeutics (RNAC) bought $200k of the stock (largest purchase ever, out of 19). It’s a clinical-stage biotech that is down 70% in the last year

The Chief Investment Officer at Sintx Technologies (SINT) continues to buy the stock

A director at Diamondback Energy (FANG) sold $52M (largest sale ever, out of 4).

The Chief of Global Operations at Western Digital (WDC) sold $3.72M (largest sale ever, out of 3). The stock is up almost 200% in the last year.

The CEO at Select Water Solutions (WTTR) sold $3M (3rd largest sale, out of 5).

An EVP at Advanced Micro Devices (AMD) sold $2.2M (4th largest sale, out of 25)

The CEO at UMB Financial Corp (UMBF) sold $1.76M (6th largest sale, out of 217).

and much more…

I go into more depth on these companies in the CEO Watcher Premium sections below.

Commentary

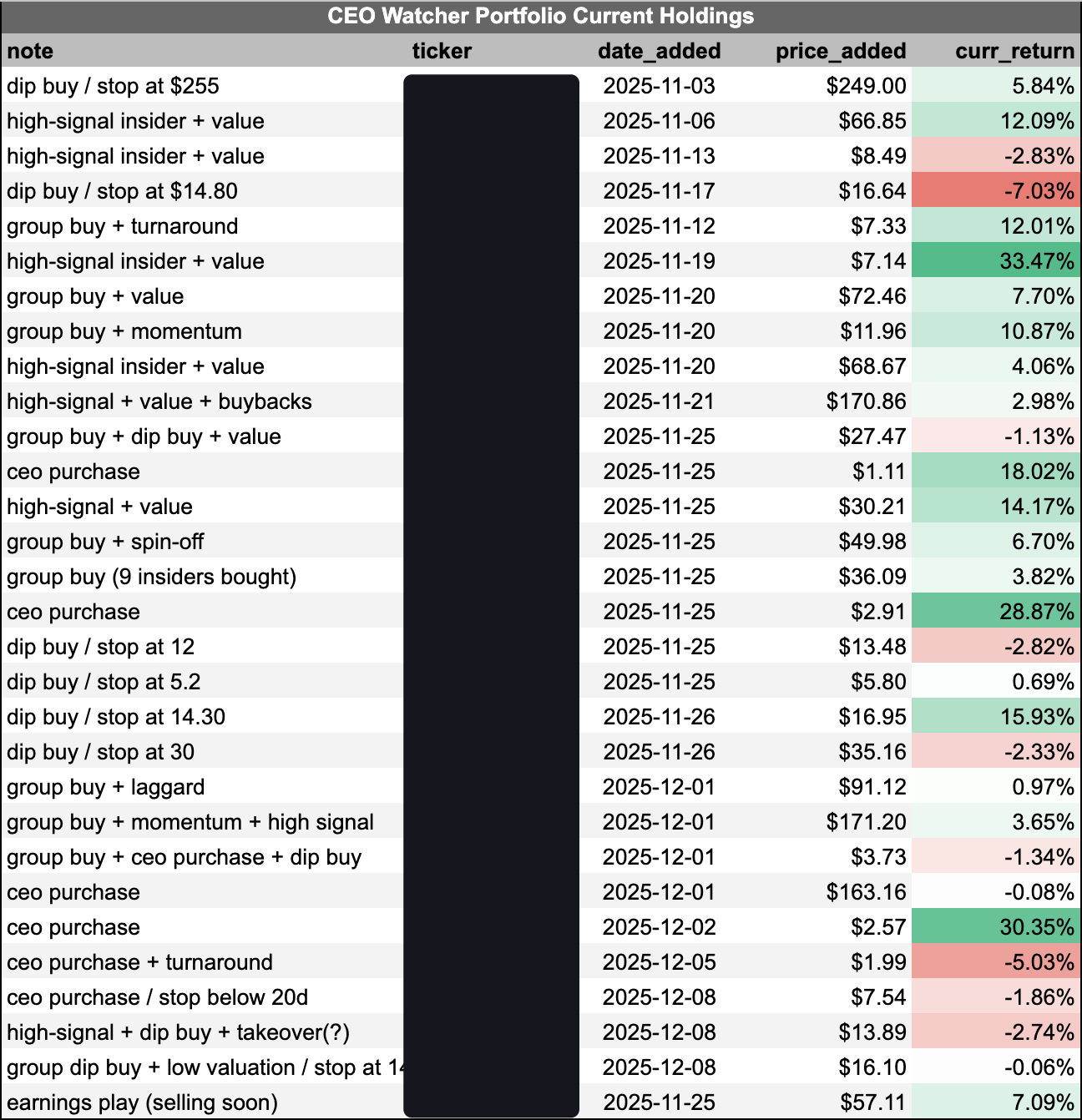

I’ve finally gotten around to adding a CEO Watcher Portfolio page to the Premium Dashboard. I’ll also add a screenshot of the portfolio each day in the Data Dump section of this email for Premium subscribers.

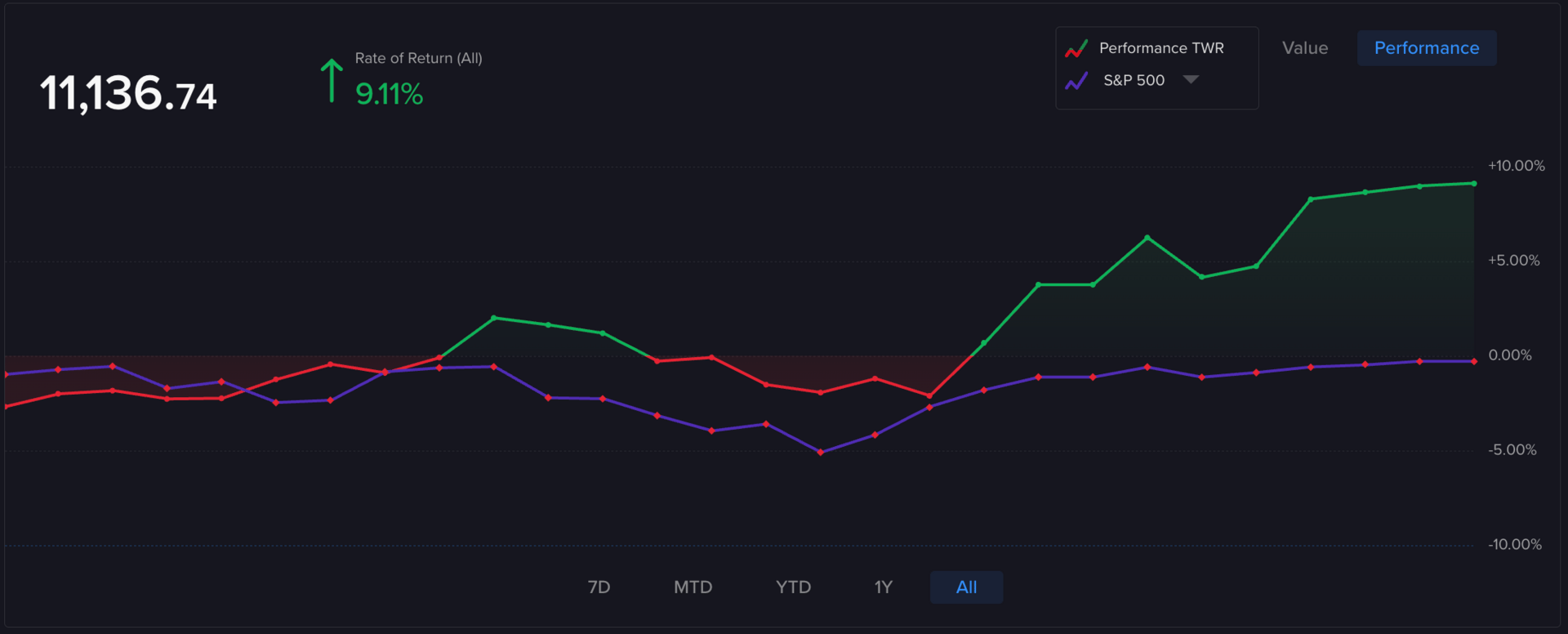

The goal of the CEO Watcher Portfolio is to significantly outperform the S&P solely using CEO Watcher data.

To accomplish this, I want to minimize my own biases/portfolio management abilities (or lack thereof).

So I’ve set up some rules that we’ll try to follow.

All positions are equally weighted

Only buying common stock. No options

No adding to or trimming positions. We will fully enter and exit positions.

Use rules for entering/exiting positions (explained more below)

Long-only for now (mostly)

My guess is that it will typically hover between 20 and 30 positions, depending on the number of current high-signal trades.

The four main types of insider purchases that we will be copying are:

High Signal Insiders - insiders with a good track record who are making an unscheduled purchase

Dip Buys - insiders (preferably multiple) buying the company stock after a large near-term drawdown (30%+ dip in the last month)

Turnaround Buys - insiders (preferably multiple) buying the company stock after a large long-term drawdown (50%+ drawdown in the last year)

CEO Purchase - a CEO making a sizable, unscheduled purchase (just trying to ride the momentum this tends to cause in stocks)

The basic entry/exit rules that we will try to follow:

High Signal Insiders and Turnaround Buys will typically use the 50d SMA to enter and exit (enter when the stock has closed significantly above the 50d and/or been above it for a few days, and vice versa for exiting)

Dip Buys will typically be entered once the stock has closed at a 5-day local high, and then we’ll put a stop just below the local low to prevent catching the falling knife

CEO Purchases - buy immediately with a stop below the local low. Use the 50d SMA for exit criteria when possible

This is a real-money portfolio that I started on November 1st. It’s just a small portion of my overall account, but I thought it was important to have some real money on the line so that we have some skin in the game and an accurate record of the CEO Watcher picks. I do also use the CEO Watcher data/picks for my personal portfolio, but, obviously, my personal portfolio has a different overall strategy than the CEO Watcher Portfolio.

The account was started on November 1st with ~$10,000 and is off to a strong start. It’s not only beating the S&P so far, it’s beating the S&P plus has enough left over to pay for multiple years of CEO Watcher Premium.

This even includes a sizable loss on the WIX earnings play we discussed last month. Not only did I make that play in this account (and my personal account), but I even sized it extra large in the CEO Watcher Portfolio and lost 1.5% of the entire portfolio!

Fortunately, the other picks have more than made up for it, but that’s one of the reasons I decided not to let me choose position sizing and instead make them all equal.

I’ll share all Portfolio updates with CEO Watcher Premium subscribers in these daily emails and in the Discord. Plus, it’ll always be available in the CEO Watcher Premium dashboard and in the Data Dump section of these daily emails.

If you aren’t a CEO Watcher Premium member, you can upgrade at ceowatcher.com.

And as one final reminder, this CEO Watcher Portfolio is not investment advice. We are trying to beat the S&P, and it is meant to highlight the highest-signal insider trades, but please do your own research and don’t blindly copy it.

keep scrolling. top trades + all of the charts and data below

🔒 CEO Watcher Premium

The rest of this email (including today’s top insider trades + all the charts and data) is for CEO Watcher Premium subscribers only. To see an example of the Premium email, click here.

Upgrade to CEO Watcher Premium at ceowatcher.com to unlock:

The Premium daily emails

Full access to the website, which has all insider trades back to 2009. It includes search/filters and the returns of every trade and every insider to help you find the top insider trades

Full access to the CEO Watcher Premium Discord where I share my notes and holdings in the CEO Watcher Portfolio

The Premium Dashboard, which has a bunch of charts/tables with insider trading data that is updated each day

If CEO Watcher Premium is not for you, I give full refunds with no questions asked.

Reply