- 📈👀 CEO Watcher

- Posts

- Top insider trades (Thu, Dec 4)

Top insider trades (Thu, Dec 4)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

There were 292 insider trades filed.

4 execs buy $7.7M of Blue Owl Capital ($OWL)

The CEO at SmartRent (SMRT) keeps buying, and a director just bought too

The CEO at Nerdy (NRDY) also keeps buying the stock

The CEO joins the COO in buying $15k of SR Bancorp (SRBK). Small dollar values, but they have good track records

The director at Grindr ($GRND) buys another $3.87M. This is the same director who bought a couple of months ago before the acquisiiton rumors

Insiders at AXT (AXTI) are running for the exits after the stock’s nearly 600% returns in the last 6 months. First time insiders have sold since 2022

Kratos Defense (KTOS) defense CEO just sold $29M after buying the stock a couple of times early this year

and much more…

I go into more depth on these companies in the CEO Watcher Premium sections below.

Commentary

I’m aggregating all of our insider trading research right now, and I figured I’ll start sharing some of it in these daily emails when there isn’t more pressing insider trading activity to discuss.

In this email, we’ll start at the very beginning and just look at plain old insider buying. In future emails, we’ll look at all the different ways we can slice and dice insider trading data to identify the highest signal insider trades.

Empirical research on U.S. insider trading started to take shape in the 1960s and 1970s. In one of the earliest large-sample studies, Jaffe (1974), in Special Information and Insider Trading, shows that insider purchases are followed by significant abnormal returns, while insider sales have weak, if any, predictive power. This was also among the first systematic pieces of evidence inconsistent with the Efficient Market Hypothesis, which had gained prevalence at the time.

In the 1980s and 1990s, Seyhun carried out a series of influential studies using broader and more modern samples. Seyhun (1986), in Insiders’ Profits, Costs of Trading, and Market Efficiency, finds that insider purchases earn significant abnormal returns, but most of the abnormal returns are eroded by transaction costs (which were significantly higher back then).

Lakonishok and Lee (2001), in Are Insiders’ Trades Informative?, extend the analysis to virtually all U.S. listed firms from the mid-1970s through the mid-1990s. They document that insiders behave like contrarian value investors: they tend to buy after stock price declines (particularly in small, value companies) and to sell after strong price runs. Consistent with earlier work, they show that insider purchases, particularly in small-cap stocks, are followed by positive abnormal returns, while insider sales are much less informative.

Brochet (2010), in Information Content of Insider Trades Before and After the Sarbanes–Oxley Act, examines how the Sarbanes–Oxley Act (SOX) changed the information content of insider trades by accelerating Form 4 reporting to within two business days of the transaction. He finds that insider purchases have a larger short-term impact on stock prices and trading volume in the post-SOX period, consistent with faster disclosure increasing the informativeness of these trades.

Finally, Cohen, Malloy, and Pomorski (2012), in Decoding Inside Information, show that raw insider trading data is mostly noise from an investment perspective: many trades are routine or mechanical (tax sales, dividend reinvestments, etc). However, once routine and mechanical trades are stripped out, “opportunistic” insider trades - particularly purchases, but in some cases sales as well - continue to generate economically and statistically significant abnormal returns even in the 2000s.

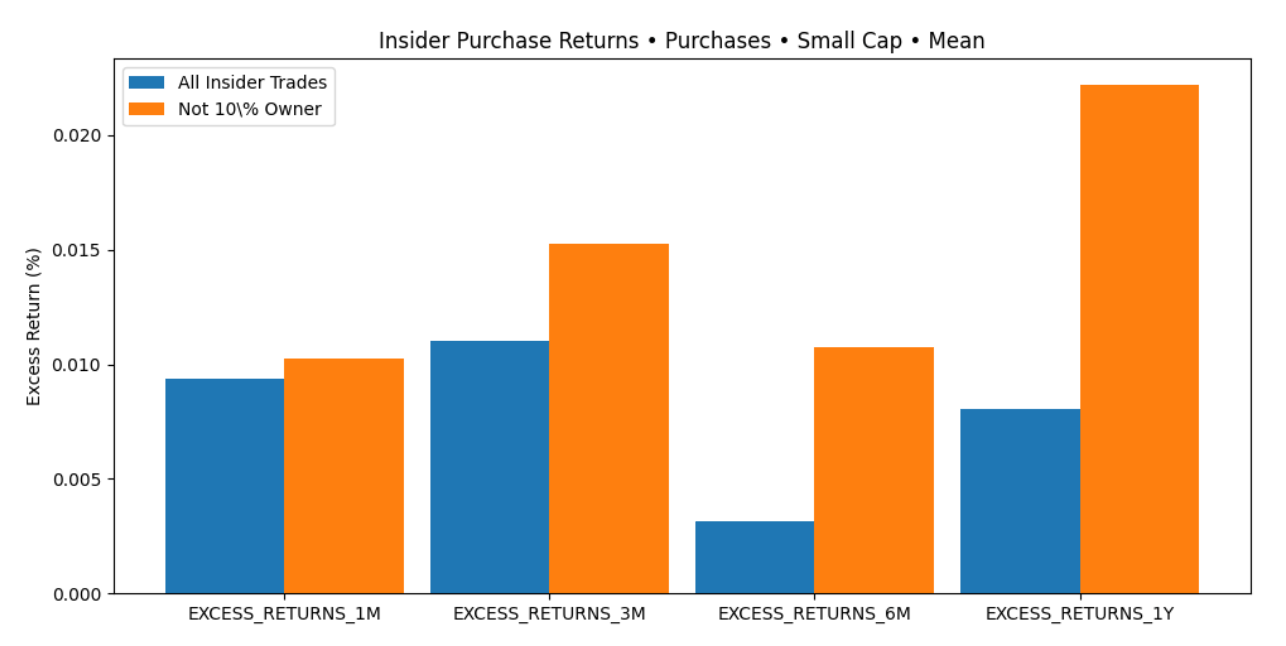

Our database goes back to 2009, and our results largely align with the academic research. Specifically, insider purchases do outperform their benchmark (Russell 2000 for companies with a market cap <$2B and the S&P for >$2B), but it is limited to small-cap companies.

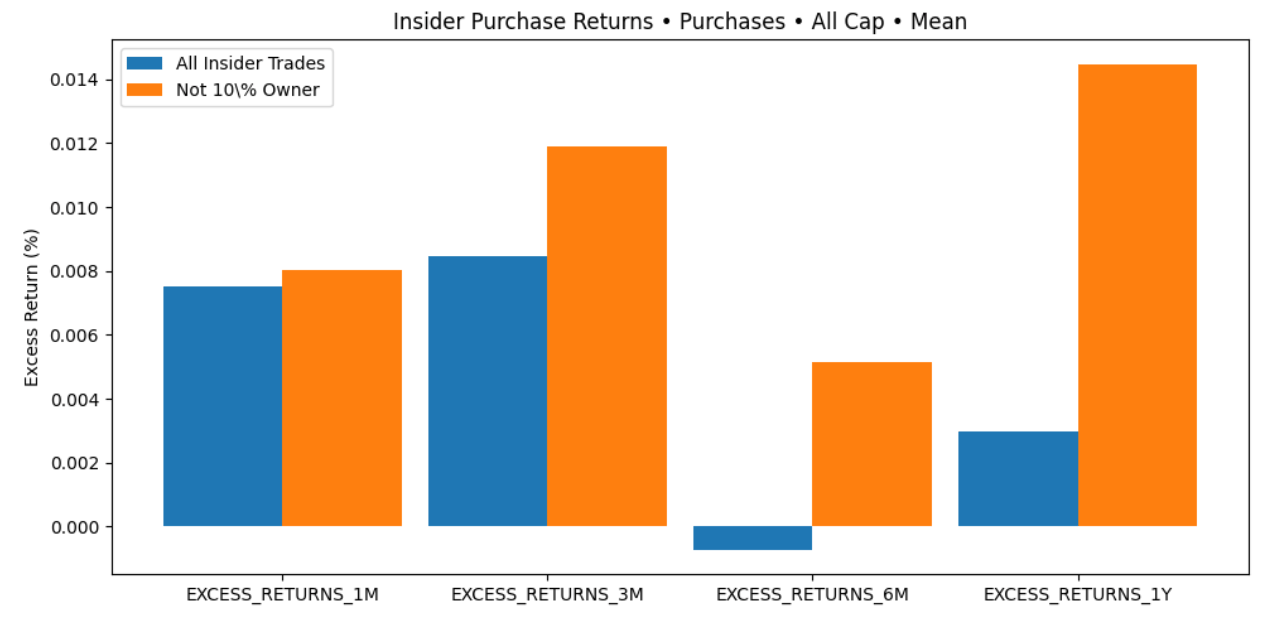

The chart below shows that insider purchases outperform the benchmark across most timeframes, but even a simple filter, like removing 10% Owners and only looking at insider purchases by executives and directors, can improve your returns significantly.

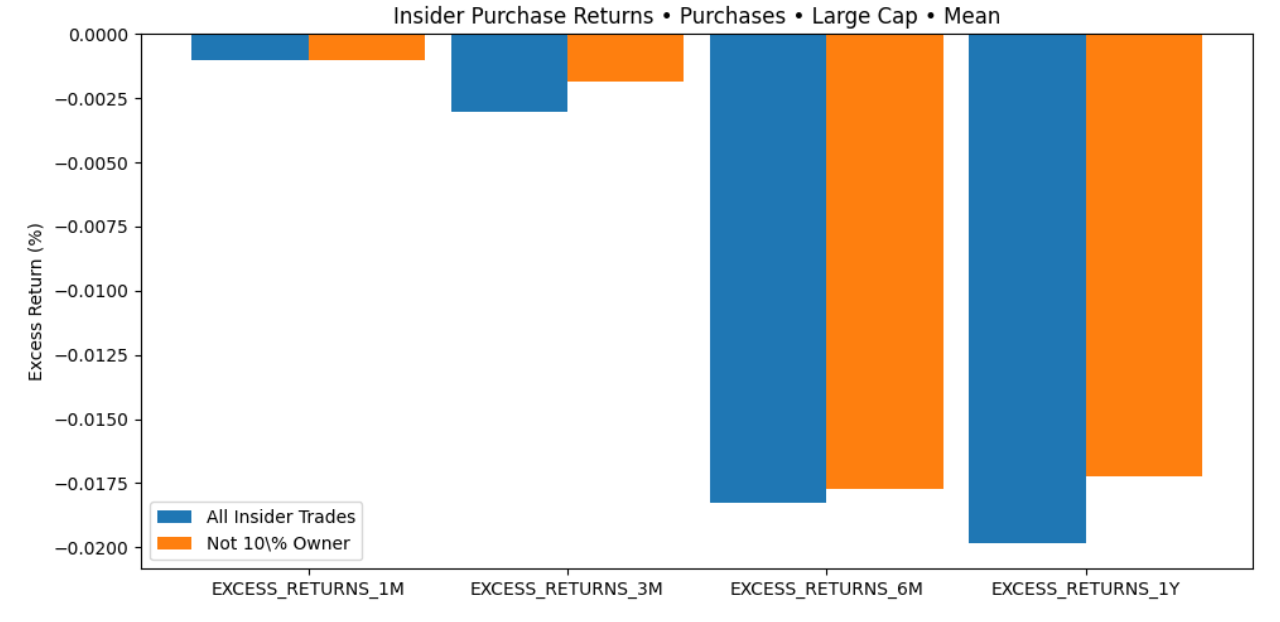

However, consistent with the research, the excess returns are solely attributable to companies with a market cap of less than $2B.

On average, insider purchases at large caps do not outperform the S&P.

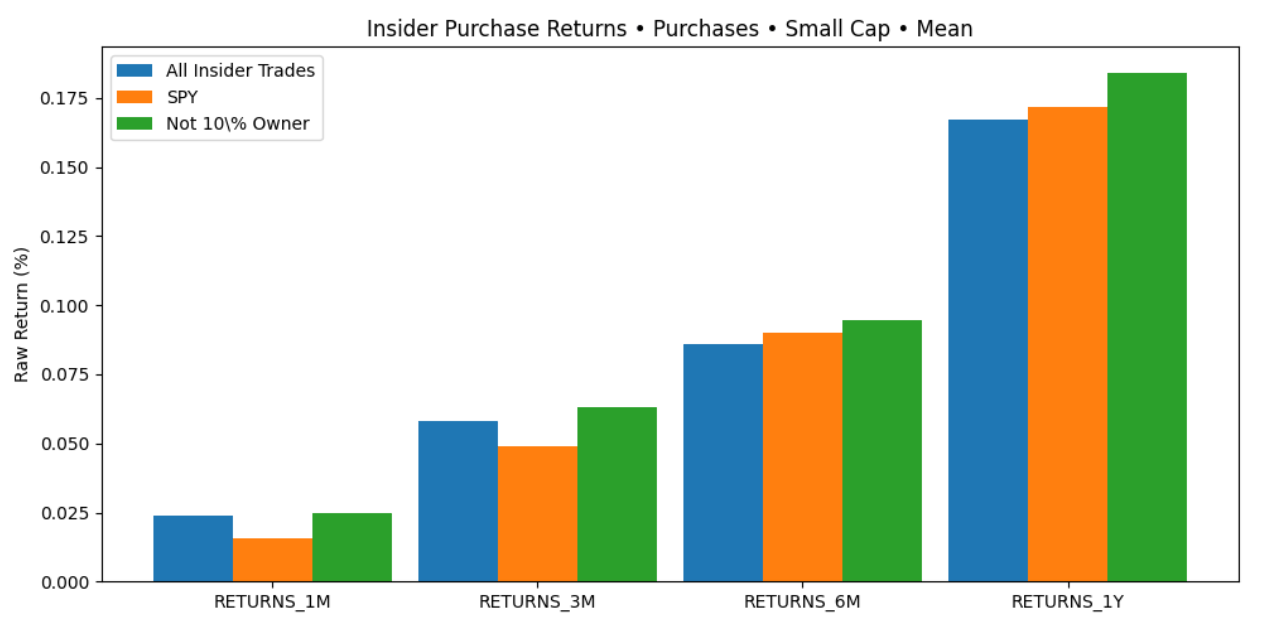

However, even if you use the S&P as your benchmark for the small-cap stocks (instead of the Russell 2000), insider purchases by non-10% Owners still outperform the S&P.

Even now, 50+ years after the early insider buying research, the results are mostly the same. Insider buying at small-cap companies outperforms.

However, the returns are not as easy to come by as they were 50 years ago. In future emails, we will look at more recent research that looks at different types of insider trades and finds that there is still a lot of alpha to be found (in both large and small cap companies!) in insider trades, as long as you know what to look for.

keep scrolling. more data below

🔒 CEO Watcher Premium

The rest of this email is for CEO Watcher Premium subscribers only. To see an example of the Premium email, click here.

Upgrade to CEO Watcher Premium at ceowatcher.com to unlock:

The Premium daily emails

Full access to the website, which has all insider trades back to 2009. It includes search/filters and the returns of every trade and every insider to help you find the top insider trades

Full access to the CEO Watcher Premium Discord where I share my notes and holdings in the CEO Watcher Portfolio

The Premium Dashboard, which has a bunch of charts/tables with insider trading data that is updated each day

If CEO Watcher Premium is not for you, I give full refunds with no questions asked.

Reply