- 📈👀 CEO Watcher

- Posts

- Top insider trades (Thu, Dec 11)

Top insider trades (Thu, Dec 11)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

There were 234 new insider trades filed.

SmartRent (SMRT) CEO continues to buy

Nerdy (NRDY) CEO continues to buy

A Director at Alumis (ALMS) bought another $1.83M. His 3rd $1M+ purchase in December. A bunch of insiders have been buying since November.

A director at Alta Equipment Group (ALTG) bought $200k. Their first purchase since 2023

A Director at Figure Technology (FIGR) bought $153k. The first-ever purchase at FIGR

Director at Transdigm (TDG) sold $121M (5th largest sale, out of 23). Two other executives and a few directors also sold the stock recently.

CEO at Sotera Health (SHC) sold $7M (3rd largest sale, out of 4). His first sales in over 1.5 years.

COO at Five Below (FIVE) sold $4.37M (largest sale ever, out of 11). It’s his first sale since 2022. The Chief HR Officer also sold

and much more…

I go into more depth on these companies in the CEO Watcher Premium sections below.

Commentary

Is a CEO purchase a better signal than other insiders? Do executive purchases lead to better returns than director purchases? Is there any difference at all depending on who is buying the stock?

While we don’t find much evidence of significant differences in stock returns between executives and directors, there is one group of insiders whose purchases are a significantly lower signal (on average) than the others - the 10% Owners.

The three groups of insiders who must file Form 4s when they buy/sell the stock are Executives, Directors, and 10% Owners. As the name implies, a 10% Owner is any person/entity that owns at least 10% of a company (typically a fund).

According to our own insider trading data since 2009, along with the research done by Tavakoli, McMillan, and McKnight (2012) in “Insider trading and stock prices”, there is no alpha to be had in copying the purchases of 10% Owners. All of the upside from copying insider purchases comes from Executives and Directors.

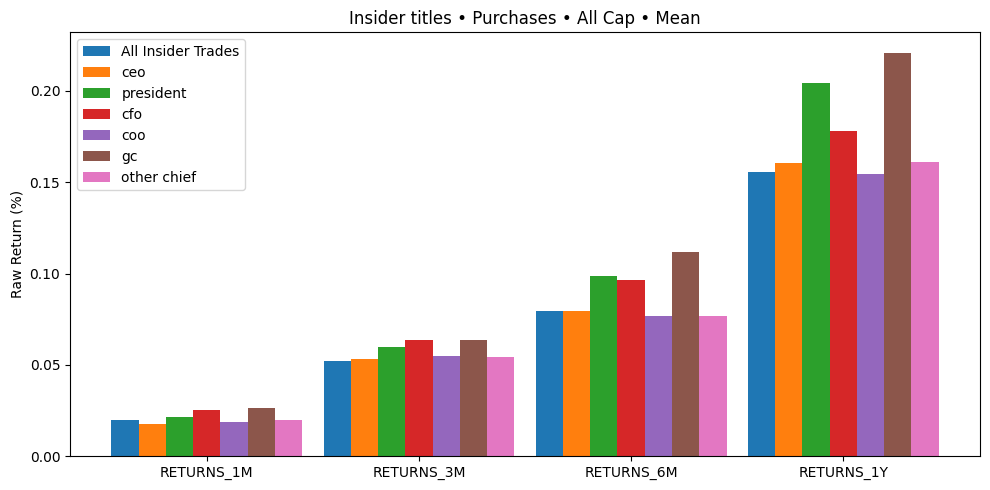

As you can see in the chart above, we also find that executives (referred to as “officers” in the graph) slightly outperform directors. However, Jeng, Metrick & Zeckhauser (2003) in their paper Estimating the Returns to Insider Trading, looked at insider trades between 1975 and 1996 and did not find any differences in returns between executives and directors.

Many of you have likely heard that CFO purchases are the highest signal insider purchases. This comes from Wang, Shin & Francis (2012) in their paper CFOs vs. CEOs: Whose Purchases Are More Informative?. They found that CFOs earned 5% higher excess returns than CEOs on their purchases over the following 12 months.

We do not find that big a delta, but our data does show that CFOs outperform CEOs. However, we find that Presidents outperform the CFOs and General Counsels outperform both!

This is a direct contradiction to the findings by Jiang & Wintoki (2016) in “Insider trading and the legal expertise of corporate executives”, who found that lawyer-insiders (like the General Counsel) significantly underperformed non-lawyer-insiders.

Our sample size does start to get a little small when comparing specific executives. We have ~3000 purchases by Presidents and ~1300 purchases by General Counsels, and the standard deviation for both is wider than that of the other executives, who have larger sample sizes.

So I’m not super convinced that Presidents and General Counsels actually outperform other executives. However, I do believe that the data unequivocally shows that purchases by 10% Owners are not high-signal on average. Your time is much better spent focusing on Executives and Directors.

Due to this finding, we exclude 10% Owners from almost all of our research and data. That’s why you will almost never see a 10% Owner purchase appear in any of the high-signal trades that we share with CEO Watcher Premium subscribers or the tables that we share in the Data Dump section.

keep scrolling. top trades + all of the charts and data below

🔒 CEO Watcher Premium

The rest of this email (including today’s top insider trades + all the charts and data) is for CEO Watcher Premium subscribers only. To see an example of the Premium email, click here.

Upgrade to CEO Watcher Premium at ceowatcher.com to unlock:

The Premium daily emails

Full access to the website, which has all insider trades back to 2009. It includes search/filters and the returns of every trade and every insider to help you find the top insider trades

Full access to the CEO Watcher Premium Discord where I share my notes and holdings in the CEO Watcher Portfolio

The Premium Dashboard, which has a bunch of charts/tables with insider trading data that is updated each day

If CEO Watcher Premium is not for you, I give full refunds with no questions asked.

Reply