- 📈👀 CEO Watcher

- Posts

- Top insider trades (Mon, Jan 12)

Top insider trades (Mon, Jan 12)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

There were 119 new insider trades filed

The CEO at Zenas BioPharma (ZBIO) buys $1.6M of the stock after it’s 60% dip (largest purchase ever)

Two insiders at Innovative Food Holdings (IVFH) bought $240k of the company as part of a purchase agreement that allowed them to buy the stock for a 20% discount. Good gig if you can get it.

Eric Sprott buys another $3.28m of Hycroft Mining (HYMC) even after its 100%+ increase in the last month.

Andressen Horowitz picks up another $839k of Navan (NAVN)

The CEO at Dorian LPG (LPG) bought $400k

A couple of directors at Limoneira (LMNR) have bought the stock in the last few days. These are the first two insider trades since 2023

AE Red Holdings has started selling off some of its Redwire (RDW) stake after the stock’s 100% returns in the last couple of months. They’ve sold $46M

A director at Argan (AGX) exercised some of their stock options for $40.15 and sold them for over $300 ($3.38M total). The stock options didn't expire until 2029.

A director at Dycom (DY) sold $1.26M of the stock (first time ever selling the stock).

and more…

Commentary

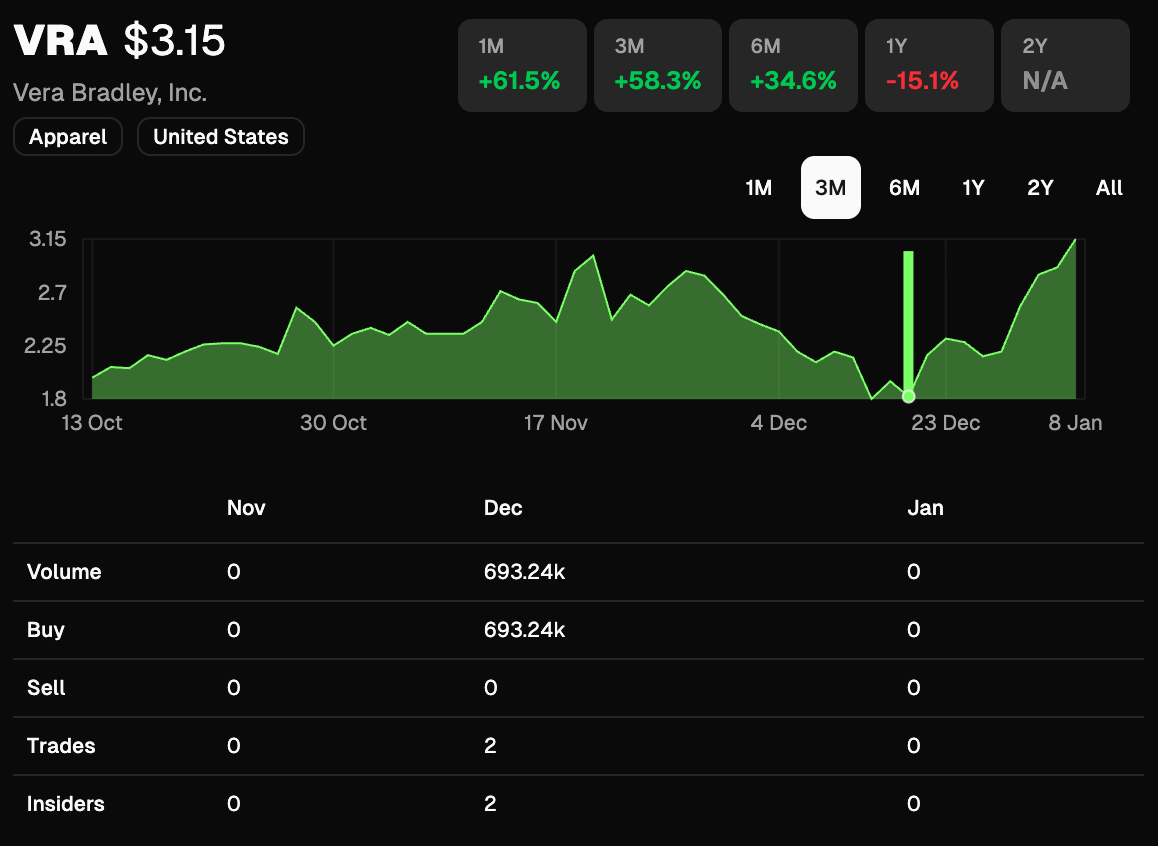

In the December 16th email, I shared the following note with CEO Watcher Premium subscribers.

The stock is now up 73% since the insider purchases were filed and 40% since the email was sent.

The main reason this insider purchase was on our radar was that it was a dip buy, with the stock down 30% in the previous month and 50% in the previous year.

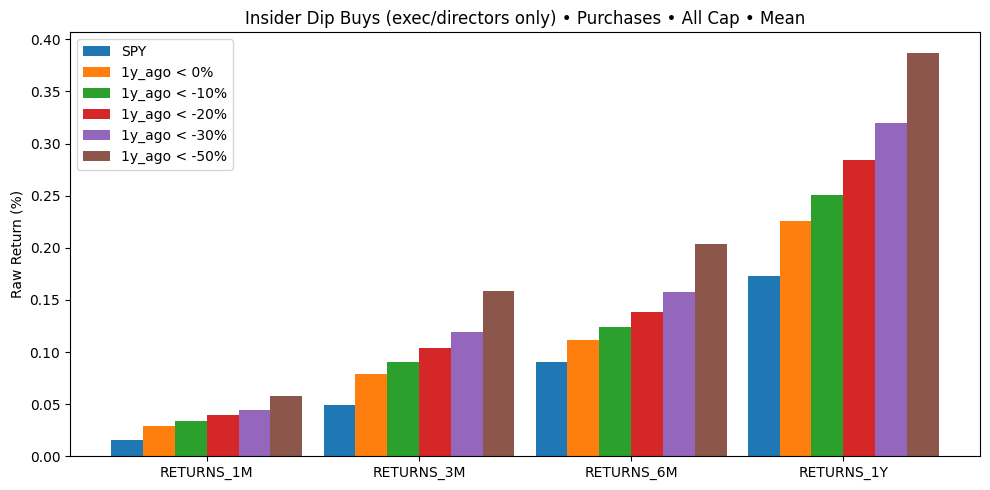

Historically, insiders buying a stock when it is down 30% in the last month has been a great signal.

Insiders buying when the stock is down 50% in the previous year is also a great signal.

-

As a reminder, CEO Watcher Premium subscribers can now set custom alerts on ceowatcher.com to receive an email at 6am with all of the insider trades that meet their criteria.

We even set up a template for Dip Buys so you can create that alert in one click.

We also share all of the dip buys in the last 30 days in the CEO Watcher Premium dashboard (the link is always available for Premium subscribers in the Data Dump section).

-

The insider purchases at Vera Bradley also had two other bullish data points:

The insiders combined to buy over 1% of the company, which is a very large amount of insider buying. That makes it the 3rd most bought stock (based on % of market cap) by insiders in the last 30 days. The #2 stock on that list is also up over 40%

Two different insiders bought the stock, making it a cluster buy.

On top of all of that, a couple of smart investors had recently pitched the stock on Yellowbrick, including the below pitch from Clark Square Capital (link).

The company doesn’t have earnings until March, but we will see if there are more signs of a turnaround taking place then.

keep scrolling. top trades + all of the charts and data below

🔒 CEO Watcher Premium

The rest of this email (including today’s top insider trades + all the charts and data) is for CEO Watcher Premium subscribers only. To see an example of the Premium email, click here.

Upgrade to CEO Watcher Premium at ceowatcher.com to unlock:

The Premium daily emails

Full access to the website, which has all insider trades back to 2009. It includes search/filters and the returns of every trade and every insider to help you find the top insider trades

Full access to the CEO Watcher Premium Discord where I share my notes and holdings in the CEO Watcher Portfolio

The Premium Dashboard, which has a bunch of charts/tables with insider trading data that is updated each day

If CEO Watcher Premium is not for you, I give full refunds with no questions asked.

Reply