- 📈👀 CEO Watcher

- Posts

- Top insider trades (Fri, Jan 30)

Top insider trades (Fri, Jan 30)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

There were 81 new insider trades filed.

No new insider trades were flagged as High Signal, but I shared a couple of notes on some moderately interesting trades with CEO Watcher Premium subs in the Trade Notes section.

As a reminder, if you upgrade to CEO Watcher Premium (link) and find that it isn’t for you, I’ll give you a refund.

Director at Worthington Steel (WS) bought $274k of the stock (largest purchase ever, out of 4). This is her first time ever buying WS, and her previous purchases were 15 years ago.

A director at NBT Bancorp (NBTB) bought $976k of the stock. This is their 2nd largest purchase ever (out of 4) and their 3rd purchase in the last 4 months.

CEO at Northrim Bancorp (NRIM) bought $34k. Small purchase, but it was their first purchase ever, and it comes after they got smoked on earnings.

Co-Chairman at Schwab (SCHW) was being a little sneaky. They exercised and sold $18.6M worth of options that expire in March, but then threw in another $2.7M of common stock to sell in that transaction as well.

The Chief Accounting Officer at CSX Corporation (CSX) sold $2.5M of the stock (3rd largest sale, out of 4). This was their first sale in two years.

The insider selling at Argan (AGX) continues after its 170% run-up in the last year

Director at Teledyne (TDY) sells $1.5M of the stock (largest sale ever, out of 26). The stock is up 20% in the last month.

The CFO at Corning (GLW) exercised and sold another $2.2M of options. These options vested 3 years ago and don't expire for another 4 years.

and more…

Commentary

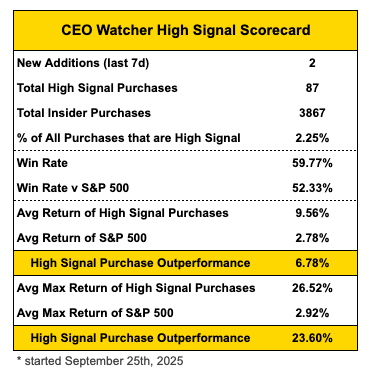

It’s Friday, so let’s do an update on the CEO Watcher data.

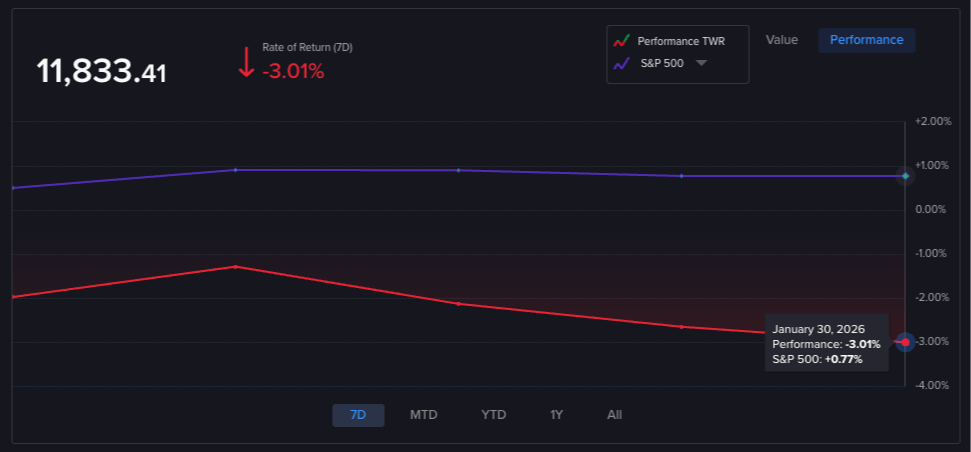

The CEO Watcher Portfolio* had its first losing week of the year and got whooped by the S&P.

*The CEO Watcher Portfolio is a standalone portfolio I started with ~$10k to buy equally-weighted positions in High Signal Stocks so we can track the performance in a real-money portfolio. I also hold much larger positions in many of the High Signal Stocks in my personal portfolio.

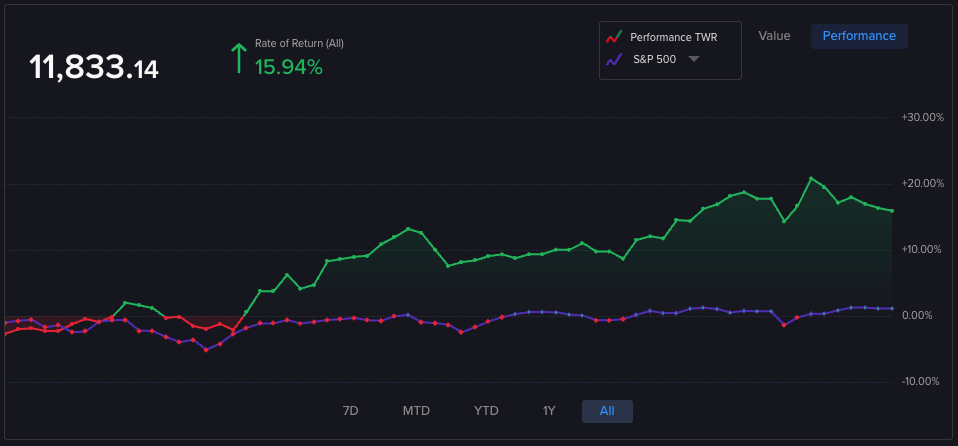

On the bright side, we are still crushing the S&P since inception on November 1st.

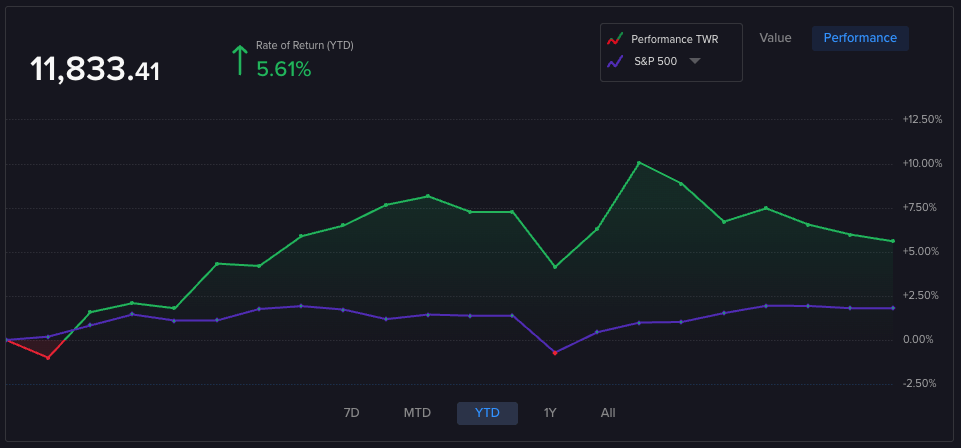

And still winning YTD.

Last week, we peaked at 20 points of outperformance v the S&P in just 2.5 months. Obviously, that couldn’t continue forever, so a pullback was expected (and the pullback may not be over).

The decline comes from a few of our more speculative positions having big down weeks, led by Intellia Therapeutics (NTLA), which was somehow down 10% in a week where the FDA removed its clinical trial hold. The news shot the stock up 20%, and yet, it not only gave back the entire 20% but also lost another 10% on top of that.

However, we still managed to make 44% in just three weeks on that trade, so I guess we shouldn’t be complaining. I wrote about this trade yesterday, if you missed it (link).

We also got stopped out of a handful of other positions, which CEO Watcher Premium subscribers can see in the Data Dump section of this email.

Hopefully, we see some good post-earnings dip buys come in over the next few weeks that we can add to the portfolio.

As a reminder, if you upgrade to CEO Watcher Premium (link) and find that it isn’t for you, I’ll give you a refund.

-

The High Signal Watchlist also lost a little bit of ground to the S&P, driven by the same reasons as the CEO Watcher Portfolio above, and the one critical mineral play on the list is down 20% this week (and fell from being up 150% a couple of weeks ago to just +20% now).

However, the High Signal List continues to outperform the S&P by a wide margin.

-

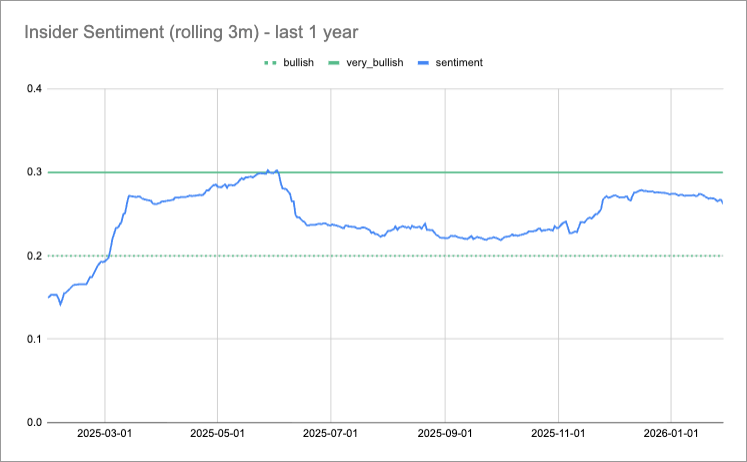

Insider sentiment continues to fade slightly, but is still well above the Bullish threshold.

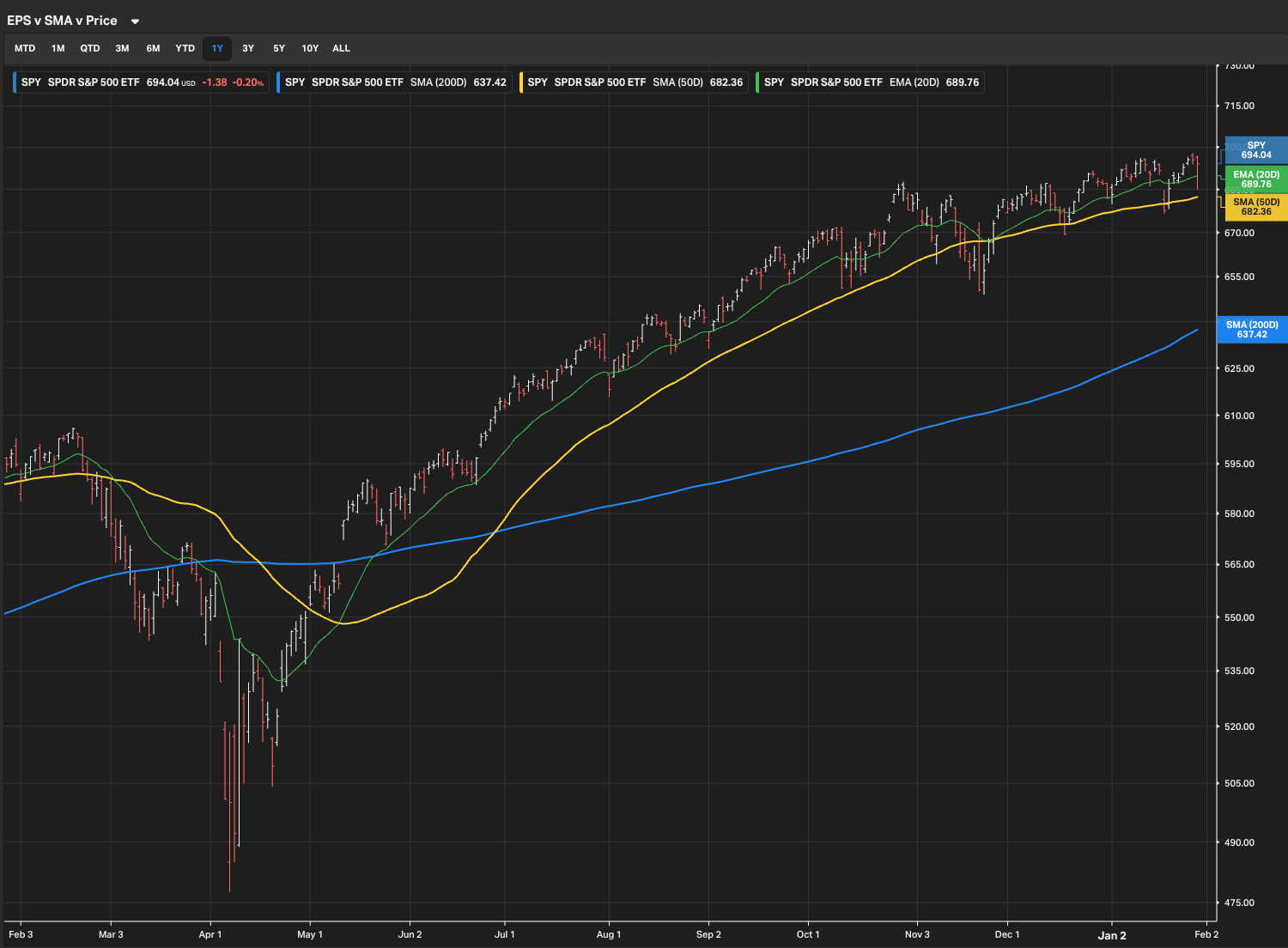

The S&P also continues to weaken a little bit, with this week’s high just barely edging out the previous high from January 12th.

Definitely a weaker week across the board, but still nothing to get too worried about yet (in my opinion).

Have a great weekend!

keep scrolling. top trades + all of the charts and data below

CEO Watcher Premium

The rest of this email (including today’s top insider trades + all the charts and data) is for CEO Watcher Premium subscribers only. To see an example of the Premium email, click here.

Upgrade to CEO Watcher Premium at ceowatcher.com to unlock:

The Premium daily emails

Full access to the website, which has all insider trades back to 2009. It includes search/filters and the returns of every trade and every insider to help you find the top insider trades

Full access to the CEO Watcher Premium Discord where I share my notes and holdings in the CEO Watcher Portfolio

The Premium Dashboard, which has a bunch of charts/tables with insider trading data that is updated each day

If CEO Watcher Premium is not for you, I give full refunds with no questions asked.

Reply