- 📈👀 CEO Watcher

- Posts

- Top insider trades (week of Sep 6)

Top insider trades (week of Sep 6)

Welcome to this week’s edition of CEO Watcher.

This is the only tool that tracks the returns of insiders so we know which insider trades are worth copying.

This week we tracked 956 insider trades and found:

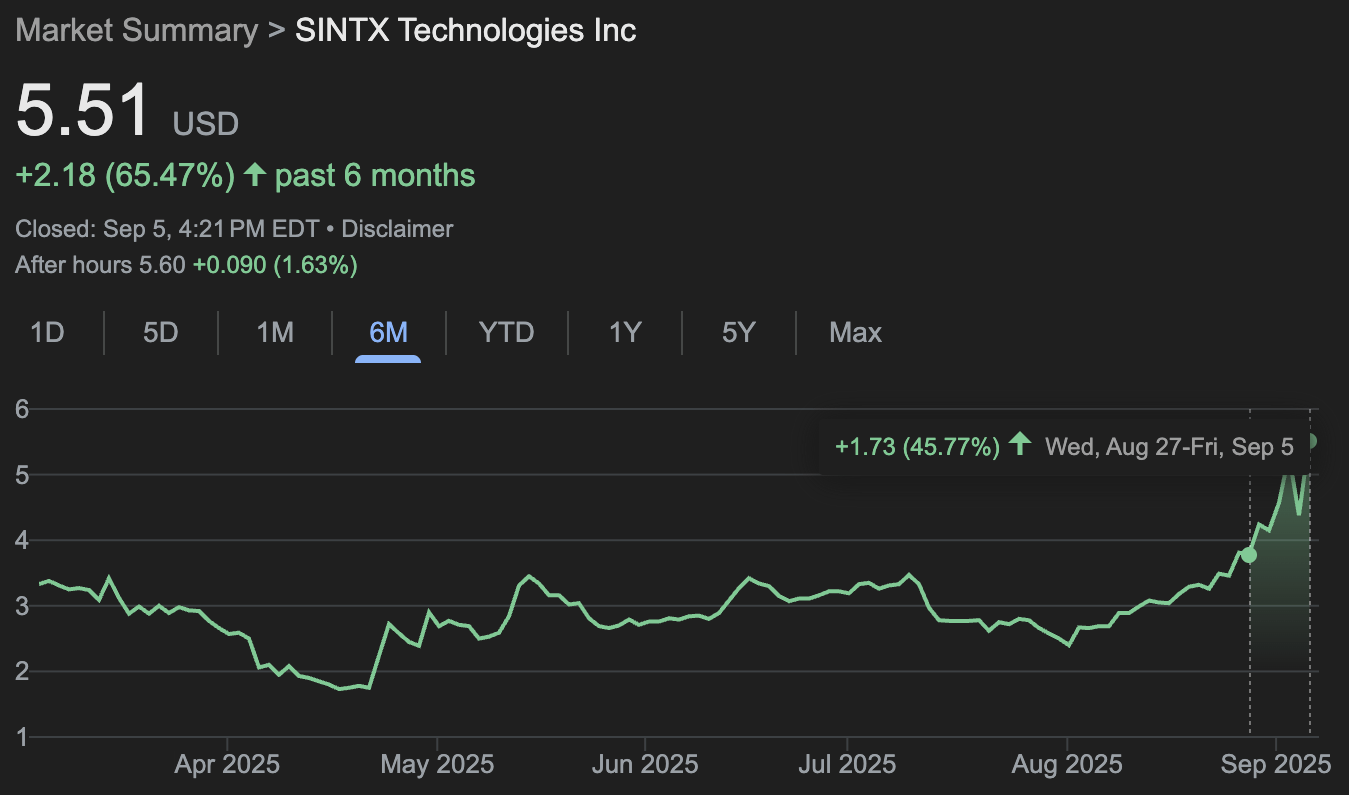

Sintx Technologies (SINTX) is up 50% in 1 week after we found a bunch of insider buying

Top directors at Resideo Technologies (REZI) continue to buy the stock

The CEO (and 4 other executives) at Frontier Holdings (ULCC) sold millions of dollars of the stock

Saba Capital continues buying ASA Gold and Precious Metals (ASA)

The CEO and CIO at TriplePoint Venture Growth (TPVG) continue buying the stock

Coreweave execs sell $200M of the stock after their post-IPO lockup expires

The CEO at General Motors (GM) sells $58M of the stock

The CEO at Affirm (AFRM) turns on a 10b5-1 plan for the first time

The CMO at Insmed (INSM) sells $27M of the stock (largest sale ever)

and more…

Have a great weekend and thanks for reading!

Connor

P.S. Make sure to follow @CEOStockWatcher on Twitter/X as I post more interesting insider trades there each day.

💰 Previous Winner

We had a VERY fast win in Sintx Technologies (SINTX) with the stock up 50% in 1 week after we found a bunch of insiders buying the stock after a 98% stock drop with no previous purchases. They announced positive results from a study and the stock shot up 50%.

The stock was $3.78 when we shared it and is over $5.50 now (+52%).

Get a free 30-day free trial of CEO Watcher Premium (no credit card required) at ceowatcher.com.

👀 Top Insider Trades this Week

🥇 Director at Resideo Technologies, Inc. ($REZI)

ANDREW C TEICH (Director) at Resideo Technologies, Inc. ($REZI) purchased 29,460 shares at $34.01/share ($1.0M total) which increased their vested holdings by +9.7%. The current price is $35.75 (+5.1%). Their median purchase size is $517.82K and this is their 2nd largest purchase out of 7 all time. link

Historic Returns

1m returns: +5.9% weighted | 83% win rate (5/6)

3m returns: +23.2% weighted | 83% win rate (5/6)

6m returns: +13.5% weighted | 75% win rate (3/4)

1y returns: +37.8% weighted | 100% win rate (3/3)

Note: This is the 5th insider purchase at this company in the last 30 days.

🥈 [SALE] CEO at Frontier Group Holdings, Inc. ($ULCC)

The CEO sold 631,806 shares at $5.62/share ($3.55M total) which decreased their vested holdings by -44.1%. Their median sale size is $1.87M and this is their 6th largest sale out of 21 all time. - link

Historic Returns

1m returns: +8.2% weighted | 43% win rate (6/14)

3m returns: +39.5% weighted | 100% win rate (14/14)

6m returns: +35.2% weighted | 93% win rate (13/14)

1y returns: +38.1% weighted | 80% win rate (8/10)

Note: This is the 6th insider sale at this company in the last 30 days (and there were 3 other sales on the same day). Selling the rip (stock was up 26.65% in the month before the sale).

🥉 11 Insiders at Eastman Chemical Company ($EMN)

11 insiders at Eastman Chemical Company bought $1.94M of the stock after the stock’s nearly 30% drop in the last 6 months. There has only ever been one previous purchase at the company since 2018. The insiders have timed their sales fairly well, so let’s see if they time their purchases well too.

Get a free 30-day free trial of CEO Watcher Premium (no credit card required) at ceowatcher.com.

📈 Largest Insider Buys (last week)

10% Owner at Resideo Technologies, Inc. (REZI) purchased 408,573 shares at $33.6 for $13.73M. This is their 6th largest purchase (out of 7) and increased their vested position to 13,270,734 shares (+3.18%). +14.43% 1m (+100.00% win rate) / +10.98% 3m (+100.00% win rate) avg returns on 7 previous purchases. This is the 6th insider purchase at this company in the last 30 days. - link

10% Owner at ASA Gold and Precious Metals Limited (ASA) purchased 100,568 shares at $38.71 for $3.89M. This is their 25th largest purchase (out of 1176) and increased their vested position to 4,202,575 shares (+2.45%). +0.18% 1m (+70.16% win rate) / +1.89% 3m (+75.02% win rate) avg returns on 1176 previous purchases. This appears to be a regularly scheduled weekly transaction. This is the 10th insider purchase at this company in the last 30 days. - link

10% Owner at Summit Midstream Corporation (SMC) purchased 120,160 shares at $20.48 for $2.46M. This is their 1st largest purchase (out of 1) and increased their vested position to 120,160 shares (0%). No returns available. This is the 1st insider purchase at this company in the last 30 days. - link

Director at Advanced Flower Capital Inc. (AFCG) purchased 474,526 shares at $4.74 for $2.25M. This is their 3rd largest purchase (out of 39) and increased their vested position to 5,117,616 shares (+10.22%). +2.54% 1m (+61.29% win rate) / +8.84% 3m (+73.33% win rate) avg returns on 39 previous purchases. This is the 4th insider purchase at this company in the last 30 days. - link

CHAIRMAN, CEO & PRESIDENT at Medalist Diversified REIT, Inc. (MDRR) purchased 140,000 shares at $12.5 for $1.75M. This is their 1st largest purchase (out of 32) and increased their vested position to 198,020 shares (+241.30%). -0.02% 1m (+38.10% win rate) / +1.25% 3m (+68.42% win rate) avg returns on 32 previous purchases. Is part of a purchase agreement. This appears to be a regularly scheduled weekly transaction. This is the 7th insider purchase at this company in the last 30 days. - link

Director at Biodesix, Inc. (BDSX) purchased 3,488,372 shares at $0.43 for $1.5M. This is their 18th largest purchase (out of 108) and increased their vested position to 39,406,546 shares (+9.71%). +6.81% 1m (+37.65% win rate) / -5.29% 3m (+41.18% win rate) avg returns on 108 previous purchases. Buying the dip (stock was down -77.19% in the one year before the purchase). This is the 1st insider purchase at this company in the last 30 days. - link

Director at Resideo Technologies, Inc. (REZI) purchased 29,460 shares at $34.01 for $1.0M. This is their 2nd largest purchase (out of 7) and increased their vested position to 332,472 shares (+9.72%). +5.91% 1m (+83.33% win rate) / +23.19% 3m (+83.33% win rate) avg returns on 7 previous purchases. This is the 5th insider purchase at this company in the last 30 days. - link

See Remarks at Freedom Holding Corp. (FRHC) purchased 5,725 shares at $171.67 for $982.81K. This is their 2nd largest purchase (out of 2) and increased their vested position to 132,425 shares (+4.52%). +14.85% 1m (+100.00% win rate) avg returns on 2 previous purchases. No 3m returns available. This is the 1st insider purchase at this company in the last 30 days. - link

Director at Huntington Ingalls Industries, Inc. (HII) purchased 3,500 shares at $272.78 for $954.73K. This is their 3rd largest purchase (out of 4) and increased their vested position to 3,610 shares (+3181.82%). -17.32% 1m (+33.33% win rate) / -11.53% 3m (0.00% win rate) avg returns on 4 previous purchases. This is the 1st insider purchase at this company in the last 30 days. - link

10% Owner at Shenandoah Telecommunications Company (SHEN) purchased 58,951 shares at $12.9 for $760.39K. This is their 3rd largest purchase (out of 27) and increased their vested position to 3,436,184 shares (+1.75%). -3.26% 1m (+43.75% win rate) / +0.36% 3m (+100.00% win rate) avg returns on 27 previous purchases. This appears to be a regularly scheduled weekly transaction. This is the 11th insider purchase at this company in the last 30 days. - link

Chief Executive Officer at TriplePoint Venture Growth BDC Corp. (TPVG) purchased 109,630 shares at $6.69 for $733.32K. This is their 2nd largest purchase (out of 6) and increased their vested position to 722,686 shares (+17.88%). +0.01% 1m (+100.00% win rate) / +0.02% 3m (+100.00% win rate) avg returns on 6 previous purchases. This is the 10th insider purchase at this company in the last 30 days (and there was 1 other purchase on the same day). - link

President and CIO at TriplePoint Venture Growth BDC Corp. (TPVG) purchased 109,630 shares at $6.69 for $733.32K. This is their 2nd largest purchase (out of 7) and increased their vested position to 784,324 shares (+16.25%). No returns available. This is the 10th insider purchase at this company in the last 30 days (and there was 1 other purchase on the same day). - link

Chief Executive Officer at TriplePoint Venture Growth BDC Corp. (TPVG) purchased 102,800 shares at $6.74 for $693.19K. This is their 3rd largest purchase (out of 7) and increased their vested position to 825,486 shares (+14.22%). +0.01% 1m (+100.00% win rate) / +0.02% 3m (+100.00% win rate) avg returns on 7 previous purchases. This appears to be a regularly scheduled weekly transaction. This is the 12th insider purchase at this company in the last 30 days (and there was 1 other purchase on the same day). - link

President and CIO at TriplePoint Venture Growth BDC Corp. (TPVG) purchased 102,800 shares at $6.74 for $693.19K. This is their 3rd largest purchase (out of 8) and increased their vested position to 887,124 shares (+13.11%). No returns available. This appears to be a regularly scheduled weekly transaction. This is the 12th insider purchase at this company in the last 30 days (and there was 1 other purchase on the same day). - link

10% Owner at ASA Gold and Precious Metals Limited (ASA) purchased 16,853 shares at $36.93 for $622.42K. This is their 313th largest purchase (out of 1175) and increased their vested position to 4,102,007 shares (+0.41%). +0.18% 1m (+70.16% win rate) / +1.89% 3m (+75.02% win rate) avg returns on 1175 previous purchases. This appears to be a regularly scheduled weekly transaction. This is the 9th insider purchase at this company in the last 30 days. - link

President at First Busey Corporation (BUSE) purchased 21,780 shares at $25.26 for $550.21K. This is their 1st largest purchase (out of 2) and increased their vested position to 347,717 shares (+6.68%). +10.46% 1m (+100.00% win rate) / +7.14% 3m (+100.00% win rate) avg returns on 2 previous purchases. This is the 2nd insider purchase at this company in the last 30 days. - link

10% Owner at Summit Midstream Corporation (SMC) purchased 26,319 shares at $20.89 for $549.8K. This is their 2nd largest purchase (out of 2) and increased their vested position to 146,479 shares (+21.90%). No returns available. This is the 2nd insider purchase at this company in the last 30 days. - link

Director at LKQ Corporation (LKQ) purchased 15,000 shares at $32.12 for $481.76K. This is their 1st largest purchase (out of 1) and increased their vested position to 33,669 shares (+80.35%). No returns available. This is the 3rd insider purchase at this company in the last 30 days. - link

Hilltop Securities Chairman at Hilltop Holdings Inc. (HTH) purchased 10,000 shares at $35.36 for $353.6K. This is their 4th largest purchase (out of 4) and increased their vested position to 127,428 shares (+8.52%). No returns available. This appears to be a regularly scheduled weekly transaction. This is the 4th insider purchase at this company in the last 30 days. - link

10% Owner at Shenandoah Telecommunications Company (SHEN) purchased 26,358 shares at $13.26 for $349.45K. This is their 20th largest purchase (out of 26) and increased their vested position to 3,377,233 shares (+0.79%). -3.26% 1m (+43.75% win rate) / +0.36% 3m (+100.00% win rate) avg returns on 26 previous purchases. This appears to be a regularly scheduled weekly transaction. This is the 10th insider purchase at this company in the last 30 days. - link

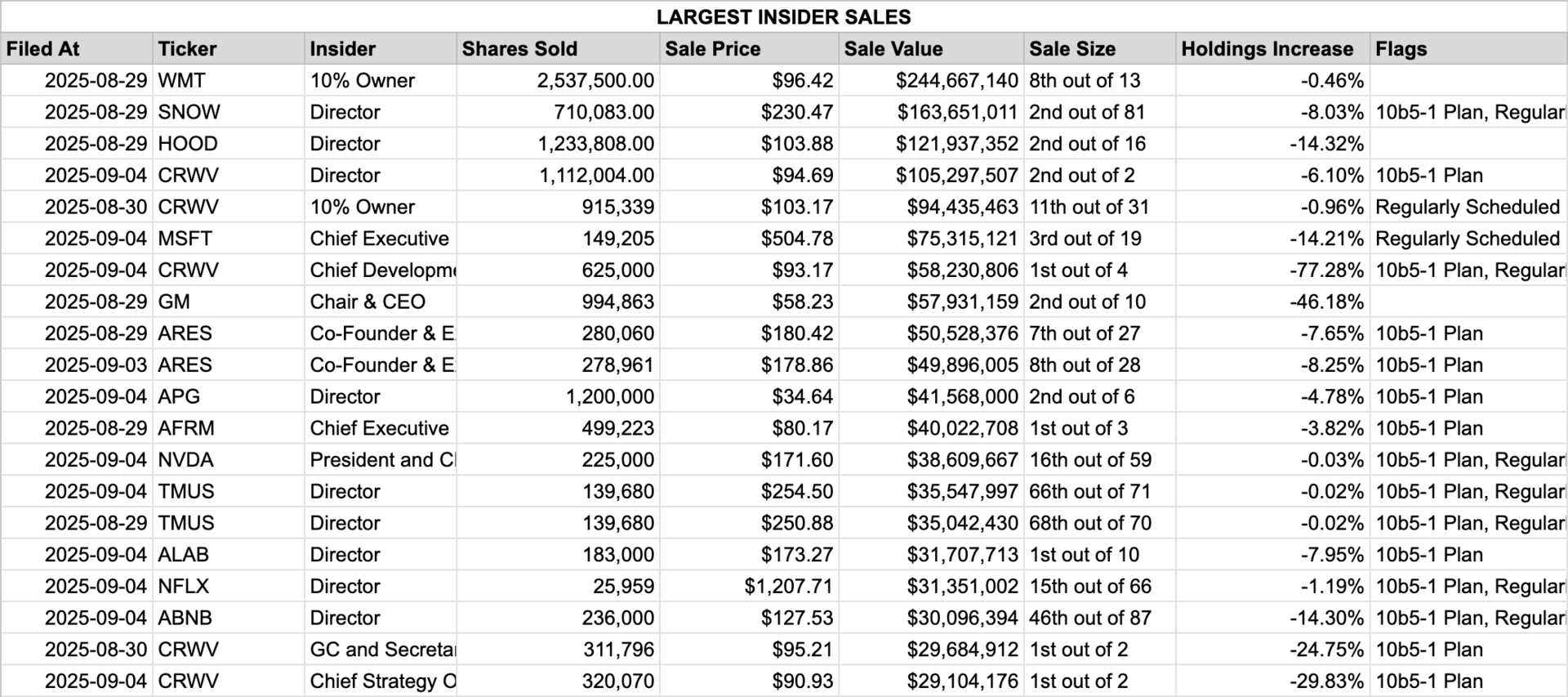

📉 Largest Insider Sells (last week)

10% Owner at Walmart Inc. (WMT) sold 2,537,500 shares at $96.42 for $244.67M. This is their 8th largest sale (out of 13) and decreased their vested position to 546,128,200 shares (-0.46%). -0.16% 1m (+45.45% win rate) / -1.21% 3m (+25.00% win rate) avg returns on 13 previous sales. This is the 5th insider sale at this company in the last 30 days. - link

Director at Snowflake Inc. (SNOW) sold 710,083 shares at $230.47 for $163.65M. This is their 2nd largest sale (out of 81) and decreased their vested position to 8,133,861 shares (-8.03%). +1.75% 1m (+47.44% win rate) / +3.61% 3m (+45.83% win rate) avg returns on 81 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled monthly transaction. Selling the rip (stock was up 21.26% in the week before the sale). This is the 4th insider sale at this company in the last 30 days (and there was 1 other sale on the same day). - link

Director at Robinhood Markets, Inc. (HOOD) sold 1,233,808 shares at $103.88 for $121.94M. This is their 2nd largest sale (out of 16) and decreased their vested position to 7,381,012 shares (-14.32%). -8.47% 1m (+36.36% win rate) / -26.07% 3m (+36.36% win rate) avg returns on 16 previous sales. Selling the rip (stock was up 62.67% in the three months before the sale). This is the 5th insider sale at this company in the last 30 days. - link

Director at CoreWeave, Inc. (CRWV) sold 1,112,004 shares at $94.69 for $105.3M. This is their 2nd largest sale (out of 2) and decreased their vested position to 17,129,596 shares (-6.10%). No returns available. Is part of a 10b5-1 plan. This is the 18th insider sale at this company in the last 30 days (and there were 3 other sales on the same day). - link

10% Owner at CoreWeave, Inc. (CRWV) sold 915,339 shares at $103.17 for $94.44M. This is their 11th largest sale (out of 31) and decreased their vested position to 94,433,550 shares (-0.96%). +2.57% 1m (+47.06% win rate) / -1.24% 3m (+70.59% win rate) avg returns on 31 previous sales. This appears to be a regularly scheduled weekly transaction. This is the 13th insider sale at this company in the last 30 days (and there were 2 other sales on the same day). - link

Chief Executive Officer at Microsoft Corporation (MSFT) sold 149,205 shares at $504.78 for $75.32M. This is their 3rd largest sale (out of 19) and decreased their vested position to 900,572 shares (-14.21%). -0.34% 1m (+41.18% win rate) / +1.12% 3m (+23.53% win rate) avg returns on 19 previous sales. This appears to be a regularly scheduled yearly transaction. This is the 2nd insider sale at this company in the last 30 days. - link

Chief Development Officer at CoreWeave, Inc. (CRWV) sold 625,000 shares at $93.17 for $58.23M. This is their 1st largest sale (out of 4) and decreased their vested position to 183,765 shares (-77.28%). No returns available. Is part of a 10b5-1 plan. This appears to be a regularly scheduled weekly transaction. This is the 18th insider sale at this company in the last 30 days (and there were 3 other sales on the same day). - link

Chair & CEO at General Motors Company (GM) sold 994,863 shares at $58.23 for $57.93M. This is their 2nd largest sale (out of 10) and decreased their vested position to 1,159,262 shares (-46.18%). -0.44% 1m (+50.00% win rate) / -7.08% 3m (+25.00% win rate) avg returns on 10 previous sales. This is the 4th insider sale at this company in the last 30 days (and there was 1 other sale on the same day). - link

Co-Founder & Exec. Chairman at Ares Management Corporation (ARES) sold 280,060 shares at $180.42 for $50.53M. This is their 7th largest sale (out of 27) and decreased their vested position to 3,380,103 shares (-7.65%). -0.70% 1m (+33.33% win rate) / -1.98% 3m (+20.83% win rate) avg returns on 27 previous sales. Is part of a 10b5-1 plan. This is the 6th insider sale at this company in the last 30 days. - link

Co-Founder & Exec. Chairman at Ares Management Corporation (ARES) sold 278,961 shares at $178.86 for $49.9M. This is their 8th largest sale (out of 28) and decreased their vested position to 3,101,142 shares (-8.25%). -0.70% 1m (+33.33% win rate) / -1.98% 3m (+20.83% win rate) avg returns on 28 previous sales. Is part of a 10b5-1 plan. This is the 7th insider sale at this company in the last 30 days. - link

Director at APi Group Corporation (APG) sold 1,200,000 shares at $34.64 for $41.57M. This is their 2nd largest sale (out of 6) and decreased their vested position to 23,883,403 shares (-4.78%). +11.83% 1m (+75.00% win rate) / +6.80% 3m (+50.00% win rate) avg returns on 6 previous sales. Is part of a 10b5-1 plan. Selling the rip (stock was up 57.13% in the year before the sale). This is the 3rd insider sale at this company in the last 30 days. - link

Chief Executive Officer at Affirm Holdings, Inc. (AFRM) sold 499,223 shares at $80.17 for $40.02M. This is their 1st largest sale (out of 3) and decreased their vested position to 12,553,675 shares (-3.82%). No returns available. Is part of a 10b5-1 plan. Selling the rip (stock was up 30.16% in the month before the sale). This is the 8th insider sale at this company in the last 30 days. - link

President and CEO at NVIDIA Corporation (NVDA) sold 225,000 shares at $171.6 for $38.61M. This is their 16th largest sale (out of 59) and decreased their vested position to 855,998,766 shares (-0.03%). -1.22% 1m (+46.15% win rate) / -3.94% 3m (+28.57% win rate) avg returns on 59 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled monthly transaction. Selling the rip (stock was up 61.67% in the year before the sale). This is the 6th insider sale at this company in the last 30 days (and there was 1 other sale on the same day). - link

Director at T-Mobile US, Inc. (TMUS) sold 139,680 shares at $254.5 for $35.55M. This is their 66th largest sale (out of 71) and decreased their vested position to 635,363,804 shares (-0.02%). -1.92% 1m (+27.42% win rate) / -7.31% 3m (+6.00% win rate) avg returns on 71 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled weekly transaction. This is the 10th insider sale at this company in the last 30 days. - link

Director at T-Mobile US, Inc. (TMUS) sold 139,680 shares at $250.88 for $35.04M. This is their 68th largest sale (out of 70) and decreased their vested position to 635,503,484 shares (-0.02%). -1.92% 1m (+27.42% win rate) / -7.31% 3m (+6.00% win rate) avg returns on 70 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled weekly transaction. This is the 9th insider sale at this company in the last 30 days. - link

Director at Astera Labs, Inc. (ALAB) sold 183,000 shares at $173.27 for $31.71M. This is their 1st largest sale (out of 10) and decreased their vested position to 2,117,712 shares (-7.95%). -45.50% 1m (+11.11% win rate) / -18.01% 3m (+50.00% win rate) avg returns on 10 previous sales. Is part of a 10b5-1 plan. Selling the rip (stock was up 36.26% in the month before the sale). This is the 11th insider sale at this company in the last 30 days. - link

Director at Netflix, Inc. (NFLX) sold 25,959 shares at $1.21K for $31.35M. This is their 15th largest sale (out of 66) and decreased their vested position to 2,154,687 shares (-1.19%). -3.79% 1m (+32.81% win rate) / -8.81% 3m (+21.31% win rate) avg returns on 66 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled monthly transaction. Selling the rip (stock was up 85.01% in the year before the sale). This is the 7th insider sale at this company in the last 30 days (and there was 1 other sale on the same day). - link

Director at Airbnb, Inc. (ABNB) sold 236,000 shares at $127.53 for $30.1M. This is their 46th largest sale (out of 87) and decreased their vested position to 1,414,875 shares (-14.30%). -0.05% 1m (+51.19% win rate) / +2.82% 3m (+47.50% win rate) avg returns on 87 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled monthly transaction. This is the 10th insider sale at this company in the last 30 days (and there was 1 other sale on the same day). - link

GC and Secretary at CoreWeave, Inc. (CRWV) sold 311,796 shares at $95.21 for $29.68M. This is their 1st largest sale (out of 2) and decreased their vested position to 948,207 shares (-24.75%). No returns available. Is part of a 10b5-1 plan. This is the 13th insider sale at this company in the last 30 days (and there were 2 other sales on the same day). - link

Chief Strategy Officer at CoreWeave, Inc. (CRWV) sold 320,070 shares at $90.93 for $29.1M. This is their 1st largest sale (out of 2) and decreased their vested position to 752,949 shares (-29.83%). No returns available. Is part of a 10b5-1 plan. This is the 18th insider sale at this company in the last 30 days (and there were 3 other sales on the same day). - link

Get the insider trades as soon as they happen

By upgrading to CEO Watcher Premium, you get the top insider trades as soon as they happen and full access to the ceowatcher.com website (including the custom feeds of highest-signal insider trades).

Each morning you get an email with the top insider buys/sells (ranked by the proprietary CEO Watcher ranking system), largest insider buys/sells, largest holdings increases/decreases, and the companies with the most insider buying/selling sent before the market opens each morning.

How was today's email? |

Reply