- 📈👀 CEO Watcher

- Posts

- Top insider trades (week of Jun 28)

Top insider trades (week of Jun 28)

Welcome to this week’s edition of CEO Watcher.

This is the only tool that tracks the returns of insiders so we know which insider trades are worth copying.

This week we tracked 651 insider trades and found:

Director at VAC with 77% 1y returns bought $57M of the stock

The CEO at ORCL sold over $1.5B of the stock (making it the most sold stock in the last 30 days)

Exec chair at IONQ sells $50M

and more…

Have a great weekend and thanks for reading!

Connor

P.S. Make sure to follow @CEOStockWatcher on Twitter/X as I post more interesting insider trades there each day.

💰 Top Buys/Sells Returns

We are closing in on 500 Top Buys/Sells shared on CEO Watcher, so I wanted to check in on the performance so far.

The goal of CEO Watcher is to identify high-signal insider buys that will outperform the market on average and high-signal insider sells that will underperform the market on average. These then give you a good universe of stocks to consider adding to your portfolio (for the high-signal buys) and to avoid (for the high-signal sells).

Summary: so far, so good.

On average, the Top Insider Buys we have shared are up 4.75% v 4.14% for the S&P.

The Top Insider Sells are up 2.46% v 3.59% for the S&P.

So the Top Buys are beating the S&P and Top Sells are lagging it, just as we’d like. Based on our research, I expect this delta to increase as more time passes. In fact, we can already see signs of this by looking at the Top Buys/Sells that are over a month old.

The Top Buys (that are at least 1m old) have an average 1m return of 4.50% v 2.60% for the S&P, and the Top Sells have actually gone down an average of -0.61% v +2.40% for the S&P.

Note: the reason the S&P returns are different for buys and sells is that we calculate the S&P return for each individual buy and sell (so it replicates if you were to buy the S&P instead of the insider trade). Different days have different numbers of buys v sells, which causes the difference in average S&P returns. What is interesting is that you will notice the average S&P return is lower for the Top Sells v the Top Buys, which indicates that the entire market performs better when there is more Top Buying and worse when there is more Top Selling.

👀 Top Insider Trades this Week

🥇 Director at Marriott Vacations Worldwide Corporation ($VAC)

Christian Asmar (Director) at Marriott Vacations Worldwide Corporation ($VAC) purchased 750,000 shares at $67.83/share ($50.87M total) which increased their vested holdings by +22.8%. The current price is $73.36 (+8.2%). Their median purchase size is $6.71M and this is their 1st largest purchase out of 11 all time. link

Historic Returns

1m returns: +1.5% weighted | 70% win rate (7/10)

3m returns: +3.7% weighted | 90% win rate (9/10)

6m returns: +18.2% weighted | 100% win rate (10/10)

1y returns: +77.4% weighted | 90% win rate (9/10)

Note: the stock is up 7% since we shared this pitch in the CEO Watcher Premium daily email. Get a free 30-day free trial of CEO Watcher Premium (no credit card required) at ceowatcher.com.

🥈 [SALE] Director at Photronics, Inc. ($PLAB)

Kang Jyh Lee (Director) at Photronics, Inc. ($PLAB) made a large, unusual sale. They just sold 28,118 shares at $18.40/share ($517.34K total) which decreased their vested holdings by -5.0%. The current price is $19.03 (+3.4%). Their median sale size is $265.01K and this is their 1st largest sale out of 18 all time. link

Historic Returns

1m returns: +5.2% weighted | 69% win rate (11/16)

3m returns: +16.2% weighted | 75% win rate (12/16)

6m returns: +5.3% weighted | 36% win rate (4/11)

1y returns: +0.6% weighted | 33% win rate (3/9)

🥉 President at Freedom Holding Corp. ($FRHC)

Askar Tashtitov (President) at Freedom Holding Corp. ($FRHC) purchased 600 shares at $140.75/share ($84.45K total) which increased their vested holdings by +0.4%. The current price is $144.60 (+2.7%). Their median purchase size is $211.78K and this is their 3rd largest purchase out of 3 all time. link

Historic Returns

1m returns: +6.3% weighted | 50% win rate (1/2)

3m returns: +25.3% weighted | 50% win rate (1/2)

6m returns: +50.7% weighted | 50% win rate (1/2)

1y returns: +187.6% weighted | 100% win rate (2/2)

Note: Buying the dip (stock was down -24.46% in the month before the purchase)

Get a free 30-day free trial of CEO Watcher Premium (no credit card required) at ceowatcher.com.

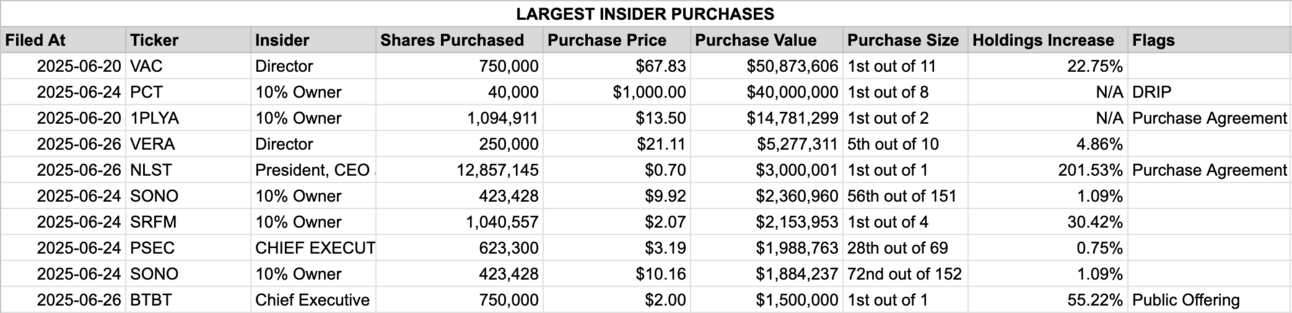

📈 Largest Insider Buys (last week)

Director at Marriott Vacations Worldwide Corporation (VAC) purchased 750,000 shares at $67.83 for $50.87M. This is their 1st largest purchase (out of 11) and increased their vested position to 4,045,984 shares (+22.75%). +1.54% 1m (+70.00% win rate) / +3.67% 3m (+90.00% win rate) avg returns on 11 previous purchases. This is the 1st insider purchase at this company in the last 30 days. - link

10% Owner at PureCycle Technologies, Inc. (PCT) purchased 40,000 shares at $1.0K for $40.0M. This is their 1st largest purchase (out of 8) and increased their vested position to 40,000 shares (0%). +12.67% 1m (+85.71% win rate) / +2.63% 3m (+40.00% win rate) avg returns on 8 previous purchases. Is part of a dividend reinvestment. This is the 1st insider purchase at this company in the last 30 days. - link

10% Owner at Playa Hotels & Resorts N.V. (1PLYA) purchased 1,094,911 shares at $13.5 for $14.78M. This is their 1st largest purchase (out of 2) and increased their vested position to 0 shares (0%). No returns available. Is part of a purchase agreement. This is the 2nd insider purchase at this company in the last 30 days. - link

Director at Vera Therapeutics, Inc. (VERA) purchased 250,000 shares at $21.11 for $5.28M. This is their 5th largest purchase (out of 10) and increased their vested position to 5,394,212 shares (+4.86%). +5.63% 1m (+66.67% win rate) / -16.22% 3m (+50.00% win rate) avg returns on 10 previous purchases. This is the 1st insider purchase at this company in the last 30 days. - link

President, CEO and Chairman at Netlist, Inc. (NLST) purchased 12,857,145 shares at $0.7 for $3.0M. This is their 1st largest purchase (out of 1) and increased their vested position to 19,236,989 shares (+201.53%). No returns available. Is part of a purchase agreement. Buying the dip (stock was down -37.67% in the three months before the purchase). This is the 1st insider purchase at this company in the last 30 days. - link

10% Owner at Sonos, Inc. (SONO) purchased 423,428 shares at $9.92 for $2.36M. This is their 56th largest purchase (out of 151) and increased their vested position to 39,281,986 shares (+1.09%). -14.24% 1m (+43.75% win rate) / -18.29% 3m (+30.43% win rate) avg returns on 151 previous purchases. This is the 4th insider purchase at this company in the last 30 days (and there was 1 other purchase on the same day). - link

10% Owner at Surf Air Mobility Inc. (SRFM) purchased 1,040,557 shares at $2.07 for $2.15M. This is their 1st largest purchase (out of 4) and increased their vested position to 4,461,564 shares (+30.42%). -6.01% 1m (+33.33% win rate) / +35.74% 3m (+50.00% win rate) avg returns on 4 previous purchases. This is the 1st insider purchase at this company in the last 30 days. - link

CHIEF EXECUTIVE OFFICER at Prospect Capital Corporation (PSEC) purchased 623,300 shares at $3.19 for $1.99M. This is their 28th largest purchase (out of 69) and increased their vested position to 83,622,108 shares (+0.75%). -7.02% 1m (+38.24% win rate) / +8.16% 3m (+62.69% win rate) avg returns on 69 previous purchases. This is the 1st insider purchase at this company in the last 30 days. - link

10% Owner at Sonos, Inc. (SONO) purchased 423,428 shares at $10.16 for $1.88M. This is their 72nd largest purchase (out of 152) and increased their vested position to 39,281,986 shares (+1.09%). -14.24% 1m (+43.75% win rate) / -18.29% 3m (+30.43% win rate) avg returns on 152 previous purchases. This is the 4th insider purchase at this company in the last 30 days (and there was 1 other purchase on the same day). - link

Chief Executive Officer at Bit Digital, Inc. (BTBT) purchased 750,000 shares at $2.0 for $1.5M. This is their 1st largest purchase (out of 1) and increased their vested position to 2,108,089 shares (+55.22%). No returns available. Is part of a public offering. Buying the dip (stock was down -20.40% in the month before the purchase). This is the 1st insider purchase at this company in the last 30 days. - link

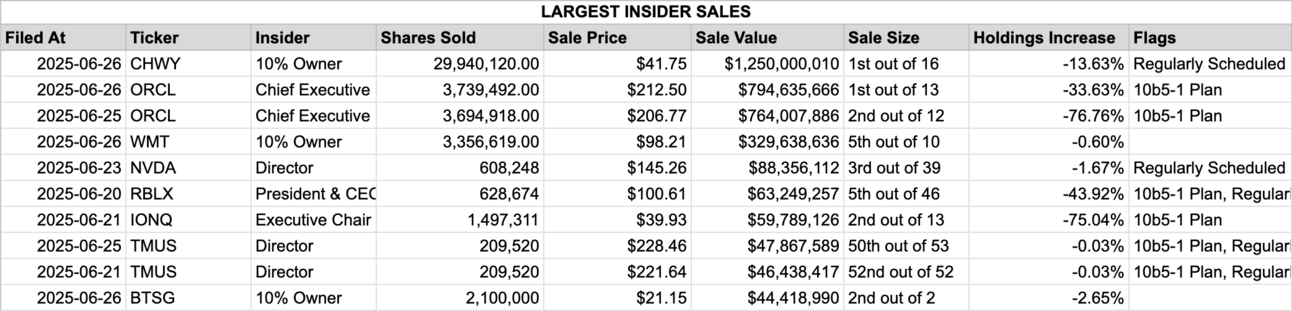

📉 Largest Insider Sells (last week)

10% Owner at Chewy, Inc. (CHWY) sold 29,940,120 shares at $41.75 for $1.25B. This is their 1st largest sale (out of 16) and decreased their vested position to 189,758,441 shares (-13.63%). +12.46% 1m (+70.00% win rate) / -3.48% 3m (+40.00% win rate) avg returns on 16 previous sales. This appears to be a regularly scheduled yearly transaction. Selling the rip (stock was up 30.62% in the three months before the sale). This is the 1st insider sale at this company in the last 30 days. - link

Chief Executive Officer at Oracle Corporation (ORCL) sold 3,739,492 shares at $212.5 for $794.64M. This is their 1st largest sale (out of 13) and decreased their vested position to 7,379,100 shares (-33.63%). -3.20% 1m (+27.27% win rate) / -2.81% 3m (+36.36% win rate) avg returns on 13 previous sales. Is part of a 10b5-1 plan. Selling the rip (stock was up 36.45% in the month before the sale). This is the 5th insider sale at this company in the last 30 days. - link

Chief Executive Officer at Oracle Corporation (ORCL) sold 3,694,918 shares at $206.77 for $764.01M. This is their 2nd largest sale (out of 12) and decreased their vested position to 1,118,592 shares (-76.76%). -3.20% 1m (+27.27% win rate) / -2.81% 3m (+36.36% win rate) avg returns on 12 previous sales. Is part of a 10b5-1 plan. Selling the rip (stock was up 35.10% in the month before the sale). This is the 4th insider sale at this company in the last 30 days. - link

10% Owner at Walmart Inc. (WMT) sold 3,356,619 shares at $98.21 for $329.64M. This is their 5th largest sale (out of 10) and decreased their vested position to 552,609,839 shares (-0.60%). -0.08% 1m (+57.14% win rate) / -0.84% 3m (+20.00% win rate) avg returns on 10 previous sales. This is the 7th insider sale at this company in the last 30 days. - link

Director at NVIDIA Corporation (NVDA) sold 608,248 shares at $145.26 for $88.36M. This is their 3rd largest sale (out of 39) and decreased their vested position to 35,859,752 shares (-1.67%). -2.80% 1m (+20.00% win rate) / -11.97% 3m (+22.86% win rate) avg returns on 39 previous sales. This appears to be a regularly scheduled yearly transaction. This is the 9th insider sale at this company in the last 30 days (and there were 3 other sales on the same day). - link

President & CEO at Roblox Corporation (RBLX) sold 628,674 shares at $100.61 for $63.25M. This is their 5th largest sale (out of 46) and decreased their vested position to 802,799 shares (-43.92%). -3.28% 1m (+55.56% win rate) / +1.81% 3m (+43.75% win rate) avg returns on 46 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled weekly transaction. Selling the rip (stock was up 24.94% in the month before the sale). This is the 16th insider sale at this company in the last 30 days. - link

Executive Chair at IonQ, Inc. (IONQ) sold 1,497,311 shares at $39.93 for $59.79M. This is their 2nd largest sale (out of 13) and decreased their vested position to 497,990 shares (-75.04%). -3.86% 1m (0.00% win rate) / -10.22% 3m (0.00% win rate) avg returns on 13 previous sales. Is part of a 10b5-1 plan. Selling the rip (stock was up 20.33% in the month before the sale). This is the 13th insider sale at this company in the last 30 days. - link

Director at T-Mobile US, Inc. (TMUS) sold 209,520 shares at $228.46 for $47.87M. This is their 50th largest sale (out of 53) and decreased their vested position to 648,149,724 shares (-0.03%). -1.56% 1m (+32.00% win rate) / -8.71% 3m (+6.00% win rate) avg returns on 53 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled yearly transaction. This is the 3rd insider sale at this company in the last 30 days. - link

Director at T-Mobile US, Inc. (TMUS) sold 209,520 shares at $221.64 for $46.44M. This is their 52nd largest sale (out of 52) and decreased their vested position to 648,359,244 shares (-0.03%). -1.56% 1m (+32.00% win rate) / -8.71% 3m (+6.00% win rate) avg returns on 52 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled yearly transaction. This is the 2nd insider sale at this company in the last 30 days. - link

10% Owner at BrightSpring Health Services, Inc. (BTSG) sold 2,100,000 shares at $21.15 for $44.42M. This is their 2nd largest sale (out of 2) and decreased their vested position to 77,096,337 shares (-2.65%). No returns available. Selling the rip (stock was up 113.90% in the year before the sale). This is the 7th insider sale at this company in the last 30 days. - link

Get the insider trades as soon as they happen

By upgrading to CEO Watcher Premium, you get the top insider trades as soon as they happen.

Each morning you get an email with the top insider buys/sells (ranked by the proprietary CEO Watcher ranking system), largest insider buys/sells, largest holdings increases/decreases, and the companies with the most insider buying/selling sent before the market opens each morning.

Just one profitable trade will pay for a full year (or more) of CEO Watcher Premium. And, I’ll even make a deal with you. If you upgrade to CEO Watcher Premium and don’t get 10x more value than what you paid, I’ll give you your money back at any time with no questions asked.

How was today's email? |

Reply