- 📈👀 CEO Watcher

- Posts

- Top insider trades (week of July 26)

Top insider trades (week of July 26)

Welcome to this week’s edition of CEO Watcher.

This is the only tool that tracks the returns of insiders so we know which insider trades are worth copying.

This week we tracked 520 insider trades and found:

The top 2 insider purchases from the May 13th email are up over 50%

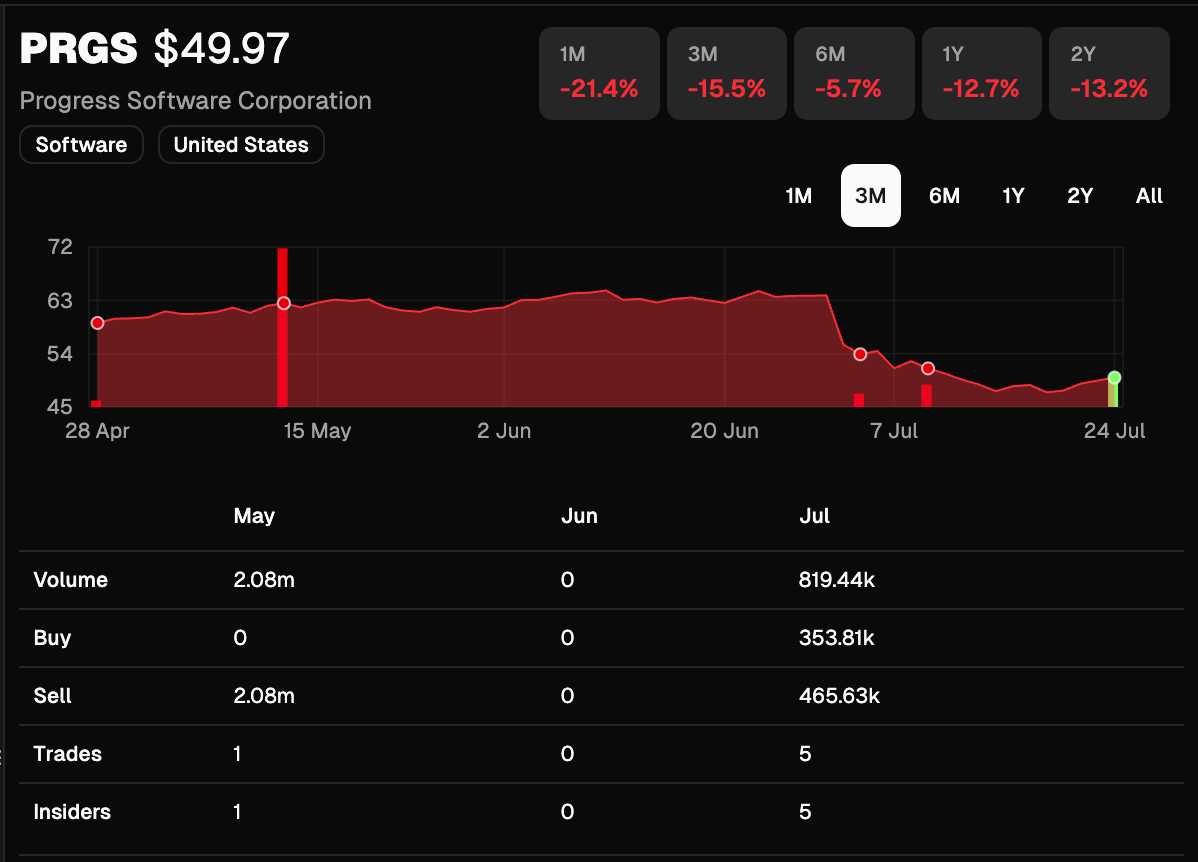

CEO and Director are buying the dip at PRGS

and much more…

Have a great weekend and thanks for reading!

Connor

P.S. Make sure to follow @CEOStockWatcher on Twitter/X as I post more interesting insider trades there each day.

💰 Previous Winner

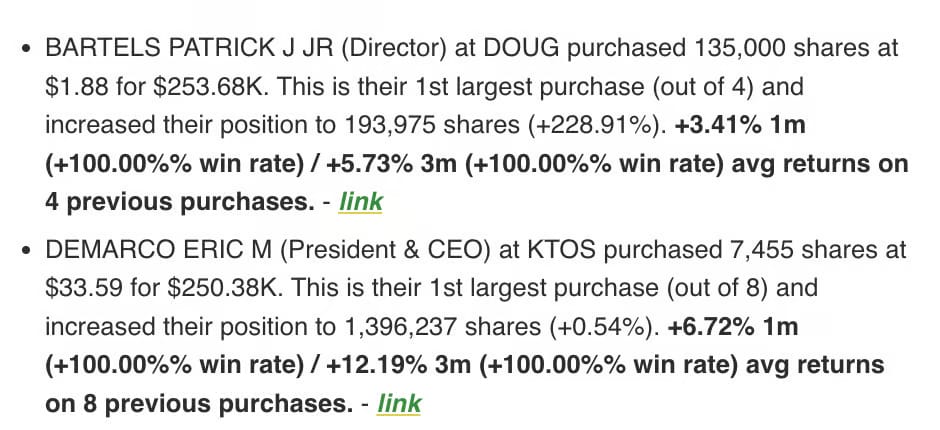

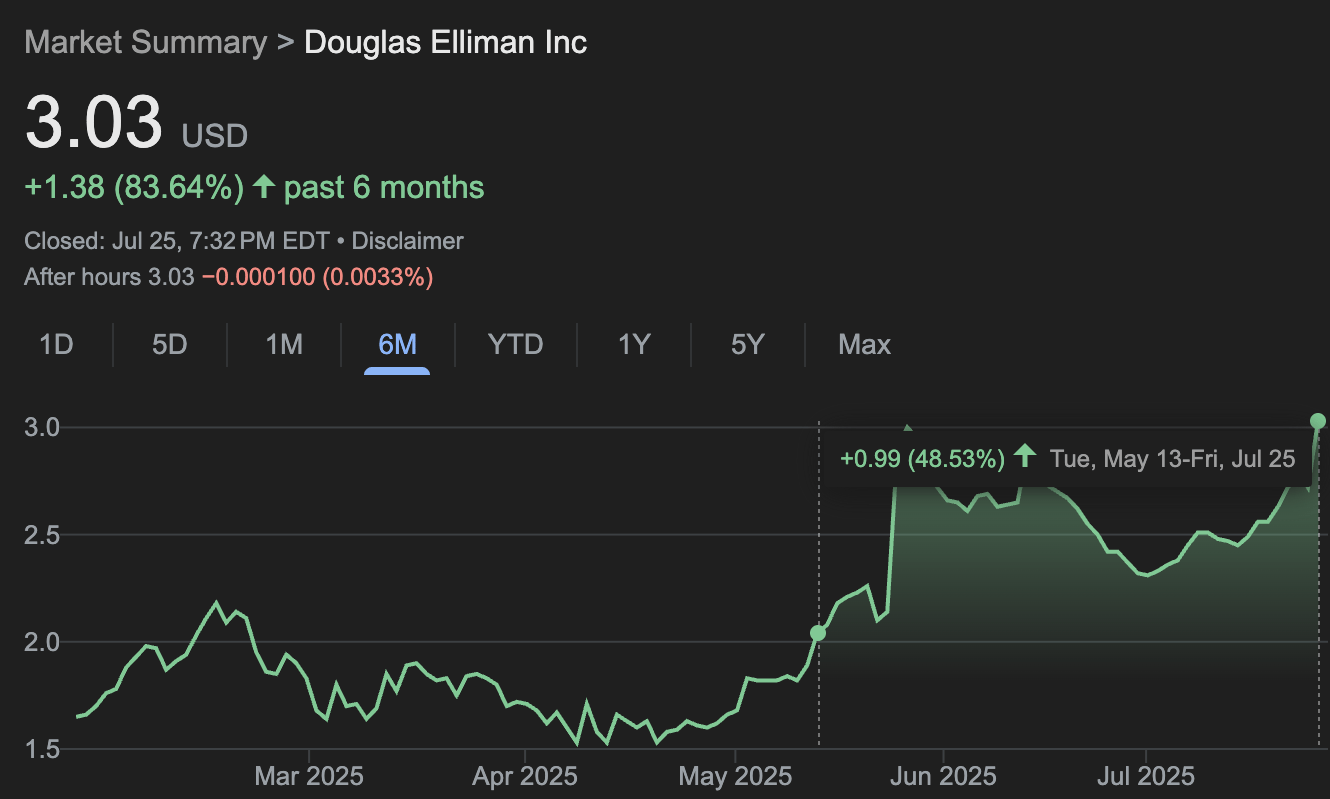

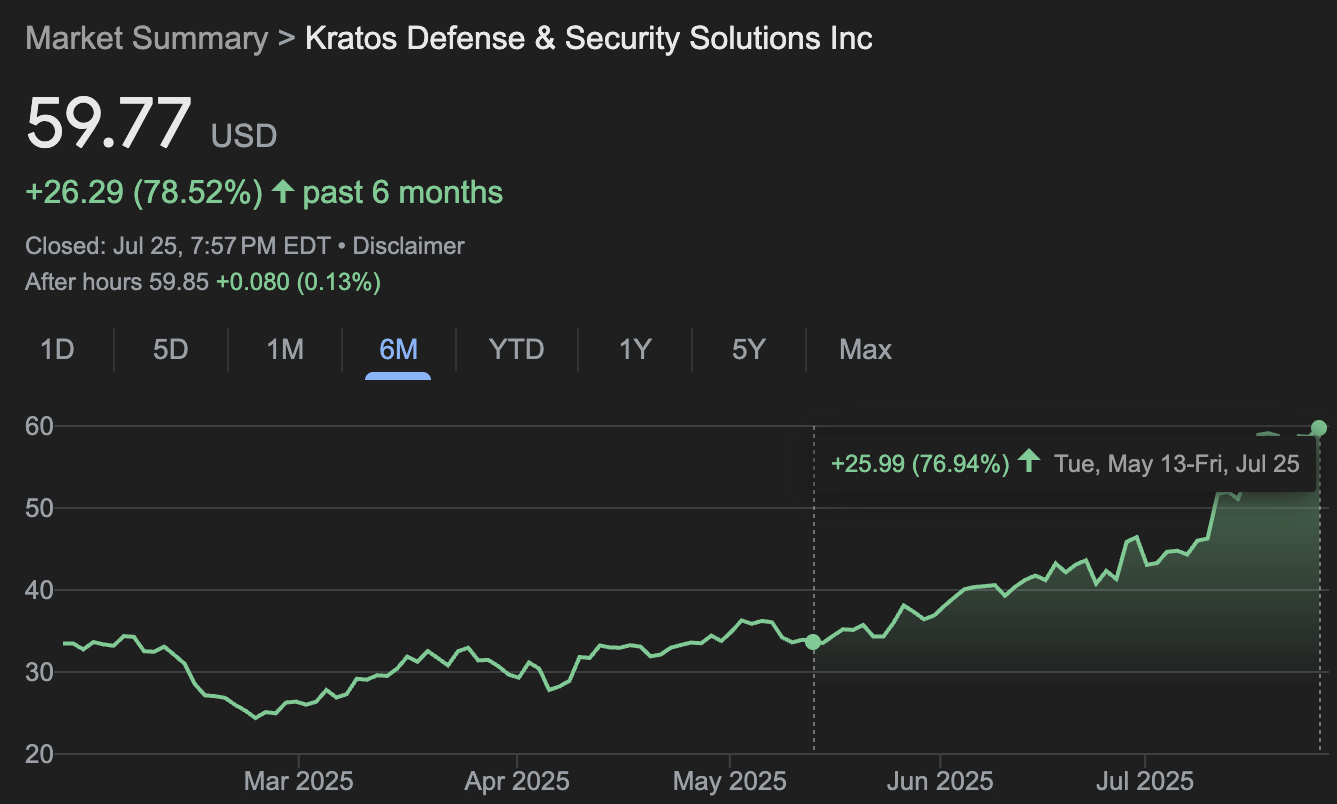

The top 2 insider purchases we shared in the May 13th newsletter are up 58% and 73%. Both were insiders with positive returns making their largest purchases ever.

DOUG opened at $1.92 and is up to $3.03 (+58%). KTOS opened at $34.46 and is up to $59.77 (+73%).

Get a free 30-day free trial of CEO Watcher Premium (no credit card required) at ceowatcher.com.

👀 Top Insider Trades this Week

🥇 CEO and Director buy the dip at PRGS

The CEO averages 20% 3m returns on his previous purchases and bought $103k of the stock. The Director averages 9% 3m returns and bought $250k of the stock.

🥈 [SELL] EVP & President, Medical at Becton, Dickinson and Company ($BDX)

Michael David Garrison (EVP & President, Medical) at Becton, Dickinson and Company ($BDX) made a large, unusual sale. They just sold 1,185 shares at $180.29/share ($213.64K total) which decreased their vested holdings by -19.5%. The current price is $185.32 (+2.8%). Their median sale size is $304.39K and this is their 5th largest sale out of 7 all time. link

Historic Returns

1m returns: +0.9% weighted | 83% win rate (5/6)

3m returns: +3.9% weighted | 67% win rate (4/6)

6m returns: +11.9% weighted | 100% win rate (5/5)

1y returns: +8.2% weighted | 100% win rate (3/3)

🥉 [SELL] EVP & Chief Legal Officer at Marvell Technology, Inc. ($MRVL)

Mark Casper (EVP & Chief Legal Officer) at Marvell Technology, Inc. ($MRVL) made a large, unusual sale. They just sold 3,000 shares at $72.35/share ($217.05K total) which decreased their vested holdings by -12.3%. The current price is $74.21 (+2.6%). Their median sale size is $314.06K and this is their 4th largest sale out of 9 all time. link

Historic Returns

1m returns: +1.0% weighted | 33% win rate (2/6)

3m returns: +21.6% weighted | 50% win rate (2/4)

6m returns: +15.9% weighted | 67% win rate (2/3)

1y returns: +0.9% weighted | 100% win rate (1/1)

Note: Selling the rip (stock was up 48.08% in the three months before the sale)

Get a free 30-day free trial of CEO Watcher Premium (no credit card required) at ceowatcher.com.

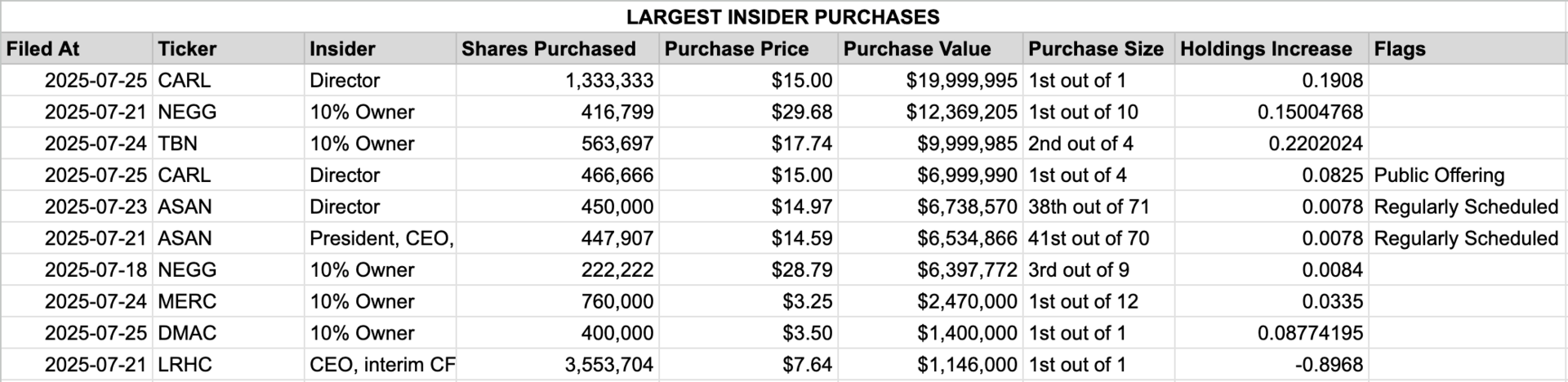

📈 Largest Insider Buys (last week)

Director at Carlsmed, Inc. (CARL) purchased 1,333,333 shares at $15.0 for $20.0M. This is their 1st largest purchase (out of 1) and increased their vested position to 8,321,763 shares (+19.08%). No returns available. 3 other insiders also purchased the stock (4 total purchases in last 30 days). - link

10% Owner at Newegg Commerce, Inc. (NEGG) purchased 416,799 shares at $29.68 for $12.37M. This is their 1st largest purchase (out of 10) and increased their vested position to 3,194,576 shares (+15.00%). -7.77% 1m (0.00% win rate) / -8.63% 3m (0.00% win rate) avg returns on 10 previous purchases. Buying the dip (stock was down -27.28% in the week before the purchase). This is the 5th insider purchase at this company in the last 30 days. - link

10% Owner at Tamboran Resources Corporation (TBN) purchased 563,697 shares at $17.74 for $10.0M. This is their 2nd largest purchase (out of 4) and increased their vested position to 3,123,601 shares (+22.02%). +2.53% 1m (+33.33% win rate) / -8.77% 3m (+33.33% win rate) avg returns on 4 previous purchases. Is part of a private placement. This is the 1st insider purchase at this company in the last 30 days. - link

Director at Carlsmed, Inc. (CARL) purchased 466,666 shares at $15.0 for $7.0M. This is their 1st largest purchase (out of 4) and increased their vested position to 6,126,072 shares (+8.25%). +10.61% 1m (+50.00% win rate) / +72.84% 3m (+50.00% win rate) avg returns on 4 previous purchases. Is part of a public offering. 3 other insiders also purchased the stock (4 total purchases in last 30 days). - link

Director at Asana, Inc. (ASAN) purchased 450,000 shares at $14.97 for $6.74M. This is their 38th largest purchase (out of 71) and increased their vested position to 58,328,045 shares (+0.78%). -6.14% 1m (+53.97% win rate) / -22.54% 3m (+26.98% win rate) avg returns on 71 previous purchases. This appears to be a regularly scheduled weekly transaction. This is the 7th insider purchase at this company in the last 30 days. - link

President, CEO, & Chair at Asana, Inc. (ASAN) purchased 447,907 shares at $14.59 for $6.53M. This is their 41st largest purchase (out of 70) and increased their vested position to 57,878,045 shares (+0.78%). -6.14% 1m (+53.97% win rate) / -22.54% 3m (+26.98% win rate) avg returns on 70 previous purchases. This appears to be a regularly scheduled weekly transaction. This is the 6th insider purchase at this company in the last 30 days. - link

10% Owner at Newegg Commerce, Inc. (NEGG) purchased 222,222 shares at $28.79 for $6.4M. This is their 3rd largest purchase (out of 9) and increased their vested position to 26,777,777 shares (+0.84%). -7.77% 1m (0.00% win rate) / -8.63% 3m (0.00% win rate) avg returns on 9 previous purchases. Buying the dip (stock was down -39.99% in the week before the purchase). This is the 4th insider purchase at this company in the last 30 days. - link

10% Owner at Mercer International Inc. (MERC) purchased 760,000 shares at $3.25 for $2.47M. This is their 1st largest purchase (out of 12) and increased their vested position to 23,455,000 shares (+3.35%). +5.78% 1m (+70.00% win rate) / +8.47% 3m (+40.00% win rate) avg returns on 12 previous purchases. This is the 1st insider purchase at this company in the last 30 days. - link

10% Owner at DiaMedica Therapeutics Inc. (DMAC) purchased 400,000 shares at $3.5 for $1.4M. This is their 1st largest purchase (out of 1) and increased their vested position to 4,958,823 shares (+8.77%). No returns available. This is the 1st insider purchase at this company in the last 30 days. - link

CEO, interim CFO at La Rosa Holdings Corp. (LRHC) purchased 3,553,704 shares at $7.64 for $1.15M. This is their 1st largest purchase (out of 1) and increased their vested position to 408,798 shares (-89.68%). No returns available. Buying the dip (stock was down -22.08% in the month before the purchase). This is the 1st insider purchase at this company in the last 30 days. - link

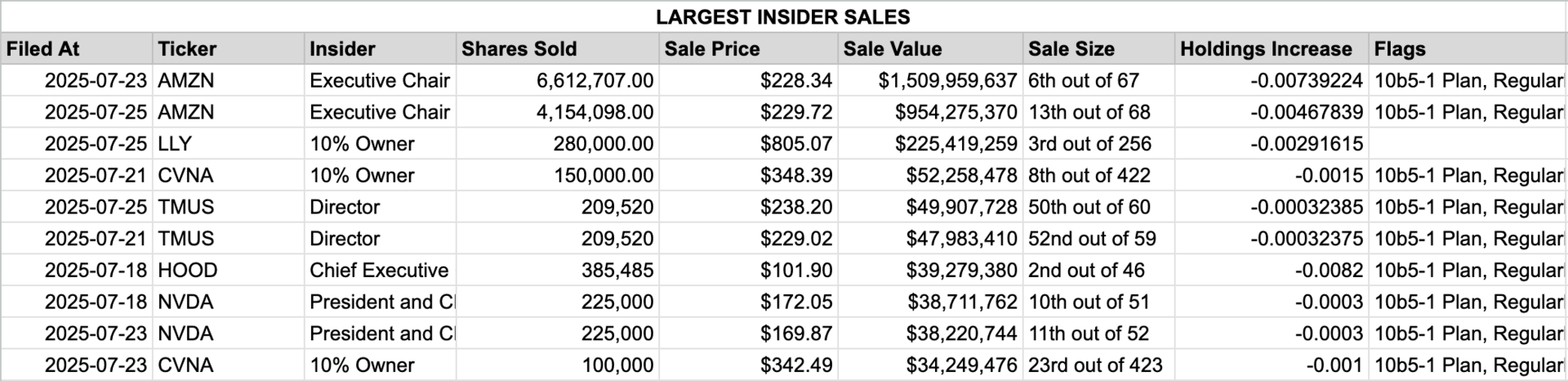

📉 Largest Insider Sells (last week)

Executive Chair at Amazon.com, Inc. (AMZN) sold 6,612,707 shares at $228.34 for $1.51B. This is their 6th largest sale (out of 67) and decreased their vested position to 887,933,999 shares (-0.74%). +1.01% 1m (+68.85% win rate) / -3.61% 3m (+42.62% win rate) avg returns on 67 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled weekly transaction. This is the 7th insider sale at this company in the last 30 days. - link

Executive Chair at Amazon.com, Inc. (AMZN) sold 4,154,098 shares at $229.72 for $954.28M. This is their 13th largest sale (out of 68) and decreased their vested position to 883,779,901 shares (-0.47%). +1.01% 1m (+68.85% win rate) / -3.61% 3m (+42.62% win rate) avg returns on 68 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled weekly transaction. This is the 8th insider sale at this company in the last 30 days. - link

10% Owner at Eli Lilly and Company (LLY) sold 280,000 shares at $805.07 for $225.42M. This is their 3rd largest sale (out of 256) and decreased their vested position to 95,736,978 shares (-0.29%). -2.48% 1m (+34.39% win rate) / -5.54% 3m (+22.53% win rate) avg returns on 256 previous sales. This is the 1st insider sale at this company in the last 30 days. - link

10% Owner at Carvana Co. (CVNA) sold 150,000 shares at $348.39 for $52.26M. This is their 8th largest sale (out of 422) and decreased their vested position to 98,421,281 shares (-0.15%). -7.48% 1m (+34.14% win rate) / -17.44% 3m (+33.17% win rate) avg returns on 422 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled weekly transaction. Selling the rip (stock was up 74.60% in the three months before the sale). This is the 28th insider sale at this company in the last 30 days. - link

Director at T-Mobile US, Inc. (TMUS) sold 209,520 shares at $238.2 for $49.91M. This is their 50th largest sale (out of 60) and decreased their vested position to 646,752,924 shares (-0.03%). -1.54% 1m (+30.77% win rate) / -8.16% 3m (+6.00% win rate) avg returns on 60 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled weekly transaction. This is the 8th insider sale at this company in the last 30 days. - link

Director at T-Mobile US, Inc. (TMUS) sold 209,520 shares at $229.02 for $47.98M. This is their 52nd largest sale (out of 59) and decreased their vested position to 646,962,444 shares (-0.03%). -1.54% 1m (+30.77% win rate) / -8.16% 3m (+6.00% win rate) avg returns on 59 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled weekly transaction. This is the 7th insider sale at this company in the last 30 days. - link

Chief Executive Officer at Robinhood Markets, Inc. (HOOD) sold 385,485 shares at $101.9 for $39.28M. This is their 2nd largest sale (out of 46) and decreased their vested position to 46,874,267 shares (-0.82%). -9.05% 1m (+29.03% win rate) / -25.36% 3m (+25.81% win rate) avg returns on 46 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled weekly transaction. Selling the rip (stock was up 40.06% in the month before the sale). This is the 8th insider sale at this company in the last 30 days. - link

President and CEO at NVIDIA Corporation (NVDA) sold 225,000 shares at $172.05 for $38.71M. This is their 10th largest sale (out of 51) and decreased their vested position to 857,723,625 shares (-0.03%). -0.15% 1m (+53.49% win rate) / -4.45% 3m (+28.57% win rate) avg returns on 51 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled weekly transaction. Selling the rip (stock was up 69.89% in the three months before the sale). This is the 13th insider sale at this company in the last 30 days (and there was 1 other sale on the same day). - link

President and CEO at NVIDIA Corporation (NVDA) sold 225,000 shares at $169.87 for $38.22M. This is their 11th largest sale (out of 52) and decreased their vested position to 857,498,625 shares (-0.03%). -0.15% 1m (+53.49% win rate) / -4.45% 3m (+28.57% win rate) avg returns on 52 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled weekly transaction. Selling the rip (stock was up 66.29% in the three months before the sale). This is the 14th insider sale at this company in the last 30 days. - link

10% Owner at Carvana Co. (CVNA) sold 100,000 shares at $342.49 for $34.25M. This is their 23rd largest sale (out of 423) and decreased their vested position to 98,196,281 shares (-0.10%). -7.48% 1m (+34.14% win rate) / -17.44% 3m (+33.17% win rate) avg returns on 423 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled weekly transaction. Selling the rip (stock was up 55.25% in the three months before the sale). This is the 31st insider sale at this company in the last 30 days. - link

Get the insider trades as soon as they happen

By upgrading to CEO Watcher Premium, you get the top insider trades as soon as they happen.

Each morning you get an email with the top insider buys/sells (ranked by the proprietary CEO Watcher ranking system), largest insider buys/sells, largest holdings increases/decreases, and the companies with the most insider buying/selling sent before the market opens each morning.

How was today's email? |

Reply