- 📈👀 CEO Watcher

- Posts

- Top insider trades (week of Aug 30)

Top insider trades (week of Aug 30)

Welcome to this week’s edition of CEO Watcher.

This is the only tool that tracks the returns of insiders so we know which insider trades are worth copying.

This week we tracked 1,152 insider trades and found:

RPAY is up 43% in 3 months after we found the President, who averaged 19% 3m returns, bought $784k of the stock (largest purchase ever and increased their listed holdings by over 250%).

A director at Infinity Natural Resources, Inc. ($INR) bought $689k of the stock. This is their largest purchase ever (out of 6), increased their listed holdings by 333%, and they average 45% 1y returns on their previous purchases.

The CEO at Western Union ($WU) is buying the dip with a $1.5M purchase

and more…

Have a great weekend and thanks for reading!

Connor

P.S. Make sure to follow @CEOStockWatcher on Twitter/X as I post more interesting insider trades there each day.

💰 Previous Winner

RPAY is up 43% in 3 months after we found the President, who averaged 19% 3m returns, bought $784k of the stock (largest purchase ever and increased their listed holdings by over 250%).

It opened at $4.11 and is up to $5.88 (+44%).

Get a free 30-day free trial of CEO Watcher Premium (no credit card required) at ceowatcher.com.

👀 Top Insider Trades this Week

🥇 Director at Infinity Natural Resources, Inc. ($INR)

STEVEN D GRAY (Director) at Infinity Natural Resources, Inc. ($INR) purchased 50,000 shares at $13.79/share ($689.58K total) which increased their vested holdings by +333.3%. The current price is $14.90 (+8.0%). Their median purchase size is $284.88K and this is their 1st largest purchase out of 6 all time. link

Historic Returns

1m returns: +10.4% weighted | 50% win rate (2/4)

3m returns: +11.1% weighted | 25% win rate (1/4)

6m returns: +20.6% weighted | 50% win rate (2/4)

1y returns: +45.6% weighted | 50% win rate (2/4)

Note: This is the 2nd insider purchase at this company in the last 30 days

🥈 Director at Vertiv Holdings Co ($VRT)

STEVEN REINEMUND (Director) at Vertiv Holdings Co ($VRT) made a large, unusual sale. They just sold 100,000 shares at $128.22/share ($12.82M total) which decreased their vested holdings by -37.3%. The current price is $127.55 (-0.5%). Their median sale size is $13.24M and this is their 2nd largest sale out of 2 all time. link

Historic Returns

1m returns: +7.5% weighted | 100% win rate (1/1)

3m returns: +16.1% weighted | 100% win rate (1/1)

6m returns: +14.5% weighted | 100% win rate (1/1)

1y returns: N/A

Note: Selling the rip (stock was up 61.43% in the year before the sale). This is the 3rd insider sale at this company in the last 30 days

🥉 President at Royce Micro-Cap Trust, Inc. ($RMT)

CHRISTOPHER D CLARK (President) at Royce Micro-Cap Trust, Inc. ($RMT) purchased 2,100 shares at $10.16/share ($21.34K total) which increased their vested holdings by +3.6%. The current price is $10.17 (+0.0%). Their median purchase size is $65.24K and this is their 10th largest purchase out of 10 all time. link

Historic Returns

1m returns: +3.7% weighted | 67% win rate (6/9)

3m returns: +9.5% weighted | 67% win rate (6/9)

6m returns: +15.5% weighted | 78% win rate (7/9)

1y returns: +19.0% weighted | 89% win rate (8/9)

Get a free 30-day free trial of CEO Watcher Premium (no credit card required) at ceowatcher.com.

📈 Largest Insider Buys (last week)

10% Owner at Tortoise Energy Infrastructure Corporation (TYG) purchased 1,500,000 shares at $10.0 for $15.0M. This is their 4th largest purchase (out of 5) and increased their vested position to 1,500,000 shares (0%). +6.44% 1m (+100.00% win rate) / +11.10% 3m (+100.00% win rate) avg returns on 5 previous purchases. This is the 1st insider purchase at this company in the last 30 days. - link

10% Owner at Cantor Equity Partners IV, Inc. (CEPF) purchased 900,000 shares at $10.0 for $9.0M. This is their 1st largest purchase (out of 1) and increased their vested position to 12,150,000 shares (+8.00%). No returns available. Is part of a purchase agreement. Is part of a private placement. This is the 1st insider purchase at this company in the last 30 days. - link

Director at Asana, Inc. (ASAN) purchased 446,966 shares at $13.74 for $6.14M. This is their 52nd largest purchase (out of 79) and increased their vested position to 61,923,012 shares (+0.73%). -6.05% 1m (+52.11% win rate) / -21.77% 3m (+26.98% win rate) avg returns on 79 previous purchases. This appears to be a regularly scheduled weekly transaction. This is the 7th insider purchase at this company in the last 30 days. - link

Director at Reynolds Consumer Products Inc. (REYN) purchased 159,506 shares at $22.99 for $3.67M. This is their 1st largest purchase (out of 2) and increased their vested position to 334,092 shares (+91.36%). No returns available. This is the 2nd insider purchase at this company in the last 30 days. - link

Director at Sharps Technology, Inc. (STSS) purchased 400,000 shares at $6.41 for $2.56M. This is their 1st largest purchase (out of 5) and increased their vested position to 400,000 shares (0%). -0.00% 1m (+25.00% win rate) / 0.00% 3m (+33.33% win rate) avg returns on 5 previous purchases. Buying the dip (stock was down -99.13% in the one year before the purchase). 5 other insiders also purchased the stock (6 total purchases in last 30 days). - link

10% Owner at Summit Midstream Corporation (SMC) purchased 120,160 shares at $20.48 for $2.46M. This is their 1st largest purchase (out of 1) and increased their vested position to 120,160 shares (0%). No returns available. This is the 1st insider purchase at this company in the last 30 days. - link

Director at Asana, Inc. (ASAN) purchased 122,470 shares at $13.52 for $1.66M. This is their 75th largest purchase (out of 80) and increased their vested position to 62,045,482 shares (+0.20%). -6.05% 1m (+52.11% win rate) / -21.77% 3m (+26.98% win rate) avg returns on 80 previous purchases. This appears to be a regularly scheduled weekly transaction. This is the 8th insider purchase at this company in the last 30 days. - link

Director at Reynolds Consumer Products Inc. (REYN) purchased 71,586 shares at $23.05 for $1.65M. This is their 2nd largest purchase (out of 1) and increased their vested position to 174,586 shares (+69.50%). No returns available. This is the 1st insider purchase at this company in the last 30 days. - link

10% Owner at Resideo Technologies, Inc. (REZI) purchased 46,953 shares at $33.55 for $1.58M. This is their 6th largest purchase (out of 6) and increased their vested position to 12,862,161 shares (+0.37%). +14.43% 1m (+100.00% win rate) / +10.98% 3m (+100.00% win rate) avg returns on 6 previous purchases. This appears to be a regularly scheduled weekly transaction. This is the 4th insider purchase at this company in the last 30 days. - link

Director at Advanced Flower Capital Inc. (AFCG) purchased 375,147 shares at $4.07 for $1.53M. This is their 3rd largest purchase (out of 38) and increased their vested position to 4,643,090 shares (+8.79%). +2.89% 1m (+61.29% win rate) / +9.96% 3m (+72.41% win rate) avg returns on 38 previous purchases. Buying the dip (stock was down -52.37% in the one year before the purchase). 2 other insiders also purchased the stock (3 total purchases in last 30 days). - link

CEO & President at The Western Union Company (WU) purchased 176,470 shares at $8.49 for $1.5M. This is their 1st largest purchase (out of 1) and increased their vested position to 913,125 shares (+23.96%). No returns available. This is the 2nd insider purchase at this company in the last 30 days. - link

CEO and President at Bakkt Holdings, Inc. (BKKT) purchased 180,000 shares at $8.19 for $1.47M. This is their 1st largest purchase (out of 1) and increased their vested position to 1,799,143 shares (+11.12%). No returns available. Buying the dip (stock was down -53.60% in the month before the purchase). This is the 1st insider purchase at this company in the last 30 days. - link

Director at Avantor, Inc. (AVTR) purchased 100,000 shares at $12.56 for $1.26M. This is their 1st largest purchase (out of 6) and increased their vested position to 258,111 shares (+63.25%). +1.46% 1m (+80.00% win rate) / +0.94% 3m (+80.00% win rate) avg returns on 6 previous purchases. This is the 1st insider purchase at this company in the last 30 days. - link

Hilltop Securities Chairman at Hilltop Holdings Inc. (HTH) purchased 30,000 shares at $34.84 for $1.05M. This is their 1st largest purchase (out of 3) and increased their vested position to 117,428 shares (+34.31%). No returns available. This is the 3rd insider purchase at this company in the last 30 days. - link

Chief Executive Officer at Coty Inc. (COTY) purchased 260,000 shares at $3.92 for $1.02M. This is their 2nd largest purchase (out of 2) and increased their vested position to 32,127,286 shares (+0.82%). -0.33% 1m (0.00% win rate) / -12.21% 3m (0.00% win rate) avg returns on 2 previous purchases. Buying the dip (stock was down -24.54% in the week before the purchase). 1 other insider also purchased the stock (2 total purchases in last 30 days). - link

Director at Intellia Therapeutics, Inc. (NTLA) purchased 100,000 shares at $10.03 for $1.0M. This is their 2nd largest purchase (out of 2) and increased their vested position to 134,693 shares (+288.24%). -4.20% 1m (0.00% win rate) / +2.37% 3m (+100.00% win rate) avg returns on 2 previous purchases. Buying the dip (stock was down -22.02% in the month before the purchase). This is the 1st insider purchase at this company in the last 30 days. - link

Chief Executive Officer at TriplePoint Venture Growth BDC Corp. (TPVG) purchased 122,003 shares at $6.46 for $788.66K. This is their 1st largest purchase (out of 4) and increased their vested position to 531,908 shares (+29.76%). +0.01% 1m (+100.00% win rate) / +0.03% 3m (+100.00% win rate) avg returns on 4 previous purchases. This is the 5th insider purchase at this company in the last 30 days. - link

President and CIO at TriplePoint Venture Growth BDC Corp. (TPVG) purchased 122,003 shares at $6.46 for $788.66K. This is their 1st largest purchase (out of 5) and increased their vested position to 593,546 shares (+25.87%). No returns available. This is the 6th insider purchase at this company in the last 30 days. - link

Other at Global Partners LP (GLP) purchased 15,000 shares at $51.95 for $779.3K. This is their 13th largest purchase (out of 57) and increased their vested position to 147,001 shares (+11.36%). +0.41% 1m (+50.00% win rate) / +5.78% 3m (+72.34% win rate) avg returns on 57 previous purchases. This appears to be a regularly scheduled weekly transaction. This is the 4th insider purchase at this company in the last 30 days. - link

Executive Chair at Eastern Bankshares, Inc. (EBC) purchased 44,642 shares at $16.71 for $745.97K. This is their 1st largest purchase (out of 1) and increased their vested position to 357,250 shares (+14.28%). No returns available. 1 other insider also purchased the stock (2 total purchases in last 30 days). - link

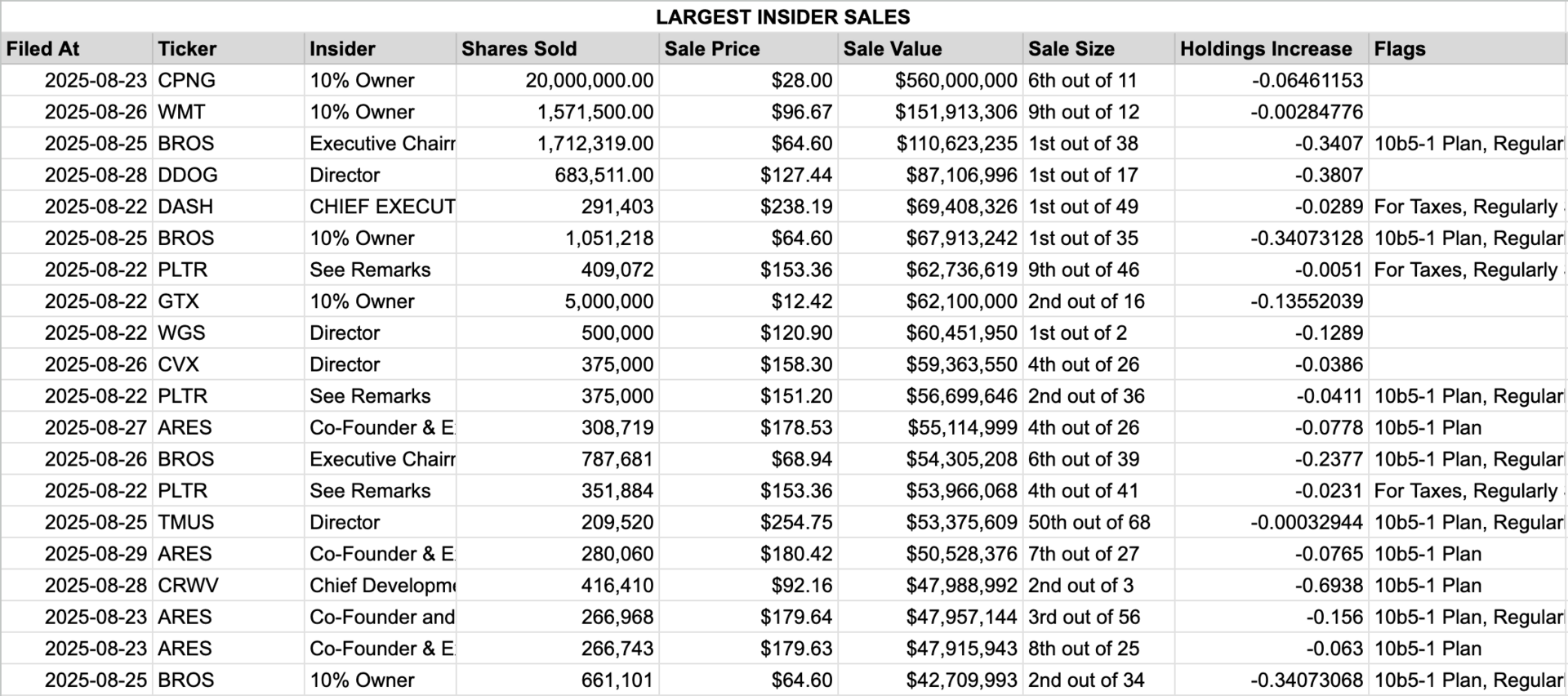

📉 Largest Insider Sells (last week)

10% Owner at Coupang, Inc. (CPNG) sold 20,000,000 shares at $28.0 for $560.0M. This is their 6th largest sale (out of 11) and decreased their vested position to 289,542,259 shares (-6.46%). -2.32% 1m (+30.00% win rate) / +3.20% 3m (+33.33% win rate) avg returns on 11 previous sales. This is the 3rd insider sale at this company in the last 30 days. - link

10% Owner at Walmart Inc. (WMT) sold 1,571,500 shares at $96.67 for $151.91M. This is their 9th largest sale (out of 12) and decreased their vested position to 550,265,700 shares (-0.28%). -0.17% 1m (+45.45% win rate) / -1.23% 3m (+28.57% win rate) avg returns on 12 previous sales. This is the 5th insider sale at this company in the last 30 days. - link

Executive Chairman of Board at Dutch Bros Inc. (BROS) sold 1,712,319 shares at $64.6 for $110.62M. This is their 1st largest sale (out of 38) and decreased their vested position to 3,313,108 shares (-34.07%). -0.70% 1m (+41.18% win rate) / -3.09% 3m (+35.29% win rate) avg returns on 38 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled yearly transaction. Selling the rip (stock was up 119.89% in the year before the sale). 2 other insiders also sold the stock (3 total sales in last 30 days). - link

Director at Datadog, Inc. (DDOG) sold 683,511 shares at $127.44 for $87.11M. This is their 1st largest sale (out of 17) and decreased their vested position to 1,111,674 shares (-38.07%). -10.07% 1m (+26.67% win rate) / +2.11% 3m (+50.00% win rate) avg returns on 17 previous sales. This is the 6th insider sale at this company in the last 30 days. - link

CHIEF EXECUTIVE OFFICER at DoorDash, Inc. (DASH) sold 291,403 shares at $238.19 for $69.41M. This is their 1st largest sale (out of 49) and decreased their vested position to 9,788,315 shares (-2.89%). -1.87% 1m (+31.11% win rate) / -6.19% 3m (+26.83% win rate) avg returns on 49 previous sales. Is a sale for taxes. This appears to be a regularly scheduled yearly transaction. Selling the rip (stock was up 92.02% in the year before the sale). This is the 16th insider sale at this company in the last 30 days (and there were 7 other sales on the same day). - link

10% Owner at Dutch Bros Inc. (BROS) sold 1,051,218 shares at $64.6 for $67.91M. This is their 1st largest sale (out of 35) and decreased their vested position to 2,033,964 shares (-34.07%). -0.73% 1m (+41.18% win rate) / -3.03% 3m (+35.29% win rate) avg returns on 35 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled yearly transaction. Selling the rip (stock was up 119.89% in the year before the sale). 2 other insiders also sold the stock (3 total sales in last 30 days). - link

See Remarks at Palantir Technologies Inc. (PLTR) sold 409,072 shares at $153.36 for $62.74M. This is their 9th largest sale (out of 46) and decreased their vested position to 79,238,165 shares (-0.51%). -18.63% 1m (+46.67% win rate) / -59.35% 3m (+43.33% win rate) avg returns on 46 previous sales. Is a sale for taxes. This appears to be a regularly scheduled yearly transaction. Selling the rip (stock was up 397.31% in the year before the sale). This is the 9th insider sale at this company in the last 30 days (and there were 6 other sales on the same day). - link

10% Owner at Garrett Motion Inc. (GTX) sold 5,000,000 shares at $12.42 for $62.1M. This is their 2nd largest sale (out of 16) and decreased their vested position to 31,894,816 shares (-13.55%). -2.51% 1m (+46.67% win rate) / -4.34% 3m (+7.14% win rate) avg returns on 16 previous sales. Selling the rip (stock was up 66.70% in the year before the sale). This is the 7th insider sale at this company in the last 30 days. - link

Director at GeneDx Holdings Corp. (WGS) sold 500,000 shares at $120.9 for $60.45M. This is their 1st largest sale (out of 2) and decreased their vested position to 3,380,073 shares (-12.89%). +0.08% 1m (+100.00% win rate) / +0.12% 3m (+100.00% win rate) avg returns on 2 previous sales. Selling the rip (stock was up 59.04% in the month before the sale). This is the 3rd insider sale at this company in the last 30 days. - link

Director at Chevron Corporation (CVX) sold 375,000 shares at $158.3 for $59.36M. This is their 4th largest sale (out of 26) and decreased their vested position to 9,346,449 shares (-3.86%). -0.59% 1m (+35.29% win rate) / -3.80% 3m (+40.00% win rate) avg returns on 26 previous sales. This is the 1st insider sale at this company in the last 30 days. - link

See Remarks at Palantir Technologies Inc. (PLTR) sold 375,000 shares at $151.2 for $56.7M. This is their 2nd largest sale (out of 36) and decreased their vested position to 8,756,391 shares (-4.11%). -8.23% 1m (+21.43% win rate) / -18.43% 3m (+23.08% win rate) avg returns on 36 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled yearly transaction. Selling the rip (stock was up 397.31% in the year before the sale). This is the 9th insider sale at this company in the last 30 days (and there were 6 other sales on the same day). - link

Co-Founder & Exec. Chairman at Ares Management Corporation (ARES) sold 308,719 shares at $178.53 for $55.11M. This is their 4th largest sale (out of 26) and decreased their vested position to 3,660,163 shares (-7.78%). -0.77% 1m (+33.33% win rate) / -2.19% 3m (+20.83% win rate) avg returns on 26 previous sales. Is part of a 10b5-1 plan. This is the 5th insider sale at this company in the last 30 days (and there was 1 other sale on the same day). - link

Executive Chairman of Board at Dutch Bros Inc. (BROS) sold 787,681 shares at $68.94 for $54.31M. This is their 6th largest sale (out of 39) and decreased their vested position to 2,525,427 shares (-23.77%). -0.70% 1m (+41.18% win rate) / -3.09% 3m (+35.29% win rate) avg returns on 39 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled yearly transaction. Selling the rip (stock was up 21.46% in the month before the sale). This is the 6th insider sale at this company in the last 30 days (and there were 2 other sales on the same day). - link

See Remarks at Palantir Technologies Inc. (PLTR) sold 351,884 shares at $153.36 for $53.97M. This is their 4th largest sale (out of 41) and decreased their vested position to 14,882,389 shares (-2.31%). -5.87% 1m (+42.86% win rate) / -44.87% 3m (+33.33% win rate) avg returns on 41 previous sales. Is a sale for taxes. This appears to be a regularly scheduled yearly transaction. Selling the rip (stock was up 397.31% in the year before the sale). This is the 9th insider sale at this company in the last 30 days (and there were 6 other sales on the same day). - link

Director at T-Mobile US, Inc. (TMUS) sold 209,520 shares at $254.75 for $53.38M. This is their 50th largest sale (out of 68) and decreased their vested position to 635,782,844 shares (-0.03%). -1.85% 1m (+28.33% win rate) / -7.42% 3m (+6.00% win rate) avg returns on 68 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled weekly transaction. This is the 10th insider sale at this company in the last 30 days. - link

Co-Founder & Exec. Chairman at Ares Management Corporation (ARES) sold 280,060 shares at $180.42 for $50.53M. This is their 7th largest sale (out of 27) and decreased their vested position to 3,380,103 shares (-7.65%). -0.77% 1m (+33.33% win rate) / -2.19% 3m (+20.83% win rate) avg returns on 27 previous sales. Is part of a 10b5-1 plan. This is the 6th insider sale at this company in the last 30 days. - link

Chief Development Officer at CoreWeave, Inc. (CRWV) sold 416,410 shares at $92.16 for $47.99M. This is their 2nd largest sale (out of 3) and decreased their vested position to 183,765 shares (-69.38%). No returns available. Is part of a 10b5-1 plan. This is the 10th insider sale at this company in the last 30 days (and there was 1 other sale on the same day). - link

Co-Founder and CEO at Ares Management Corporation (ARES) sold 266,968 shares at $179.64 for $47.96M. This is their 3rd largest sale (out of 56) and decreased their vested position to 1,444,760 shares (-15.60%). -2.09% 1m (+27.78% win rate) / -6.76% 3m (+22.22% win rate) avg returns on 56 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled yearly transaction. This is the 3rd insider sale at this company in the last 30 days (and there was 1 other sale on the same day). - link

Co-Founder & Exec. Chairman at Ares Management Corporation (ARES) sold 266,743 shares at $179.63 for $47.92M. This is their 8th largest sale (out of 25) and decreased their vested position to 3,968,882 shares (-6.30%). -0.77% 1m (+33.33% win rate) / -2.19% 3m (+20.83% win rate) avg returns on 25 previous sales. Is part of a 10b5-1 plan. This is the 3rd insider sale at this company in the last 30 days (and there was 1 other sale on the same day). - link

10% Owner at Dutch Bros Inc. (BROS) sold 661,101 shares at $64.6 for $42.71M. This is their 2nd largest sale (out of 34) and decreased their vested position to 1,279,144 shares (-34.07%). -0.65% 1m (+42.42% win rate) / -3.20% 3m (+36.36% win rate) avg returns on 34 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled yearly transaction. Selling the rip (stock was up 119.89% in the year before the sale). 2 other insiders also sold the stock (3 total sales in last 30 days). - link

Get the insider trades as soon as they happen

By upgrading to CEO Watcher Premium, you get the top insider trades as soon as they happen and full access to the ceowatcher.com website (including the custom feeds of highest-signal insider trades).

Each morning you get an email with the top insider buys/sells (ranked by the proprietary CEO Watcher ranking system), largest insider buys/sells, largest holdings increases/decreases, and the companies with the most insider buying/selling sent before the market opens each morning.

How was today's email? |

Reply