- 📈👀 CEO Watcher

- Posts

- Top insider trades (Wed, Dec 31)

Top insider trades (Wed, Dec 31)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

Fortunately, we have resolved the Snowflake issue we had yesterday (why would you ever implement breaking updates over Christmas?), so everything should be back to normal.

There won’t be an email tomorrow because of the holiday, so I will talk to you again on Friday.

There were 149 insider trades.

The CFO at Monopar Therapeutics (MNPR) buys $100k of the stock after its 20% dip in the last month (even though it is still up 170% in the last year).

The CEO at HireQuest (HQI) bought $176k (largest purchase ever, out of 45). It’s their first purchase of 2025

A director at Neuraxis (NRXS) bought $1M (largest purchase ever). The stock is on a tear, up over 40% in the last month.

The Chief Scientific Officer at Century Therapeutics (IPSC) bought $50k (first-ever purchase).

The Chief Accounting Officer at NewAmsterdam Pharma (NAMS) sold $5.2M (largest purchase ever, out of 6).

The President of Global Field Operations at Oracle (ORCL) sold $2.95M (first-ever sale).

A director at American Healthcare REIT (AHR) sold $2.65M (largest purchase ever, out of 3)

The execs at Urban Outfitters (URBN) continue to sell (another $2M by the CCO).

An EVP at Hyatt (H) sold $1.6M (first-ever sale).

and much more…

I go into more depth on these companies in the CEO Watcher Premium sections below.

Commentary

As 2025 comes to a close, I’ve been reviewing the 2025 data to see how it compares to what we’d expect based on our historical data.

In 2025, we found 47,791 insider trade filings. On average, the stocks rose 11.06% after sales and 11.45% after buys. (The returns are calculated from the day after the filing is made public through December 26th, when I pulled this data.)

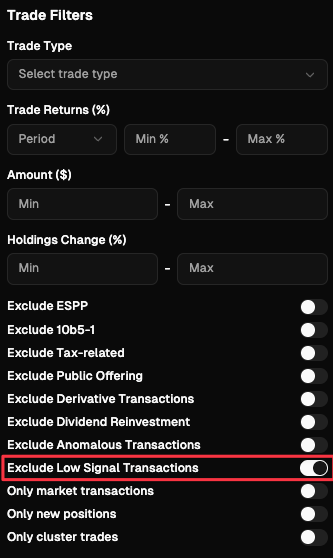

The first thing we do with the data after we ingest it is what we call a “low signal” check, where we look for things like 10b5-1 plans, tax sales, employee stock purchase programs, dividend reinvestments, private placements, late filings, etc.

This allows us to easily filter out these low signal trades.

In 2025, only 14,934 filings passed this check (a 69% reduction). This improved the average returns of both buys and sells. On average, the sell returns fell from 11.06% to 6.8%, while the buys increased from 11.45% to 12.3%.

The larger improvement in sales makes sense as the majority of stock sales are pre-planned and have no signal at all.

Note: we include the “Exclude Low Signal” filter on the ceowatcher.com website in the Trade Filters website so that you can also remove these trades when looking through the database.

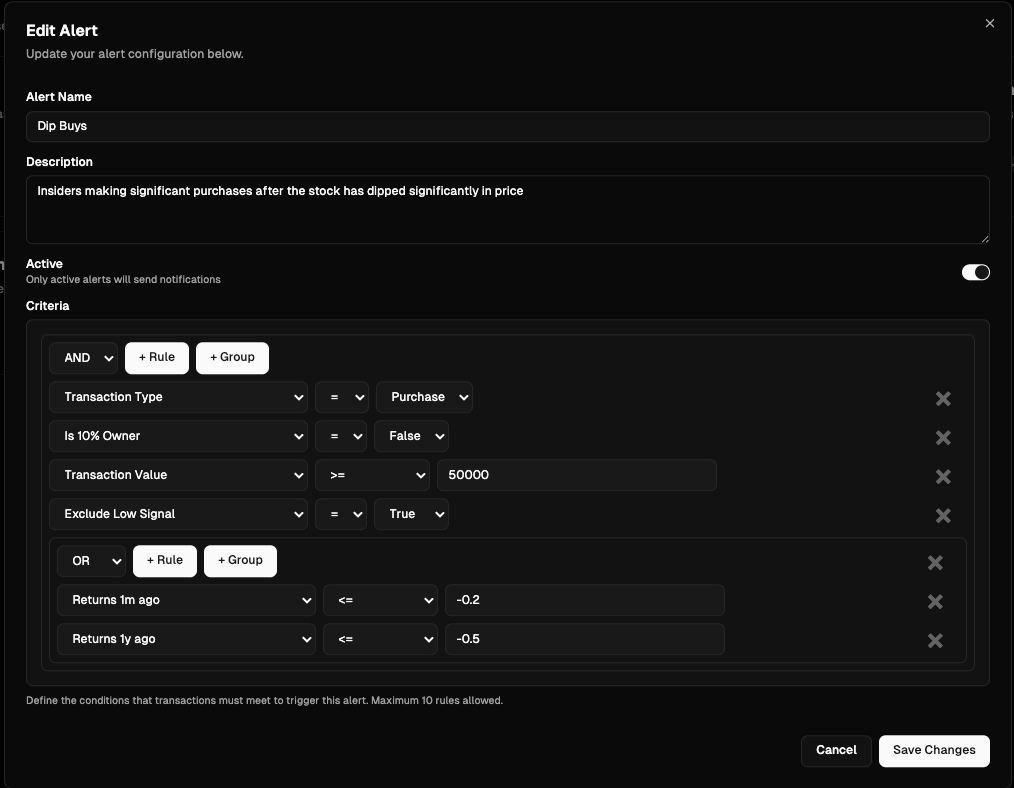

The filter is also included in our Custom Alerts feature, which is coming very soon. Premium subscribers will be able to create custom insider trading alerts that send you an email each morning with only the insider trades that match your criteria.

Another thing you heard me mention numerous times this year is that CEO purchases were performing incredibly well.

This is supported by the data: CEO purchases returned 14.83% on average, while CEO sells returned only 5.38% (a 9.45% spread).

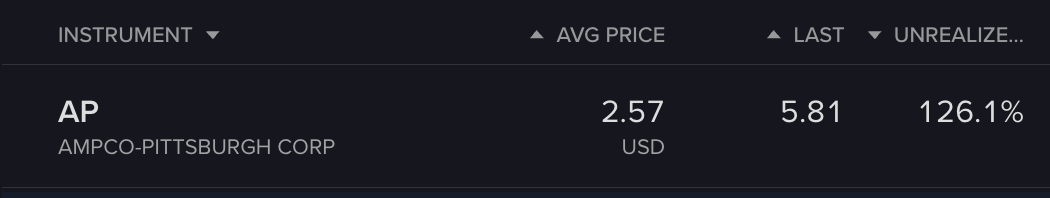

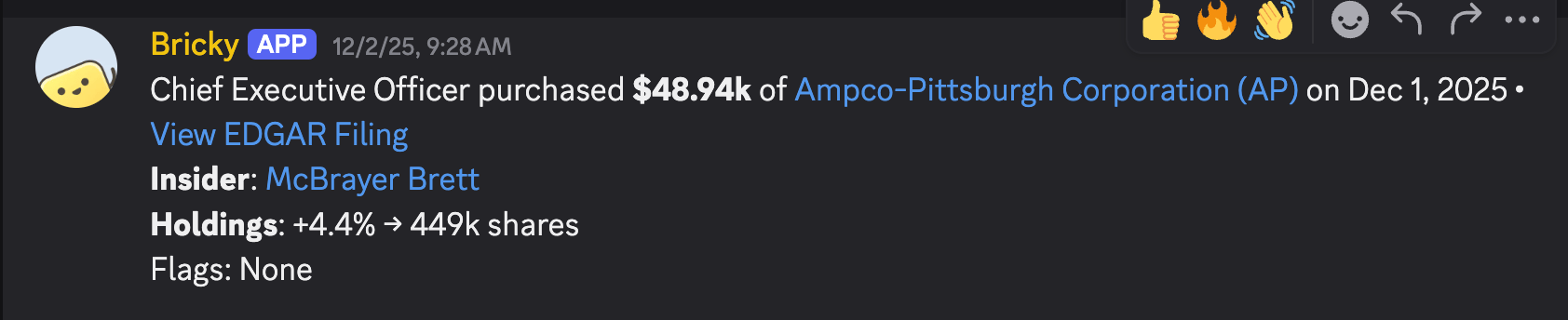

In fact, the biggest winner in the CEO Watcher Portfolio is Ampco-Pittsburgh (AP), which is up 126% since we found the CEO buying the stock in early December.

We got the real-time notification in the #ceo-trades channel of the Discord at 9:28 AM on December 2nd and bought the stock as soon as the notification came in.

In the Friday, December 12th email (in the free commentary section), I actually highlighted AP as an example of a CEO Purchase that was working well. It was already up 30% at that time and hasn’t slowed down at all!

Unfortunately, the last handful of CEO Purchases are not working out quite as well. It could be that the hot streak for CEO purchases is over, but I’m still keeping my eye on them.

I’ll share more data from 2025 in the coming emails. There is a lot of interesting data, including the performance of Reversals (insiders flipping from selling to buying - or vice versa), Dip buys, and Momentum buys.

Have a great New Year!

keep scrolling. top trades + all of the charts and data below

🔒 CEO Watcher Premium

The rest of this email (including today’s top insider trades + all the charts and data) is for CEO Watcher Premium subscribers only. To see an example of the Premium email, click here.

Upgrade to CEO Watcher Premium at ceowatcher.com to unlock:

The Premium daily emails

Full access to the website, which has all insider trades back to 2009. It includes search/filters and the returns of every trade and every insider to help you find the top insider trades

Full access to the CEO Watcher Premium Discord where I share my notes and holdings in the CEO Watcher Portfolio

The Premium Dashboard, which has a bunch of charts/tables with insider trading data that is updated each day

If CEO Watcher Premium is not for you, I give full refunds with no questions asked.

Reply