- 📈👀 CEO Watcher

- Posts

- Top insider trades (Tue, Dec 2)

Top insider trades (Tue, Dec 2)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

There were 177 new insider trade filings.

A director at Johnson & Johnson (JNJ) bought $257k. The first purchase at JNJ in almost a year

CEO at Goosehead Insurance (GSHD) bought $361k, which increased their holdings by 16%. His previous trade was a sale last march, so this is a reversal for him.

A couple of directors at Alight (ALIT) are buying the stock after its 70% dip in the last year

Insiders continue buying Arbor Realty Trust (ABR) after its 20% dip in the last 3 months

Constant insider buying at Avidia Bancorp (AVBC) since its IPO a few months ago

Director at Jazz Pharmaceuticals (JAZZ) sold $13.78M (largest sale ever, out of 95)

Director at Navitas Semiconductor (NVTS) sells the stock again. A $12.76M sale, their 2nd largest (out of 9)

The Chairman at Tyson Foods (TSN) sells $5.82M of the stock. Their first sale in almost a year.

A director at Installed Building Products (IBP) sold $536k (largest sale ever, out of 7). This is their first sale in over 3 years. The stock is up 71% in the last 6 months

and much more…

I go into more depth on these companies in the CEO Watcher Premium sections below.

Commentary

It’s been a couple of weeks since we’ve looked at insider sentiment data, and with the markets being choppy, now is a great time to take a look.

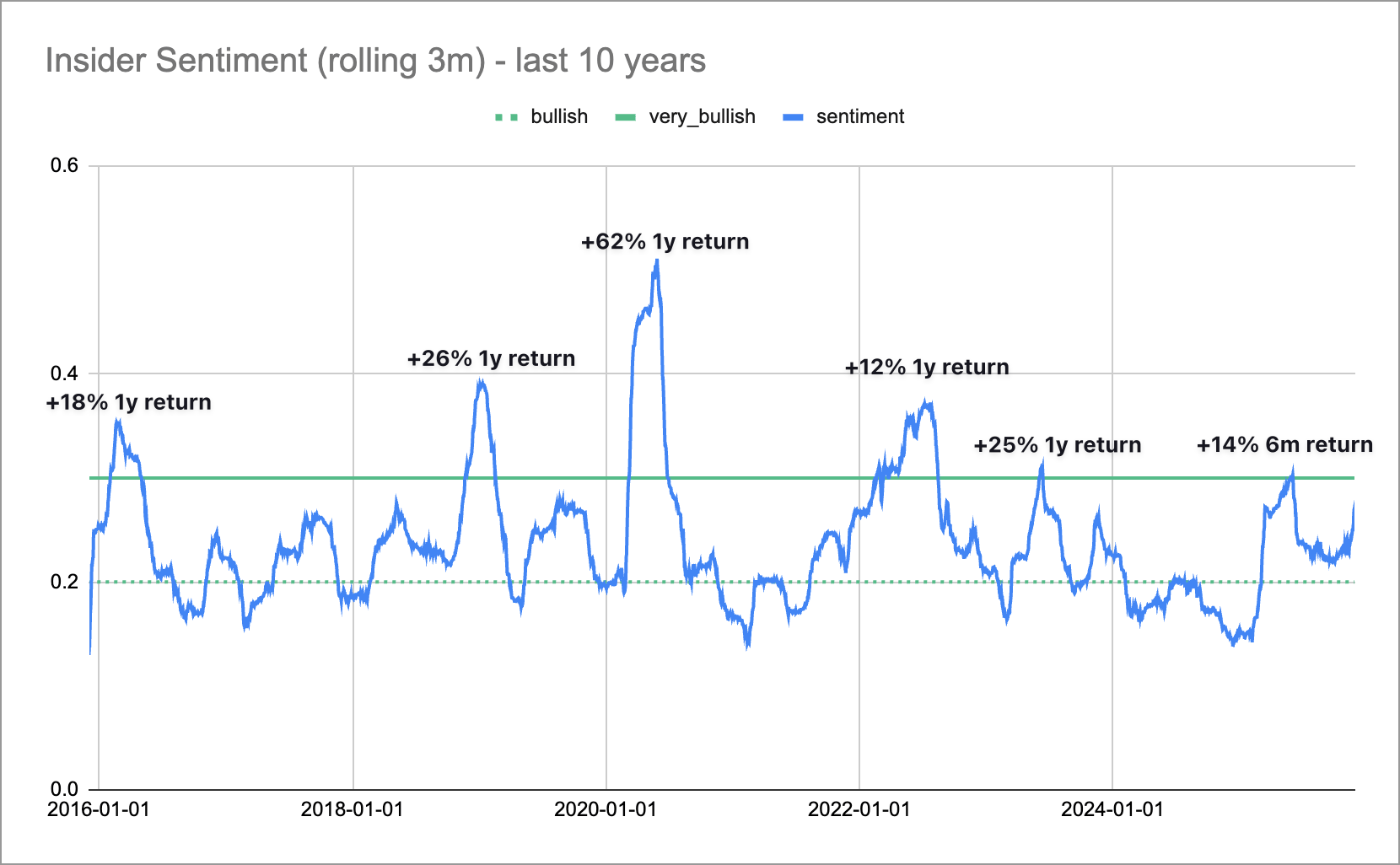

Below is my favorite sentiment chart. It shows the six times in the last ten years that our Insider Sentiment score spiked above 0.3 (the “very bullish” cutoff), and the S&P’s following one-year returns.

This chart reinforces the academic literature from Seyhun (link), Lakonishok & Lee (link), Malliouris, Vermorken & Vermorken (link), Guettler et al. (link), and others, which finds that insider trading activity correlates with the market’s returns.

Our specific Insider Sentiment score is based on the percent of companies with aggregated unscheduled insider buying over the last three months.

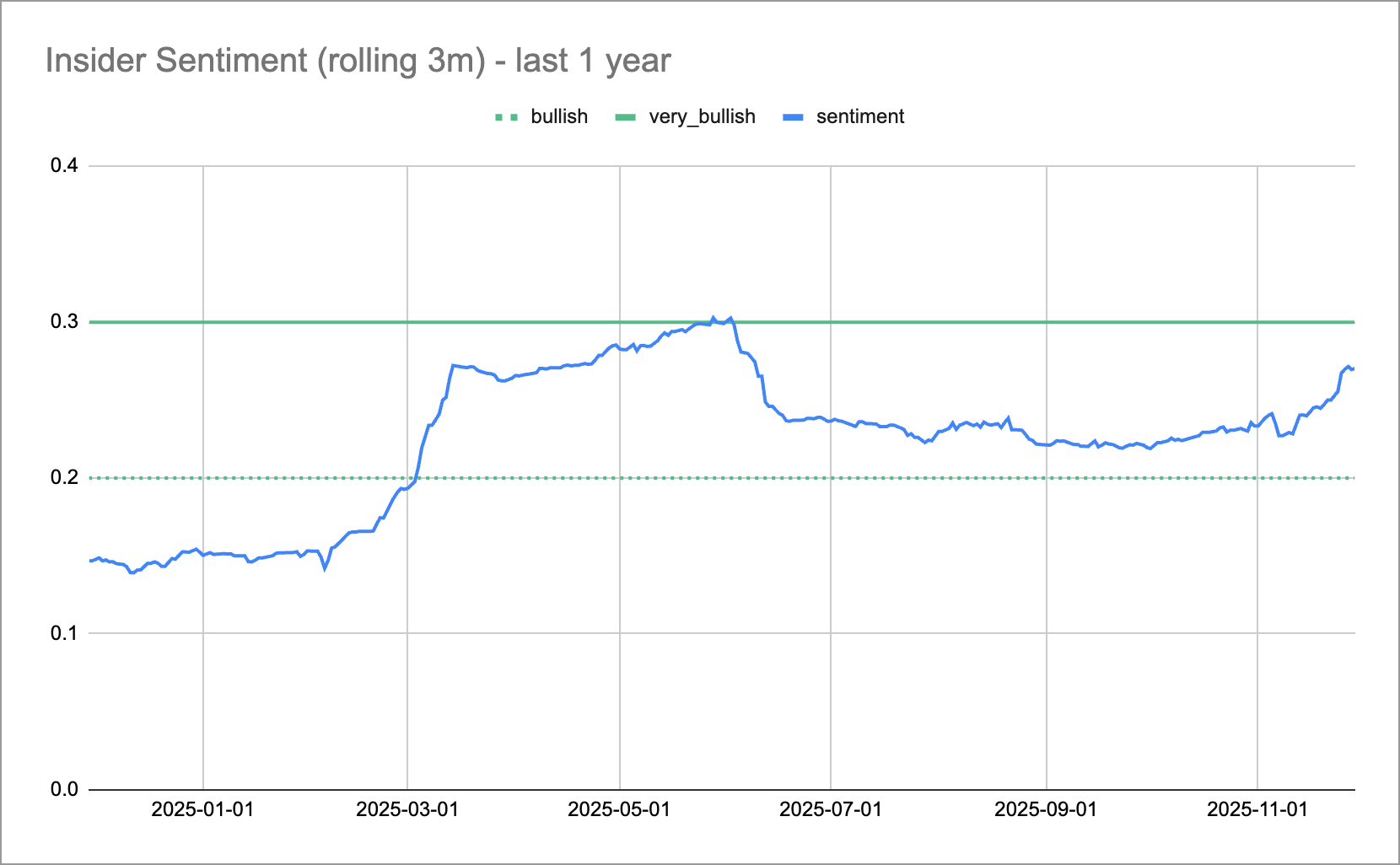

If we zoom in on the most recent year, we see that the insider sentiment has been bullish since mid-March, briefly got above the very bullish threshold in the beginning of June (and is up 14% since then), and has been creeping back up since October.

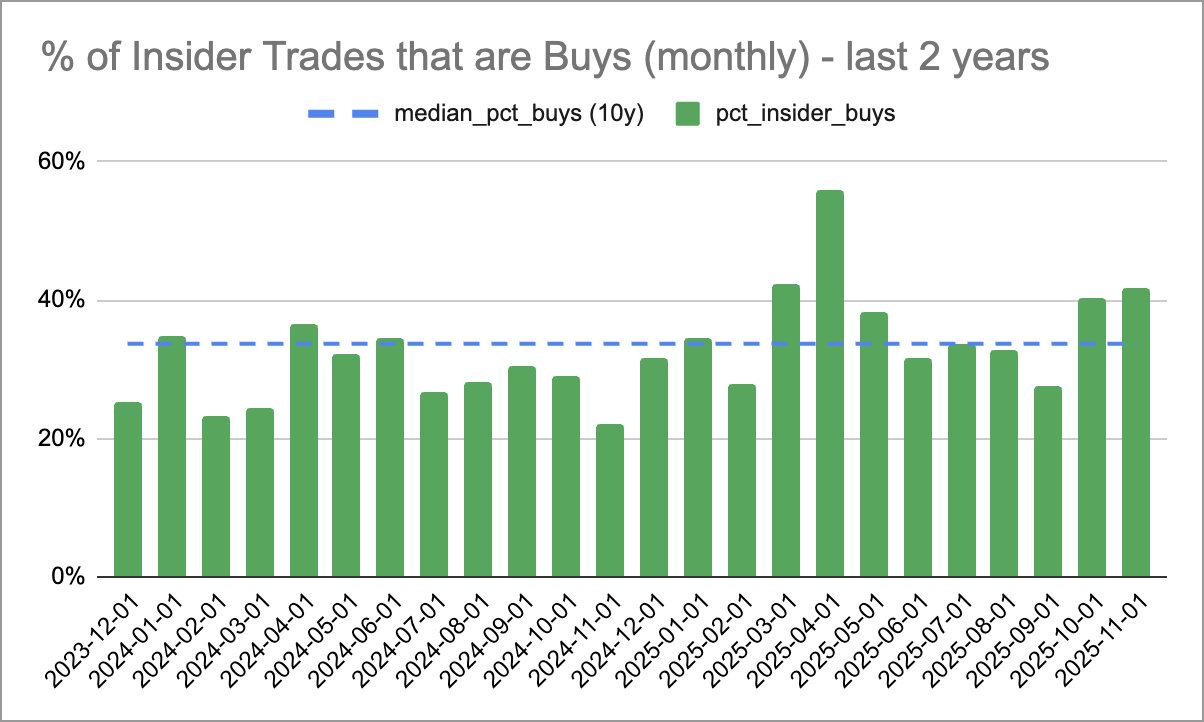

We can zoom in on our monthly insider buying charts and see that both October and November had significantly more insider buying than average (which would explain why the Insider Sentiment score is increasing).

We also know that the median S&P stock is in a ~16% drawdown (link), and we have seen a bunch of insider dip buying this quarter. We are only two months into Q4, but it’s already had the most insider dip buys of any quarter in the last two years (except for the Trump tariffs earlier this year).

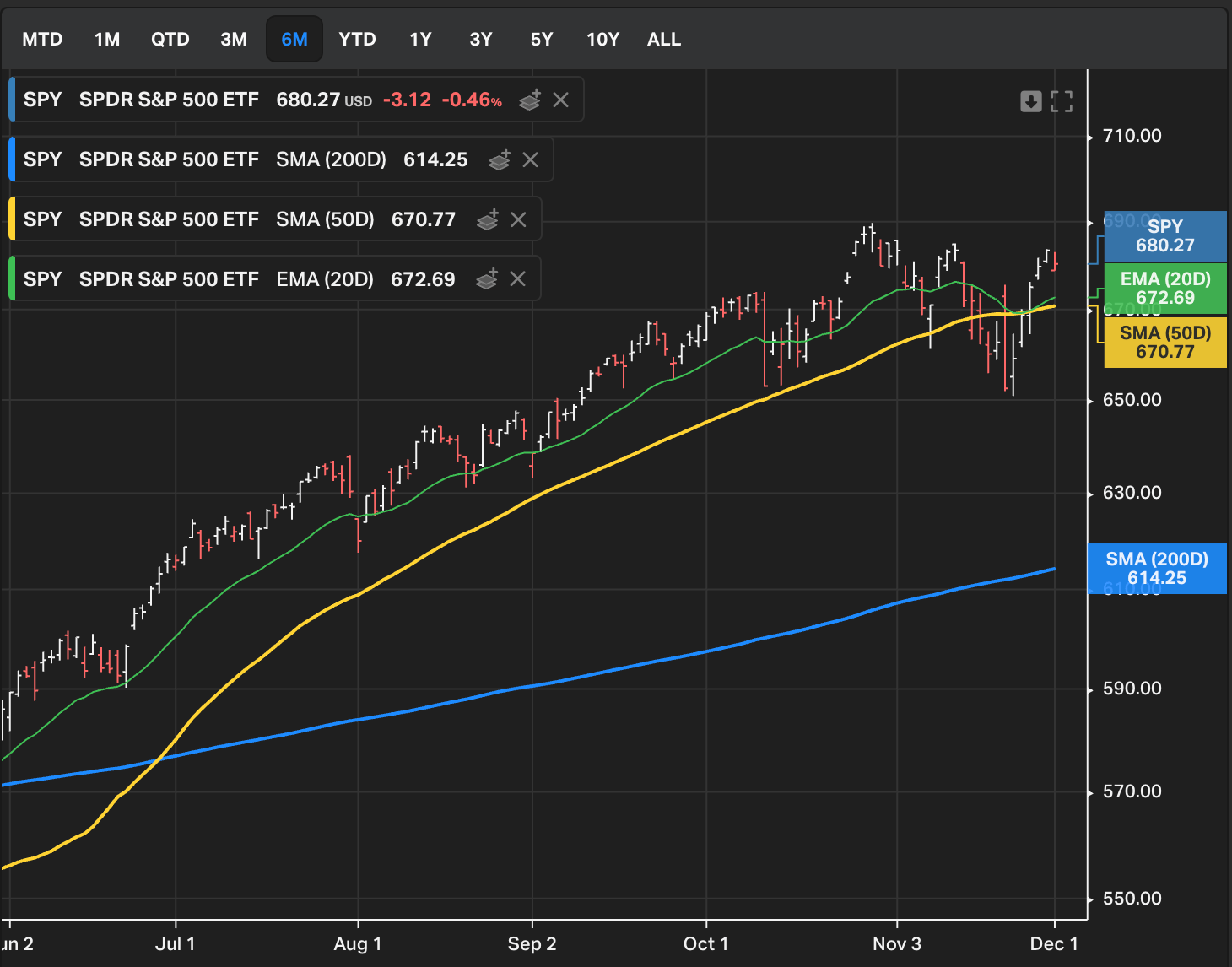

I’ve also seen some chart fans point out that the S&P putting in lower highs is a bearish signal.

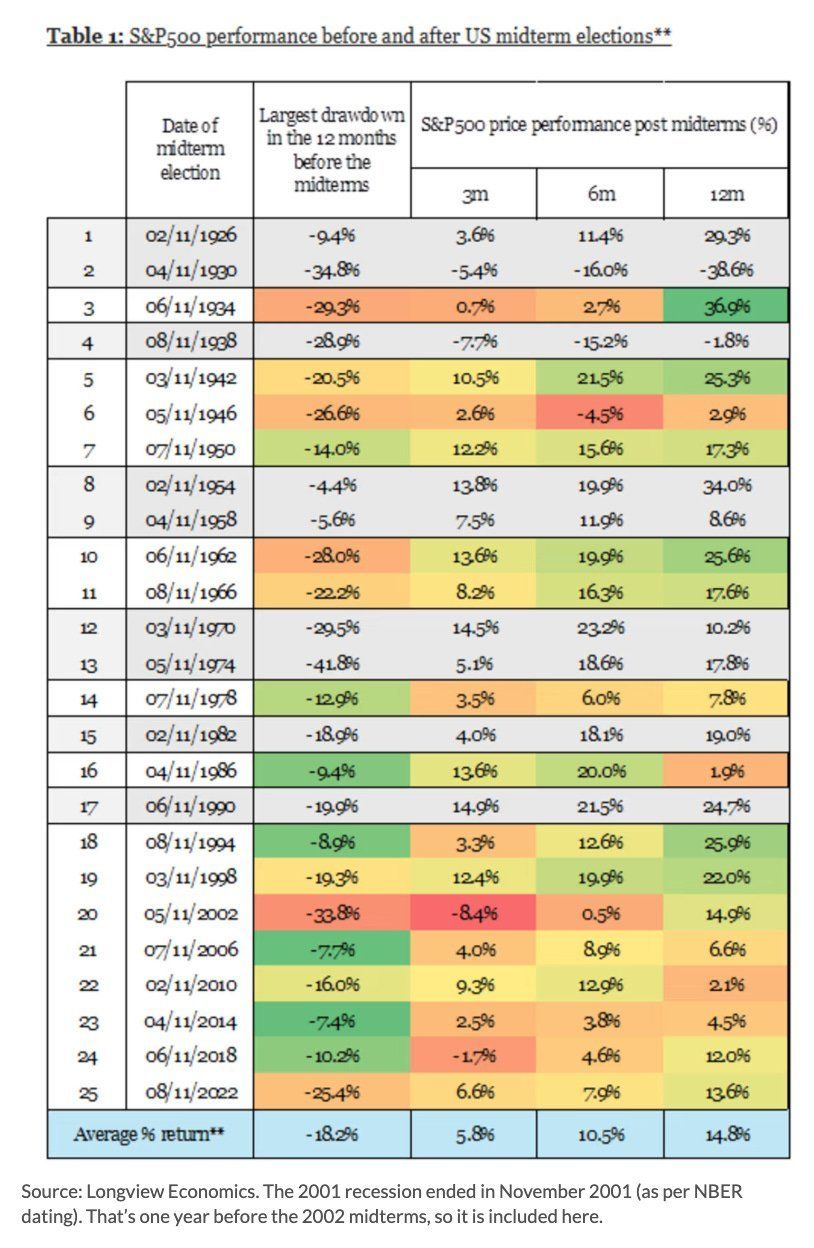

And others are pointing out that the S&P experiences an 18% drawdown on average at some point in the 12 months before midterms.

Obviously, the entire market is basically riding the AI train, and if that train loses steam, it’s going to hurt.

But for now, insiders seem pretty bullish. And I’m not one to argue with them.

keep scrolling. more data below

🔒 Trade Notes

I’ve done a pass on these potentially high-signal trades (mostly dip buys and/or insiders with a good track record). I look at the insider trade signal, stock price action, and company valuation. These are not recommendations, even though I’ll mention if I add them to the CEO Watcher Portfolio. (The most compelling trades are first)

This section is for premium subscribers only. Upgrade at ceowatcher.com to unlock all of the premium sections + full access to the CEO Watcher website + access to the CEO Watcher Discord.

🔒 Need More Research

I’ve done a quick pass on these to verify the trades are unscheduled, and the insiders have a good track record, but I haven’t had time to dive in deeper. They are worth a closer look.

This section is for premium subscribers only. Upgrade at ceowatcher.com to unlock all of the premium sections + full access to the CEO Watcher website + access to the CEO Watcher Discord.

🔒 Data Dump

All of the most important charts and tables, including sentiment charts, largest buys/sells tables, dip buys, and more.

This section is for premium subscribers only. Upgrade at ceowatcher.com to unlock all of the premium sections + full access to the CEO Watcher website + access to the CEO Watcher Discord.

Reply