- 📈👀 CEO Watcher

- Posts

- Top insider trades (Sep 4 - Sep 12)

Top insider trades (Sep 4 - Sep 12)

Welcome to this week’s edition of CEO Watcher.

This is the only tool that tracks the returns of insiders so we know which insider trades are worth copying.

This week we tracked 979 insider trades and found:

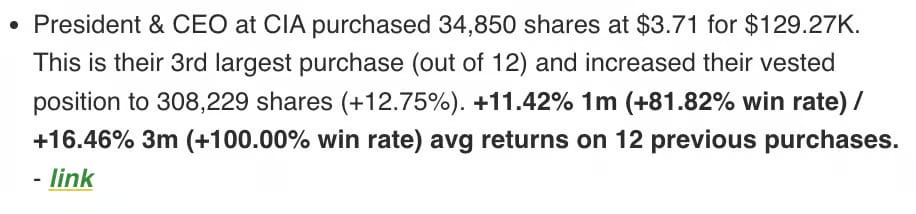

CIA is up 50% in 3 months after we found the CEO, who averages 16% 3m returns, buying $130k of the stock in the June 3rd email.

A Director at AudioEye (AEYE) with 296% 1y returns bought $316k of the stock

The CEO at GigaCloud Technologies (GCT) sold $2.85M in his first-ever unscheduled sale. In 2024, he made 21 scheduled sales when the stock was in the $30s, and it fell to $12.

The co-CEOs at Summit Therapeutics (SMMT) sell $6M of the stock each after its 25% dip in the last month

Saba Capital continues to buy ASA Gold (ASA)

A director at Broadcom (AVGO) bought $1M of the stock. It’s the first insider purchase at Broadcom since 2023

and more…

Have a great weekend and thanks for reading!

Connor

P.S. Make sure to follow @CEOStockWatcher on Twitter/X as I post more interesting insider trades there each day.

💰 Previous Winner

CIA is up 50% in 3 months after we found the CEO, who averages 16% 3m returns, buying $130k of the stock in the June 3rd email.

It opened at $3.62 and is up to $5.45 (+50%).

Get a free 30-day free trial of CEO Watcher Premium (no credit card required) at ceowatcher.com.

👀 Top Insider Trades this Week

🥇 Director at AudioEye, Inc. ($AEYE)

Director at AudioEye, Inc. ($AEYE) purchased 25,000 shares at $12.65/share ($316.29K total) which increased their vested holdings by +7.7%. Their median purchase size is $312.2K and this is their 2nd largest purchase out of 3 all time. This is the 2nd insider purchase at this company in the last 30 days. - link

Historic Returns

1m returns: 0.15% weighted | 50% win rate (1/2)

3m returns: -14% weighted | 0% win rate (0/2)

6m returns: 55% weighted | 50% win rate (1/2)

1y returns: 296% weighted | 100% win rate (2/2)

🥈 [SELL] Chief Executive Officer at GigaCloud Technology Inc. ($GCT)

Lei Wu (Chief Executive Officer) at GigaCloud Technology Inc. ($GCT) made a large, unusual sale. They just sold 100,000 shares at $28.52/share ($2.85M total) which decreased their vested holdings by -1.2%. The current price is $29.89 (+4.8%). Their median sale size is $2.18M and this is their 9th largest sale out of 22 all time. link

Historic Returns

1m returns: +9.8% weighted | 57% win rate (12/21)

3m returns: +28.6% weighted | 90% win rate (19/21)

6m returns: +31.7% weighted | 100% win rate (21/21)

1y returns: +58.6% weighted | 100% win rate (21/21)

Note: Selling the rip (stock was up 55.12% in the three months before the sale). This is the 3rd insider sale at this company in the last 30 days

🥉 KURA CEO buys another $400k

President & CEO at Kura Oncology, Inc. ($KURA) purchased 50,000 shares at $8.20/share ($410.14K total) which increased their vested holdings by +7.9%. This comes just one month after they bought $300K of the stock.

This is notable because they have an application review from the FDA coming on/before November 30th, which could be a huge catalyst assuming the outcome is good. These are the CEO’s only two purchases and the stock was down 60% in the previous year.

Get a free 30-day free trial of CEO Watcher Premium (no credit card required) at ceowatcher.com.

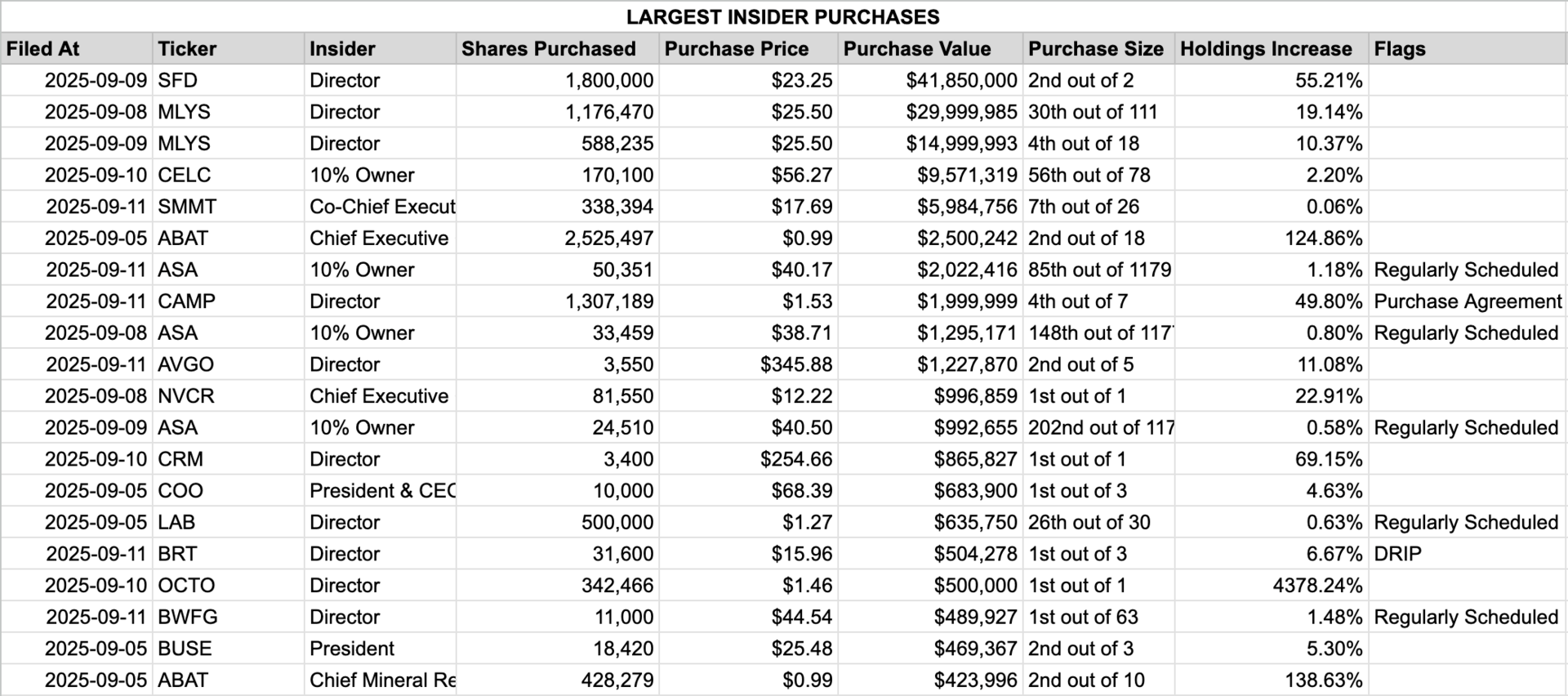

📈 Largest Insider Buys (last week)

Director at Smithfield Foods, Inc. (SFD) purchased 1,800,000 shares at $23.25 for $41.85M. This is their 2nd largest purchase (out of 2) and increased their vested position to 5,060,000 shares (+55.21%). -3.79% 1m (0.00% win rate) / +0.85% 3m (+100.00% win rate) avg returns on 2 previous purchases. 6 other insiders also purchased the stock (7 total purchases in last 30 days). - link

Director at Mineralys Therapeutics, Inc. (MLYS) purchased 1,176,470 shares at $25.5 for $30.0M. This is their 30th largest purchase (out of 111) and increased their vested position to 7,323,750 shares (+19.14%). -2.48% 1m (+37.21% win rate) / -7.18% 3m (+34.94% win rate) avg returns on 111 previous purchases. This is the 1st insider purchase at this company in the last 30 days. - link

Director at Mineralys Therapeutics, Inc. (MLYS) purchased 588,235 shares at $25.5 for $15.0M. This is their 4th largest purchase (out of 18) and increased their vested position to 6,263,151 shares (+10.37%). +4.75% 1m (+28.57% win rate) / +16.04% 3m (+35.71% win rate) avg returns on 18 previous purchases. This is the 2nd insider purchase at this company in the last 30 days. - link

10% Owner at Celcuity Inc. (CELC) purchased 170,100 shares at $56.27 for $9.57M. This is their 56th largest purchase (out of 78) and increased their vested position to 7,915,792 shares (+2.20%). -3.06% 1m (+63.33% win rate) / +13.80% 3m (+62.07% win rate) avg returns on 78 previous purchases. This is the 1st insider purchase at this company in the last 30 days. - link

Co-Chief Executive Officer at Summit Therapeutics Inc. (SMMT) purchased 338,394 shares at $17.69 for $5.98M. This is their 7th largest purchase (out of 26) and increased their vested position to 591,831,532 shares (+0.06%). +1.31% 1m (+36.36% win rate) / +9.44% 3m (+72.73% win rate) avg returns on 26 previous purchases. Buying the dip (stock was down -21.85% in the week before the purchase). This is the 1st insider purchase at this company in the last 30 days. - link

Chief Executive Officer at American Battery Technology Company (ABAT) purchased 2,525,497 shares at $0.99 for $2.5M. This is their 2nd largest purchase (out of 18) and increased their vested position to 4,548,135 shares (+124.86%). -1.29% 1m (+25.00% win rate) / -18.66% 3m (+25.00% win rate) avg returns on 18 previous purchases. 1 other insider also purchased the stock (2 total purchases in last 30 days). - link

10% Owner at ASA Gold and Precious Metals Limited (ASA) purchased 50,351 shares at $40.17 for $2.02M. This is their 85th largest purchase (out of 1179) and increased their vested position to 4,310,895 shares (+1.18%). +0.18% 1m (+70.16% win rate) / +1.88% 3m (+75.18% win rate) avg returns on 1179 previous purchases. This appears to be a regularly scheduled weekly transaction. This is the 11th insider purchase at this company in the last 30 days. - link

Director at Camp4 Therapeutics Corporation (CAMP) purchased 1,307,189 shares at $1.53 for $2.0M. This is their 4th largest purchase (out of 7) and increased their vested position to 3,932,251 shares (+49.80%). -20.65% 1m (0.00% win rate) / -44.26% 3m (0.00% win rate) avg returns on 7 previous purchases. Is part of a purchase agreement. Is part of a private placement. 4 other insiders also purchased the stock (5 total purchases in last 30 days). - link

10% Owner at ASA Gold and Precious Metals Limited (ASA) purchased 33,459 shares at $38.71 for $1.3M. This is their 148th largest purchase (out of 1177) and increased their vested position to 4,236,034 shares (+0.80%). +0.18% 1m (+70.16% win rate) / +1.88% 3m (+75.18% win rate) avg returns on 1177 previous purchases. This appears to be a regularly scheduled weekly transaction. This is the 9th insider purchase at this company in the last 30 days. - link

Director at Broadcom Inc. (AVGO) purchased 3,550 shares at $345.88 for $1.23M. This is their 2nd largest purchase (out of 5) and increased their vested position to 35,602 shares (+11.08%). -6.34% 1m (+33.33% win rate) / -7.45% 3m (+33.33% win rate) avg returns on 5 previous purchases. This is the 1st insider purchase at this company in the last 30 days. - link

Chief Executive Officer at NovoCure Limited (NVCR) purchased 81,550 shares at $12.22 for $996.86K. This is their 1st largest purchase (out of 1) and increased their vested position to 437,569 shares (+22.91%). No returns available. This is the 1st insider purchase at this company in the last 30 days. - link

10% Owner at ASA Gold and Precious Metals Limited (ASA) purchased 24,510 shares at $40.5 for $992.65K. This is their 202nd largest purchase (out of 1178) and increased their vested position to 4,260,544 shares (+0.58%). +0.18% 1m (+70.16% win rate) / +1.88% 3m (+75.18% win rate) avg returns on 1178 previous purchases. This appears to be a regularly scheduled weekly transaction. This is the 10th insider purchase at this company in the last 30 days. - link

Director at Salesforce, Inc. (CRM) purchased 3,400 shares at $254.66 for $865.83K. This is their 1st largest purchase (out of 1) and increased their vested position to 8,317 shares (+69.15%). No returns available. This is the 1st insider purchase at this company in the last 30 days. - link

President & CEO at The Cooper Companies, Inc. (COO) purchased 10,000 shares at $68.39 for $683.9K. This is their 1st largest purchase (out of 3) and increased their vested position to 226,151 shares (+4.63%). +1.05% 1m (+50.00% win rate) / +1.98% 3m (+50.00% win rate) avg returns on 3 previous purchases. This is the 4th insider purchase at this company in the last 30 days (and there was 1 other purchase on the same day). - link

Director at Standard BioTools Inc. (LAB) purchased 500,000 shares at $1.27 for $635.75K. This is their 26th largest purchase (out of 30) and increased their vested position to 80,359,918 shares (+0.63%). +9.37% 1m (+56.00% win rate) / -1.82% 3m (+36.00% win rate) avg returns on 30 previous purchases. This appears to be a regularly scheduled yearly transaction. This is the 3rd insider purchase at this company in the last 30 days. - link

Director at BRT Apartments Corp. (BRT) purchased 31,600 shares at $15.96 for $504.28K. This is their 1st largest purchase (out of 3) and increased their vested position to 505,014 shares (+6.67%). +0.98% 1m (+50.00% win rate) / +11.55% 3m (+100.00% win rate) avg returns on 3 previous purchases. Is part of a dividend reinvestment. This is the 4th insider purchase at this company in the last 30 days. - link

Director at Eightco Holdings Inc. (OCTO) purchased 342,466 shares at $1.46 for $500.0K. This is their 1st largest purchase (out of 1) and increased their vested position to 350,288 shares (+4378.24%). No returns available. 1 other insider also purchased the stock (2 total purchases in last 30 days). - link

Director at Bankwell Financial Group, Inc. (BWFG) purchased 11,000 shares at $44.54 for $489.93K. This is their 1st largest purchase (out of 63) and increased their vested position to 756,555 shares (+1.48%). +3.14% 1m (+50.82% win rate) / +9.63% 3m (+65.57% win rate) avg returns on 63 previous purchases. This appears to be a regularly scheduled yearly transaction. This is the 6th insider purchase at this company in the last 30 days. - link

President at First Busey Corporation (BUSE) purchased 18,420 shares at $25.48 for $469.37K. This is their 2nd largest purchase (out of 3) and increased their vested position to 366,137 shares (+5.30%). +0.14% 1m (+100.00% win rate) / +0.10% 3m (+100.00% win rate) avg returns on 3 previous purchases. This is the 3rd insider purchase at this company in the last 30 days. - link

Chief Mineral Resource Officer at American Battery Technology Company (ABAT) purchased 428,279 shares at $0.99 for $424.0K. This is their 2nd largest purchase (out of 10) and increased their vested position to 737,222 shares (+138.63%). +2.15% 1m (+11.11% win rate) / -17.51% 3m (+33.33% win rate) avg returns on 10 previous purchases. 1 other insider also purchased the stock (2 total purchases in last 30 days). - link

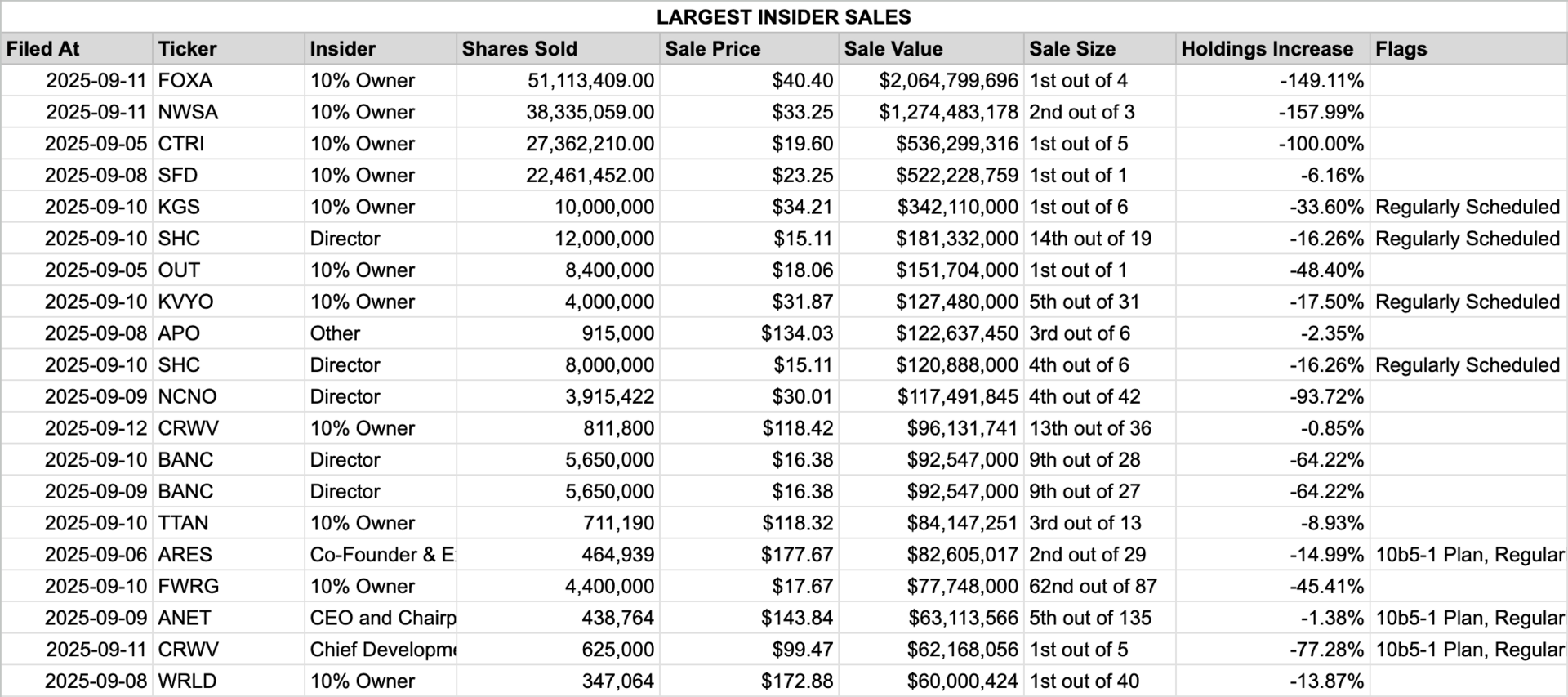

📉 Largest Insider Sells (last week)

10% Owner at Fox Corporation (FOXA) sold 51,113,409 shares at $40.4 for $2.06B. This is their 1st largest sale (out of 4) and decreased their vested position to -16,835,016 shares (-149.11%). No returns available. Selling the rip (stock was up 50.47% in the year before the sale). 1 other insider also sold the stock (2 total sales in last 30 days). - link

10% Owner at News Corporation (NWSA) sold 38,335,059 shares at $33.25 for $1.27B. This is their 2nd largest sale (out of 3) and decreased their vested position to -14,071,293 shares (-157.99%). No returns available. This is the 5th insider sale at this company in the last 30 days (and there was 1 other sale on the same day). - link

10% Owner at Centuri Holdings, Inc. (CTRI) sold 27,362,210 shares at $19.6 for $536.3M. This is their 1st largest sale (out of 5) and decreased their vested position to 0 shares (-100.00%). No returns available. This is the 1st insider sale at this company in the last 30 days. - link

10% Owner at Smithfield Foods, Inc. (SFD) sold 22,461,452 shares at $23.25 for $522.23M. This is their 1st largest sale (out of 1) and decreased their vested position to 342,036,069 shares (-6.16%). No returns available. This is the 1st insider sale at this company in the last 30 days. - link

10% Owner at Kodiak Gas Services, Inc. (KGS) sold 10,000,000 shares at $34.21 for $342.11M. This is their 1st largest sale (out of 6) and decreased their vested position to 19,762,573 shares (-33.60%). No returns available. This appears to be a regularly scheduled yearly transaction. This is the 1st insider sale at this company in the last 30 days. - link

Director at Sotera Health Company (SHC) sold 12,000,000 shares at $15.11 for $181.33M. This is their 14th largest sale (out of 19) and decreased their vested position to 61,822,952 shares (-16.26%). +0.93% 1m (+38.46% win rate) / -1.72% 3m (+61.54% win rate) avg returns on 19 previous sales. This appears to be a regularly scheduled yearly transaction. This is the 3rd insider sale at this company in the last 30 days (and there was 1 other sale on the same day). - link

10% Owner at OUTFRONT Media Inc. (OUT) sold 8,400,000 shares at $18.06 for $151.7M. This is their 1st largest sale (out of 1) and decreased their vested position to 8,955,012 shares (-48.40%). No returns available. This is the 2nd insider sale at this company in the last 30 days. - link

10% Owner at Klaviyo, Inc. (KVYO) sold 4,000,000 shares at $31.87 for $127.48M. This is their 5th largest sale (out of 31) and decreased their vested position to 18,852,778 shares (-17.50%). +1.84% 1m (+40.00% win rate) / +1.29% 3m (+32.00% win rate) avg returns on 31 previous sales. This appears to be a regularly scheduled yearly transaction. This is the 9th insider sale at this company in the last 30 days. - link

Other at Apollo Global Management, Inc. (APO) sold 915,000 shares at $134.03 for $122.64M. This is their 3rd largest sale (out of 6) and decreased their vested position to 38,081,048 shares (-2.35%). +0.28% 1m (+60.00% win rate) / +2.22% 3m (+40.00% win rate) avg returns on 6 previous sales. This is the 2nd insider sale at this company in the last 30 days. - link

Director at Sotera Health Company (SHC) sold 8,000,000 shares at $15.11 for $120.89M. This is their 4th largest sale (out of 6) and decreased their vested position to 41,215,301 shares (-16.26%). +7.36% 1m (+75.00% win rate) / +6.87% 3m (+75.00% win rate) avg returns on 6 previous sales. This appears to be a regularly scheduled yearly transaction. This is the 3rd insider sale at this company in the last 30 days (and there was 1 other sale on the same day). - link

Director at nCino, Inc. (NCNO) sold 3,915,422 shares at $30.01 for $117.49M. This is their 4th largest sale (out of 42) and decreased their vested position to 262,515 shares (-93.72%). +0.48% 1m (+45.00% win rate) / +2.63% 3m (+55.00% win rate) avg returns on 42 previous sales. This is the 3rd insider sale at this company in the last 30 days (and there was 1 other sale on the same day). - link

10% Owner at CoreWeave, Inc. (CRWV) sold 811,800 shares at $118.42 for $96.13M. This is their 13th largest sale (out of 36) and decreased their vested position to 94,165,771 shares (-0.85%). +2.57% 1m (+47.06% win rate) / -1.24% 3m (+70.59% win rate) avg returns on 36 previous sales. Selling the rip (stock was up 26.49% in the week before the sale). This is the 22nd insider sale at this company in the last 30 days (and there were 2 other sales on the same day). - link

Director at Banc of California, Inc. (BANC) sold 5,650,000 shares at $16.38 for $92.55M. This is their 9th largest sale (out of 28) and decreased their vested position to 3,147,470 shares (-64.22%). +5.07% 1m (+57.89% win rate) / +0.35% 3m (+57.89% win rate) avg returns on 28 previous sales. This is the 3rd insider sale at this company in the last 30 days. - link

Director at Banc of California, Inc. (BANC) sold 5,650,000 shares at $16.38 for $92.55M. This is their 9th largest sale (out of 27) and decreased their vested position to 3,147,470 shares (-64.22%). +5.07% 1m (+57.89% win rate) / +0.35% 3m (+57.89% win rate) avg returns on 27 previous sales. This is the 2nd insider sale at this company in the last 30 days. - link

10% Owner at ServiceTitan, Inc. (TTAN) sold 711,190 shares at $118.32 for $84.15M. This is their 3rd largest sale (out of 13) and decreased their vested position to 7,255,144 shares (-8.93%). +1.02% 1m (+54.55% win rate) / +12.01% 3m (+60.00% win rate) avg returns on 13 previous sales. This is the 5th insider sale at this company in the last 30 days (and there was 1 other sale on the same day). - link

Co-Founder & Exec. Chairman at Ares Management Corporation (ARES) sold 464,939 shares at $177.67 for $82.61M. This is their 2nd largest sale (out of 29) and decreased their vested position to 2,636,203 shares (-14.99%). -0.63% 1m (+33.33% win rate) / -1.77% 3m (+20.83% win rate) avg returns on 29 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled weekly transaction. This is the 8th insider sale at this company in the last 30 days. - link

10% Owner at First Watch Restaurant Group, Inc. (FWRG) sold 4,400,000 shares at $17.67 for $77.75M. This is their 62nd largest sale (out of 87) and decreased their vested position to 5,289,784 shares (-45.41%). -4.82% 1m (+24.71% win rate) / -8.06% 3m (+25.00% win rate) avg returns on 87 previous sales. This is the 3rd insider sale at this company in the last 30 days. - link

CEO and Chairperson at Arista Networks Inc (ANET) sold 438,764 shares at $143.84 for $63.11M. This is their 5th largest sale (out of 135) and decreased their vested position to 31,387,577 shares (-1.38%). -4.26% 1m (+39.69% win rate) / -3.65% 3m (+27.87% win rate) avg returns on 135 previous sales. Is part of a 10b5-1 plan. This appears to be a regularly scheduled yearly transaction. Selling the rip (stock was up 46.60% in the three months before the sale). This is the 3rd insider sale at this company in the last 30 days. - link

Chief Development Officer at CoreWeave, Inc. (CRWV) sold 625,000 shares at $99.47 for $62.17M. This is their 1st largest sale (out of 5) and decreased their vested position to 183,765 shares (-77.28%). No returns available. Is part of a 10b5-1 plan. This appears to be a regularly scheduled weekly transaction. Selling the rip (stock was up 28.82% in the week before the sale). This is the 19th insider sale at this company in the last 30 days. - link

10% Owner at World Acceptance Corporation (WRLD) sold 347,064 shares at $172.88 for $60.0M. This is their 1st largest sale (out of 40) and decreased their vested position to 2,155,098 shares (-13.87%). +6.17% 1m (+74.36% win rate) / +12.51% 3m (+64.10% win rate) avg returns on 40 previous sales. This is the 1st insider sale at this company in the last 30 days. - link

Get the insider trades as soon as they happen

By upgrading to CEO Watcher Premium, you get the top insider trades as soon as they happen and full access to the ceowatcher.com website (including the custom feeds of highest-signal insider trades).

Each morning you get an email with the top insider buys/sells (ranked by the proprietary CEO Watcher ranking system), largest insider buys/sells, largest holdings increases/decreases, and the companies with the most insider buying/selling sent before the market opens each morning.

How was today's email? |

Reply