- 📈👀 CEO Watcher

- Posts

- Top insider trades (Sep 29 - Oct 3)

Top insider trades (Sep 29 - Oct 3)

Welcome to this week’s edition of CEO Watcher.

This is the only tool that tracks the returns of insiders so we know which insider trades are worth copying.

We closed out September with one of our best months of CEO Watcher ever. We shared 16 Top Buys in the CEO Watcher Premium Daily emails and they were up an average of 17% v just 2.5% for the S&P (including a couple of stocks up over 70%).

This week we found 587 insider trades and found:

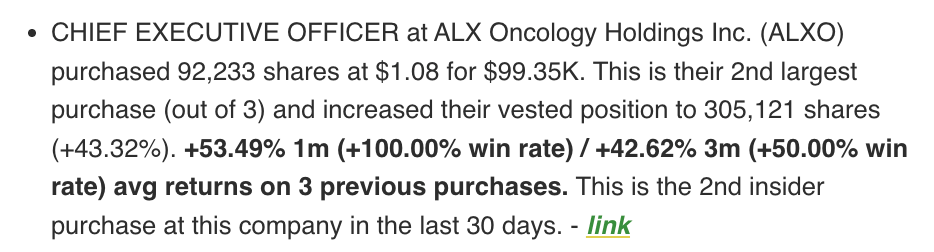

ALXO is up over 70% in just two weeks

5 insiders at The Cooper Companies (COO) are buying the dip

The President and CEO at Concentrix Corporation ($CNXC), who averages 25% 3m returns, is buying the earnings dip

and more…

Have a great weekend and thanks for reading!

Connor

P.S. Make sure to follow @CEOStockWatcher on Twitter/X as I post more interesting insider trades there each day.

💰 Previous Winner

The Top Insider Buy that we shared in the Friday, September 19th Premium email has continued its strong run and is now up over 70% in just two weeks.

It opened at $1.23 and is up to $2.13 (+73%).

Get a free 30-day free trial of CEO Watcher Premium (no credit card required) at ceowatcher.com.

👀 Top Insider Trades this Week

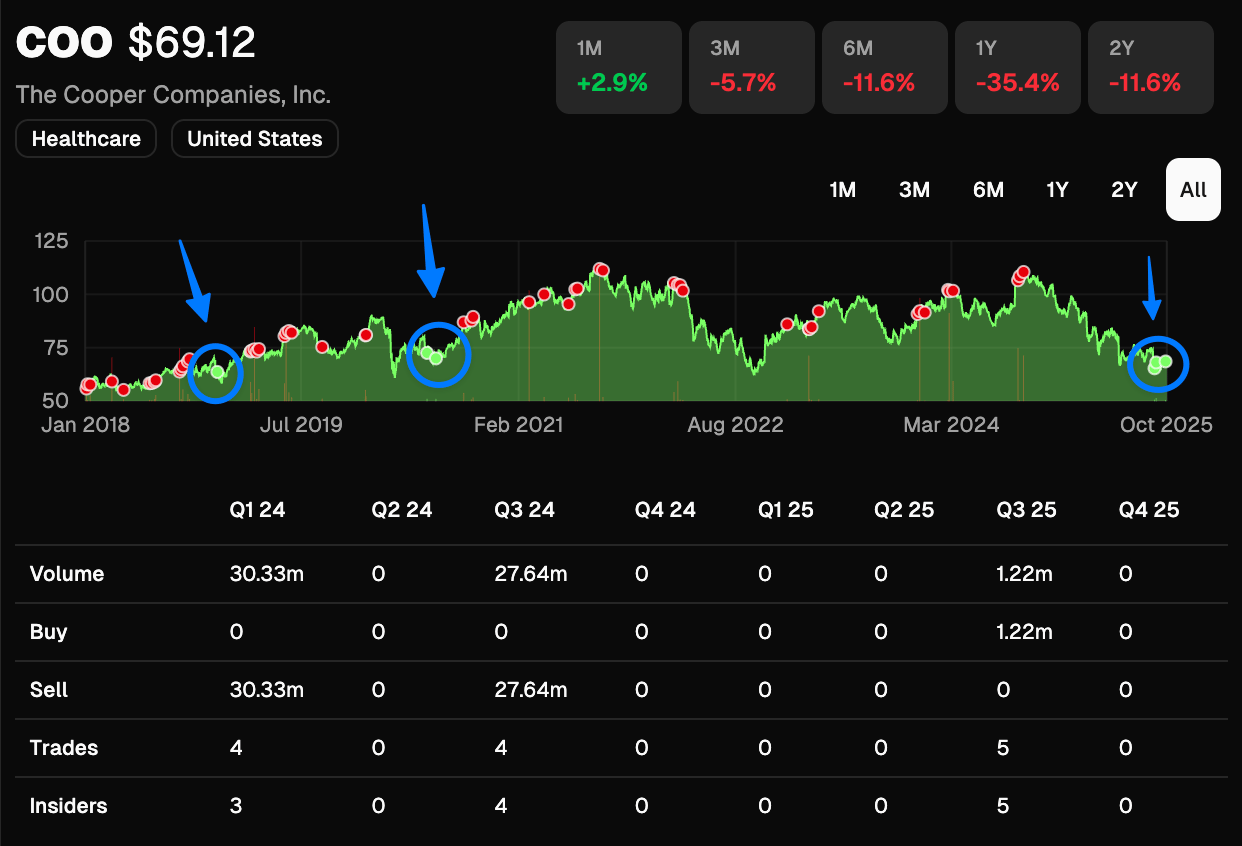

🥇 5 insiders buy The Cooper Companies ($COO)

The Cooper Companies (COO) is down 20% in the last 6 months and 40% in the last year, but it looks like insiders are calling the bottom.

As you can see from the image below, insiders at COO have historically nailed the timing of their purchases. The stock is down due to tariff impacts and lower organic growth than expected, but they recently doubled their stock buybacks and are trading at a very low EV/EBITDA multiple.

🥈 Chairman & CEO at United States Antimony Corporation ($UAMY)

Chairman & CEO at United States Antimony Corporation ($UAMY) purchased 100,000 shares at $6.13/share ($613.2K total) which increased their vested holdings by +4.4%. Their median purchase size is $136.74K and this is their 1st largest purchase out of 10 all time. - link

The stock is on a tear (up over 800% in the last year), but they run the only two antimony smelters in North America and have been continuously signing contracts with the Defense Department (including two in the last week). They expect revenue to double next year and expect more contracts from the government to come in.

This is a pure momentum play, but everything looks to be pointing in the right direction.

🥉 President and CEO at Concentrix Corporation ($CNXC)

President and CEO at Concentrix Corporation ($CNXC) purchased 1,000 shares at $47.44/share ($47.44K total) which increased their vested holdings by +0.3%. The current price is $48.26 (+1.7%). Their median purchase size is $47.52K and this is their 2nd largest purchase out of 3 all time. - link

Historic Returns

1m returns: +16.4% weighted | 100% win rate (2/2)

3m returns: +24.8% weighted | 100% win rate (2/2)

6m returns: -17.5% weighted | 0% win rate (0/1)

1y returns: -8.25% weighted | 0% win rate (0/1)

The CEO is buying the earnings dip.

Get a free 30-day free trial of CEO Watcher Premium (no credit card required) at ceowatcher.com.

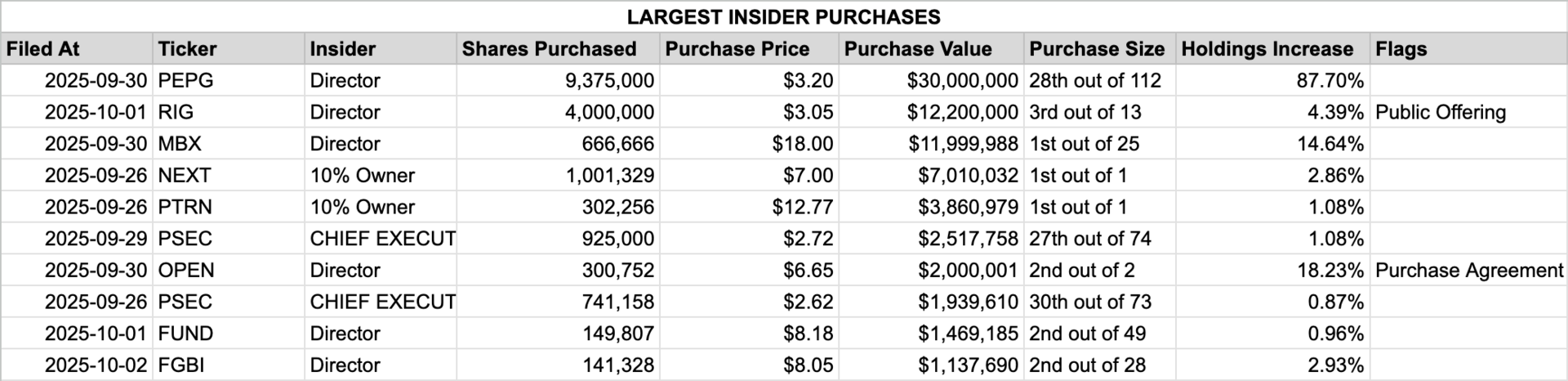

📈 Largest Insider Buys (last week)

Director at PepGen Inc. (PEPG) purchased 9,375,000 shares at $3.2 for $30.0M. This is their 28th largest purchase (out of 112) and increased their vested position to 20,064,545 shares (+87.70%). -2.44% 1m (+37.21% win rate) / -1.84% 3m (+37.21% win rate) avg returns on 112 previous purchases. This is the 1st insider purchase at this company in the last 30 days. - link

Director at Transocean Ltd. (RIG) purchased 4,000,000 shares at $3.05 for $12.2M. This is their 3rd largest purchase (out of 13) and increased their vested position to 95,074,894 shares (+4.39%). -10.12% 1m (+27.27% win rate) / -7.56% 3m (+18.18% win rate) avg returns on 13 previous purchases. Is part of a public offering. This is the 1st insider purchase at this company in the last 30 days. - link

Director at MBX Biosciences, Inc. (MBX) purchased 666,666 shares at $18.0 for $12.0M. This is their 1st largest purchase (out of 25) and increased their vested position to 5,219,440 shares (+14.64%). -3.59% 1m (+36.36% win rate) / +10.28% 3m (+81.82% win rate) avg returns on 25 previous purchases. This is the 1st insider purchase at this company in the last 30 days. - link

10% Owner at NextDecade Corporation (NEXT) purchased 1,001,329 shares at $7.0 for $7.01M. This is their 1st largest purchase (out of 1) and increased their vested position to 36,074,066 shares (+2.86%). No returns available. Buying the dip (stock was down -31.98% in the month before the purchase). This is the 6th insider purchase at this company in the last 30 days. - link

10% Owner at Pattern Group Inc. (PTRN) purchased 302,256 shares at $12.77 for $3.86M. This is their 1st largest purchase (out of 1) and increased their vested position to 28,176,542 shares (+1.08%). No returns available. This is the 1st insider purchase at this company in the last 30 days. - link

CHIEF EXECUTIVE OFFICER at Prospect Capital Corporation (PSEC) purchased 925,000 shares at $2.72 for $2.52M. This is their 27th largest purchase (out of 74) and increased their vested position to 86,439,521 shares (+1.08%). -6.73% 1m (+40.00% win rate) / +7.82% 3m (+60.00% win rate) avg returns on 74 previous purchases. This is the 6th insider purchase at this company in the last 30 days (and there was 1 other purchase on the same day). - link

Director at Opendoor Technologies Inc. (OPEN) purchased 300,752 shares at $6.65 for $2.0M. This is their 2nd largest purchase (out of 2) and increased their vested position to 1,950,636 shares (+18.23%). No returns available. Is part of a purchase agreement. This is the 2nd insider purchase at this company in the last 30 days. - link

CHIEF EXECUTIVE OFFICER at Prospect Capital Corporation (PSEC) purchased 741,158 shares at $2.62 for $1.94M. This is their 30th largest purchase (out of 73) and increased their vested position to 85,514,521 shares (+0.87%). -6.73% 1m (+40.00% win rate) / +7.82% 3m (+60.00% win rate) avg returns on 73 previous purchases. This is the 4th insider purchase at this company in the last 30 days. - link

Director at Sprott Focus Trust, Inc. (FUND) purchased 149,807 shares at $8.18 for $1.47M. This is their 2nd largest purchase (out of 49) and increased their vested position to 15,820,479 shares (+0.96%). -0.10% 1m (+38.89% win rate) / +2.62% 3m (+54.29% win rate) avg returns on 49 previous purchases. This is the 1st insider purchase at this company in the last 30 days. - link

Director at First Guaranty Bancshares, Inc. (FGBI) purchased 141,328 shares at $8.05 for $1.14M. This is their 2nd largest purchase (out of 28) and increased their vested position to 4,961,005 shares (+2.93%). -2.81% 1m (+42.86% win rate) / -0.78% 3m (+75.00% win rate) avg returns on 28 previous purchases. This is the 4th insider purchase at this company in the last 30 days (and there were 2 other purchases on the same day). - link

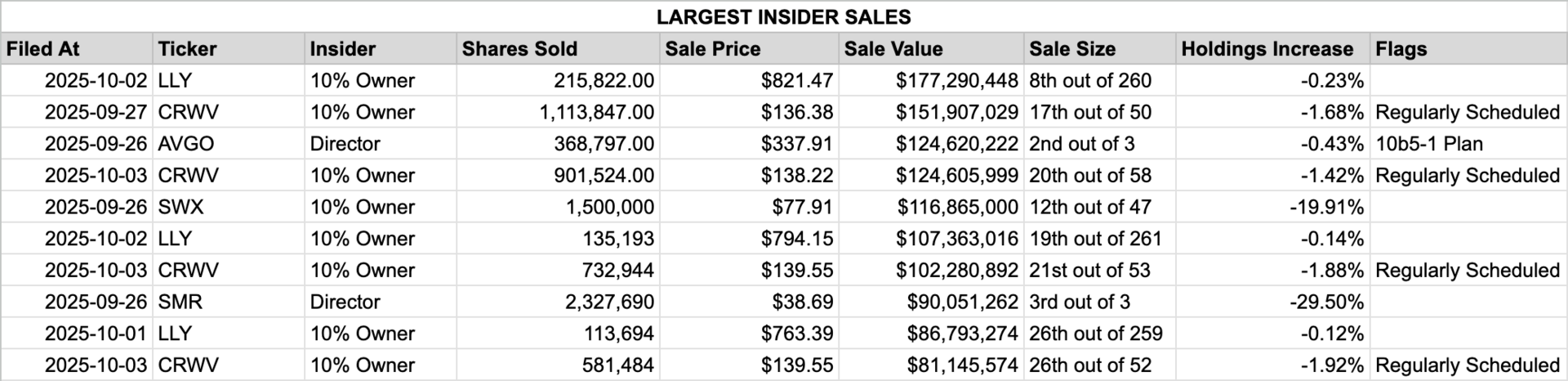

📉 Largest Insider Sells (last week)

10% Owner at Eli Lilly and Company (LLY) sold 215,822 shares at $821.47 for $177.29M. This is their 8th largest sale (out of 260) and decreased their vested position to 95,141,978 shares (-0.23%). -2.06% 1m (+34.65% win rate) / -5.28% 3m (+22.53% win rate) avg returns on 260 previous sales. This is the 5th insider sale at this company in the last 30 days (and there was 1 other sale on the same day). - link

10% Owner at CoreWeave, Inc. (CRWV) sold 1,113,847 shares at $136.38 for $151.91M. This is their 17th largest sale (out of 50) and decreased their vested position to 65,072,765 shares (-1.68%). -4.89% 1m (+38.10% win rate) / -0.28% 3m (+70.59% win rate) avg returns on 50 previous sales. This appears to be a regularly scheduled weekly transaction. Selling the rip (stock was up 24.15% in the month before the sale). This is the 30th insider sale at this company in the last 30 days (and there were 2 other sales on the same day). - link

Director at Broadcom Inc. (AVGO) sold 368,797 shares at $337.91 for $124.62M. This is their 2nd largest sale (out of 3) and decreased their vested position to 85,948,818 shares (-0.43%). -7.57% 1m (0.00% win rate) / -29.55% 3m (0.00% win rate) avg returns on 3 previous sales. Is part of a 10b5-1 plan. Selling the rip (stock was up 89.69% in the year before the sale). This is the 7th insider sale at this company in the last 30 days. - link

10% Owner at CoreWeave, Inc. (CRWV) sold 901,524 shares at $138.22 for $124.61M. This is their 20th largest sale (out of 58) and decreased their vested position to 62,713,328 shares (-1.42%). -4.89% 1m (+38.10% win rate) / -0.28% 3m (+70.59% win rate) avg returns on 58 previous sales. This appears to be a regularly scheduled weekly transaction. Selling the rip (stock was up 53.54% in the month before the sale). This is the 39th insider sale at this company in the last 30 days (and there were 5 other sales on the same day). - link

10% Owner at Southwest Gas Holdings, Inc. (SWX) sold 1,500,000 shares at $77.91 for $116.86M. This is their 12th largest sale (out of 47) and decreased their vested position to 6,032,604 shares (-19.91%). +1.76% 1m (+71.11% win rate) / -2.07% 3m (+60.00% win rate) avg returns on 47 previous sales. This is the 1st insider sale at this company in the last 30 days. - link

10% Owner at Eli Lilly and Company (LLY) sold 135,193 shares at $794.15 for $107.36M. This is their 19th largest sale (out of 261) and decreased their vested position to 95,357,800 shares (-0.14%). -2.06% 1m (+34.65% win rate) / -5.28% 3m (+22.53% win rate) avg returns on 261 previous sales. This is the 5th insider sale at this company in the last 30 days (and there was 1 other sale on the same day). - link

10% Owner at CoreWeave, Inc. (CRWV) sold 732,944 shares at $139.55 for $102.28M. This is their 21st largest sale (out of 53) and decreased their vested position to 38,269,983 shares (-1.88%). -4.89% 1m (+38.10% win rate) / -0.28% 3m (+70.59% win rate) avg returns on 53 previous sales. This appears to be a regularly scheduled weekly transaction. Selling the rip (stock was up 53.54% in the month before the sale). This is the 39th insider sale at this company in the last 30 days (and there were 5 other sales on the same day). - link

Director at NuScale Power Corporation (SMR) sold 2,327,690 shares at $38.69 for $90.05M. This is their 3rd largest sale (out of 3) and decreased their vested position to 5,562,897 shares (-29.50%). No returns available. Selling the rip (stock was up 219.60% in the year before the sale). This is the 3rd insider sale at this company in the last 30 days. - link

10% Owner at Eli Lilly and Company (LLY) sold 113,694 shares at $763.39 for $86.79M. This is their 26th largest sale (out of 259) and decreased their vested position to 95,492,993 shares (-0.12%). -2.06% 1m (+34.65% win rate) / -5.28% 3m (+22.53% win rate) avg returns on 259 previous sales. This is the 3rd insider sale at this company in the last 30 days. - link

10% Owner at CoreWeave, Inc. (CRWV) sold 581,484 shares at $139.55 for $81.15M. This is their 26th largest sale (out of 52) and decreased their vested position to 29,742,855 shares (-1.92%). -4.89% 1m (+38.10% win rate) / -0.28% 3m (+70.59% win rate) avg returns on 52 previous sales. This appears to be a regularly scheduled weekly transaction. Selling the rip (stock was up 53.54% in the month before the sale). This is the 39th insider sale at this company in the last 30 days (and there were 5 other sales on the same day). - link

Get the insider trades as soon as they happen

By upgrading to CEO Watcher Premium, you get the top insider trades as soon as they happen and full access to the ceowatcher.com website (including the custom feeds of highest-signal insider trades).

Each morning you get an email with the top insider buys/sells (ranked by the proprietary CEO Watcher ranking system), largest insider buys/sells, largest holdings increases/decreases, and the companies with the most insider buying/selling sent before the market opens each morning.

How was today's email? |

Reply