- 📈👀 CEO Watcher

- Posts

- Top insider trades (Mon, Dec 22)

Top insider trades (Mon, Dec 22)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

There were 190 new insider filings:

A second AutoZone (AZO) director buys the dip ($500k)

The Dorchester Minerals Operating LP bought $445k of Dorchester Minerals (DMLP)

Daniel Lau, a 10% Owner, bought $1.42M of Gran Tierra Energy (GTE)

Another Director at The Cooper Companies (COO) bought the stock (first-ever purchase)

The Chief Administrative & Legal Officer at AppLovin (APP) exchanged 2.6% of her shares for shares of an exchange fund that she won’t receive for at least 7 years.

The CEO at Urban Outfitters (URBN) has sold $250M of the stock in the last month

The CEO at Patrick Industries (PATK) sold $2.88M

A Sr VP at Hecla Mining (HL) sold $4M of the stock (largest sale ever). Another Sr VP also sold $1.5M

The CFO at Intuit (INTU) sold $741k.

and much more…

I go into more depth on these companies in the CEO Watcher Premium sections below.

Commentary

In the November 17th email Trade Notes section, I shared the below note on Redwire (RDW) and added it as a High Signal Trade to the CEO Watcher Premium Dashboard.

-

Redwire Corp (RDW)

Description: Provides critical space solutions and space infrastructure for government and commercial customers in the United States, Europe, and internationally. ($900M mkt cap)

Conclusion: Wait for price action to improve despite very high-signal insider activity and compelling industry setup

The Chief Accounting Officer made their largest purchase ever ($30k) with stellar historical returns (25% 1m / 44% 3m / 61% 6m / 207% 1y, 100% win rate). Obviously, not a huge purchase, but their previous returns are high enough to make it very interesting. Plus, three other executives also bought last week, giving this cluster a very strong insider signal. The company recently signed contracts with Italy’s defense sector and Croatia’s border patrol, with revenue up 50% YoY, contract awards tripling YoY, and adjusted EBITDA improving through growth and margin expansion (27% adjusted gross margin). However, they had to delay several orders into 2026 due to the U.S. government shutdown. It doesn’t look particularly cheap, so it’ll be more of a growth/momentum play. The stock is down 32% in the last month, down 50% in six months, and trading well below all moving averages, so I’ll wait for price action to turn before potentially entering.

-

Just a few days after this email, the stock chart flattened out. Then a couple of weeks later, it started to inflect. Now, just one month later, the stock is up almost 50% (but still down 50% in the last 6 months).

There are a handful of takeaways from this setup that we can learn as we look for future potential winners:

If the insider has insane returns (like 200% 1y returns), it’s probably worth taking a position most of the time

As we’ve found in our research, large transaction values are not a good signal. On average, transactions under $100k perform best. So, a $30k purchase should not scare you away.

Dip buying is the best signal

Most insider purchases are value buys, but momentum/growth plays can still work well, especially when paired with positive news (like new contracts) and/or a strong macro theme.

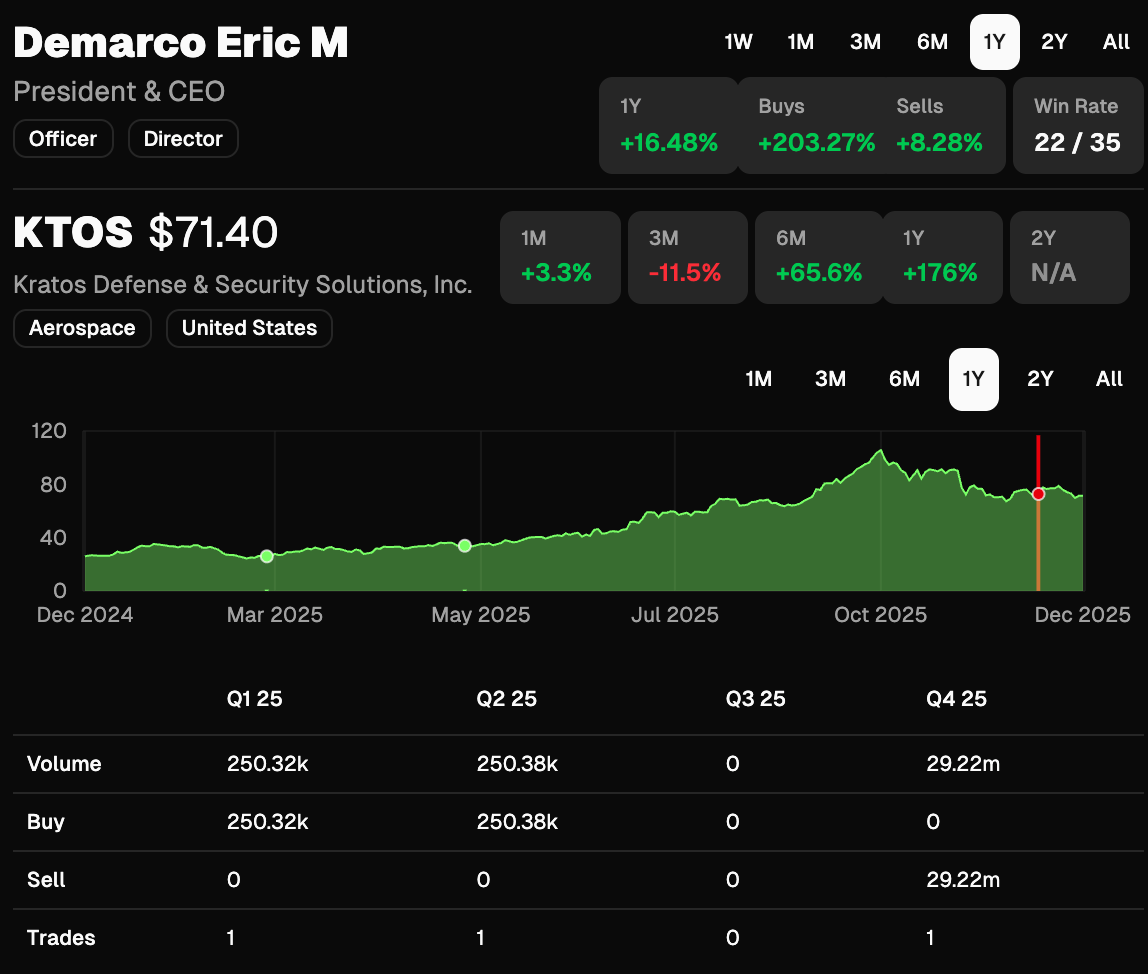

We saw a very similar growth/momentum setup at Kratos Defense (KTOS) in May. The CEO was buying the stock (and he had a killer track record), the Trump administration is very favorable for the Defense industry (good macro theme), and they were actively signing deals.

Kratos (KTOS) stock was ~$34 when we found it in May and got above $100 by October.

keep scrolling. top trades + all of the charts and data below

🔒 CEO Watcher Premium

The rest of this email (including today’s top insider trades + all the charts and data) is for CEO Watcher Premium subscribers only. To see an example of the Premium email, click here.

Upgrade to CEO Watcher Premium at ceowatcher.com to unlock:

The Premium daily emails

Full access to the website, which has all insider trades back to 2009. It includes search/filters and the returns of every trade and every insider to help you find the top insider trades

Full access to the CEO Watcher Premium Discord where I share my notes and holdings in the CEO Watcher Portfolio

The Premium Dashboard, which has a bunch of charts/tables with insider trading data that is updated each day

If CEO Watcher Premium is not for you, I give full refunds with no questions asked.

Reply