- 📈👀 CEO Watcher

- Posts

- Top insider trades (Fri, Dec 19)

Top insider trades (Fri, Dec 19)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

There were 216 new insider trades files:

A director at SentinelOne (S) bought $595k. This is the first insider purchase by any insider at the company in over a year (there have been 50 sales though lol)

A director at Salesforce (CRM) bought $500k

A director at Trump-backed American Bitcoin Corp (ABTC) bought the stock after its 80% decline since IPO

Nerdy (NRDY) CEO keeps buying

A director at Turning Point Brands (TPB) sold $216k of the stock. Their only previous sale was 3.5 years ago and the stock fell 25% in the next year

CFO at Lear Corp (LEA) sold $590k (largest sale ever, out of 6). This sale decreased their listed holdings by 25%

The Chief Commercial Officer at United Parks & Resorts (PRKS) sold $252k. The only two previous times they sold the stock, it fell 27% and 11% in the next 3 months.

A director at Warby Parker (WRBY) sold $518k of the stock after its nearly 100% run-up in the last month

The CEO at Las Vegas Sands (LVS) continues to sell insane amounts of the stock. They just sold another $84M

The CEO at Roivant Sciences (ROIV) sold $37M

and much more…

I go into more depth on these companies in the CEO Watcher Premium sections below.

Commentary

We are ending our 3rd consecutive week of below-average insider buying.

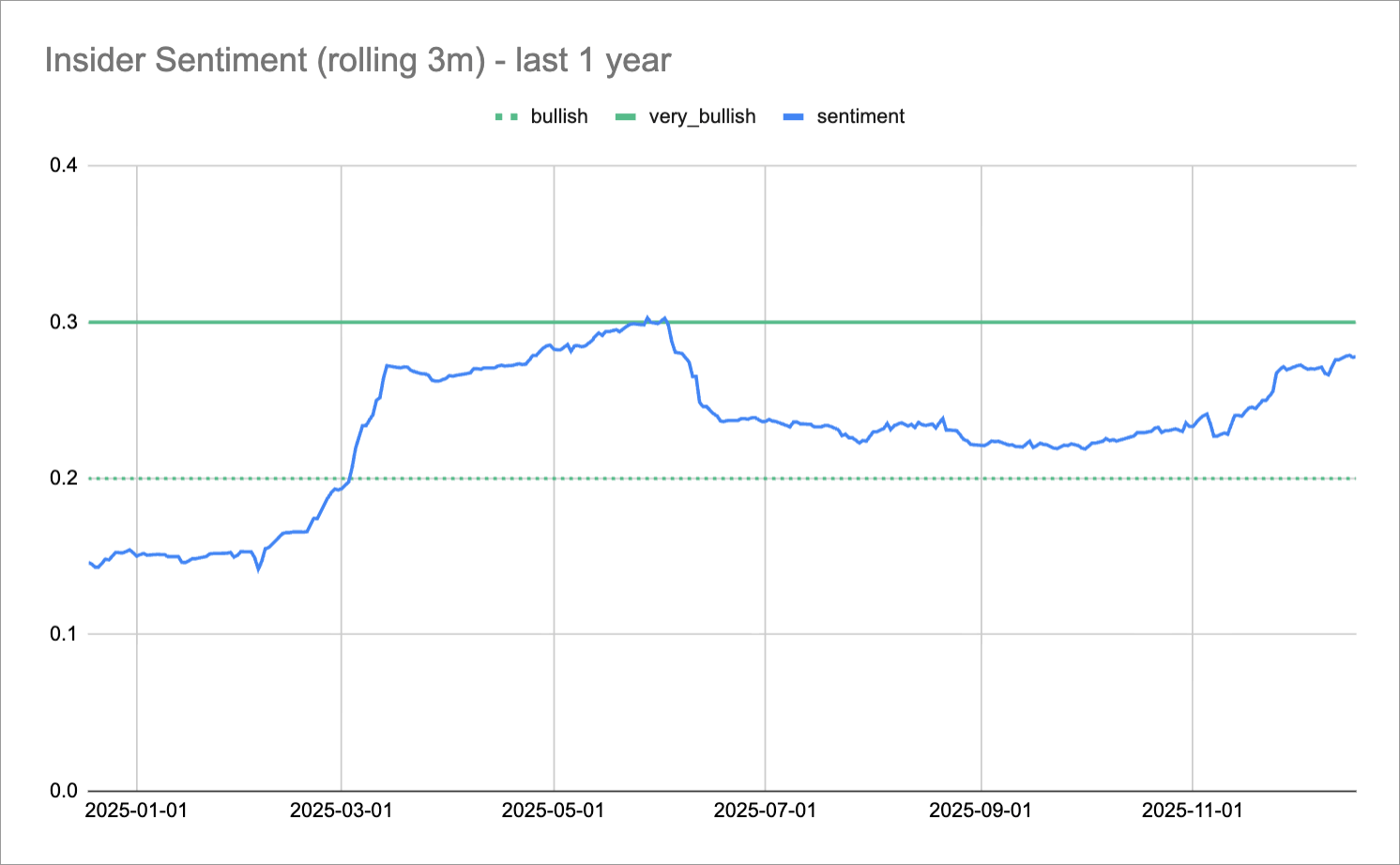

This does align with the choppiness we have been seeing in the market, but our rolling Insider Sentiment Score is still quite strong due to the above-average insider buying from the end of September through the end of November.

This score will start to roll over if the below-average insider buying continues, so it is worth keeping an eye on the insider sentiment through the end of the year.

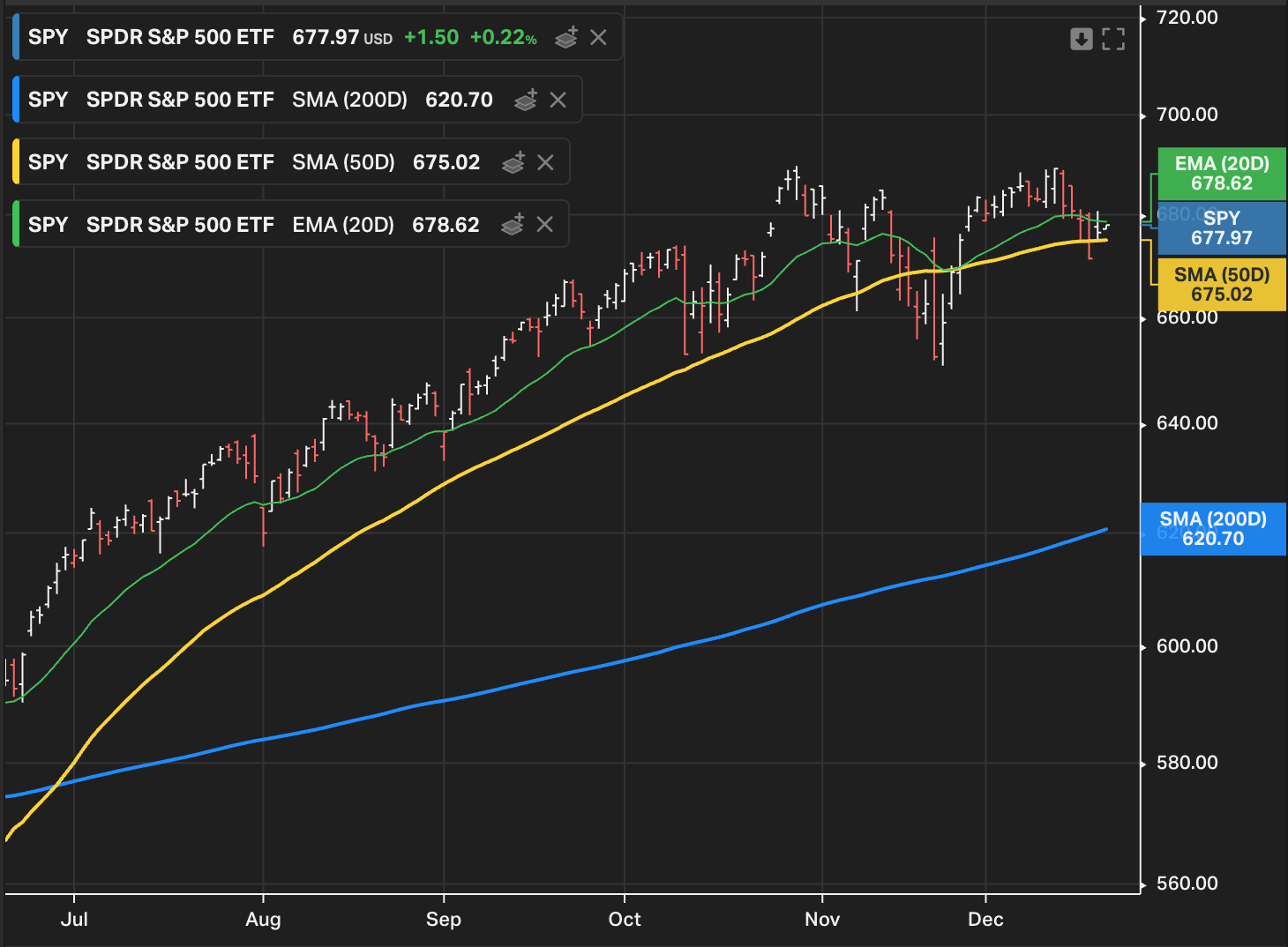

The S&P also fell below the 50d SMA briefly before bouncing back above it due to the strong economic data that came out yesterday.

The below-average insider buying over the last few weeks and the S&P consistently testing the 50d are certainly notable, but I don’t think it’s anything too worrisome yet.

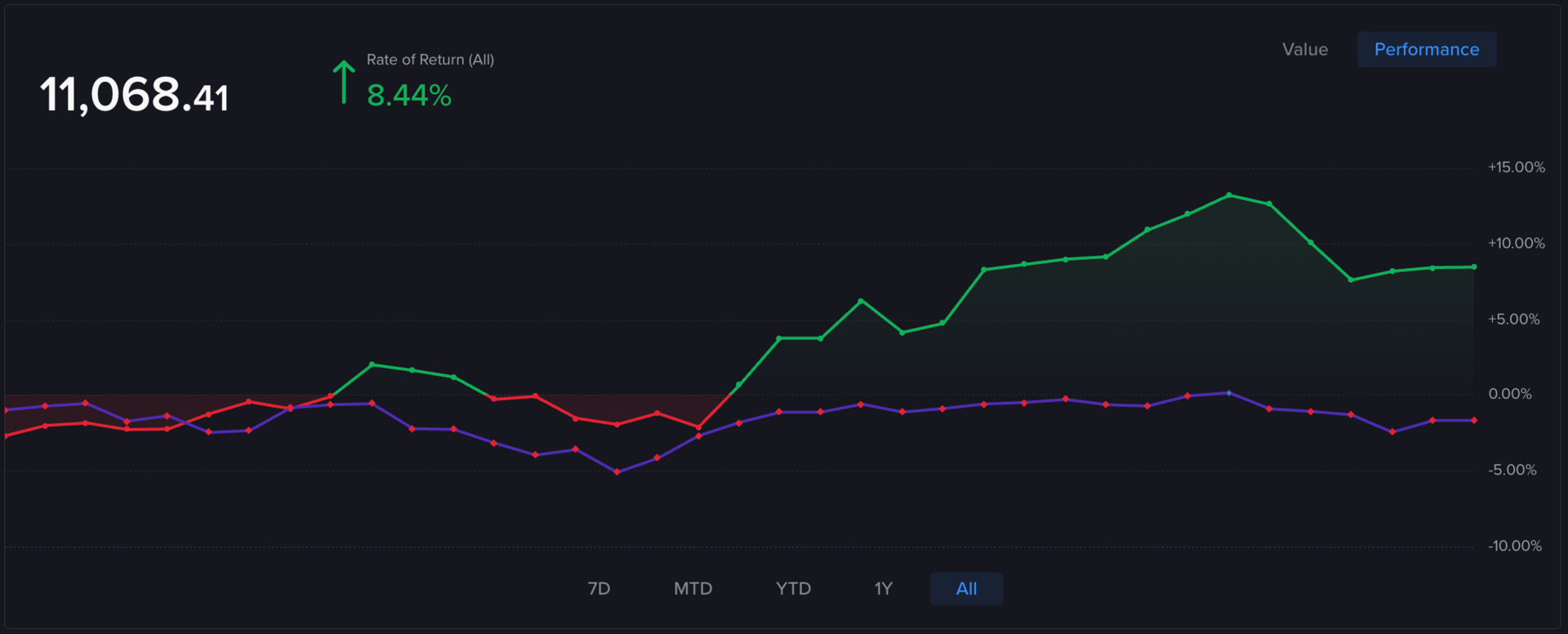

As for the CEO Watcher Portfolio, after three weeks of basically going straight up, we finally had a rough week.

We also got wildly unlucky that our rules dictated that we sell Redwire (RDW) literally one day before it popped 15% after announcing a deal with a European aerospace firm (and it’s up another 8% today).

That would’ve put us back up above 10% returns since starting on November 1st, but oh well. We are still beating the S&P quite handily (so far).

The CEO Watcher Portfolio, and the insider sentiment charts (and a bunch of other data), are always available to CEO Watcher Premium subscribers in the Data Dump section of these daily emails and the CEO Watcher Premium Dashboard (also linked in the Data Dump section).

If interested in upgrading, you can do so at ceowatcher.com. If it’s not for you, I’ll give a refund with no questions asked.

keep scrolling. top trades + all of the charts and data below

🔒 CEO Watcher Premium

The rest of this email (including today’s top insider trades + all the charts and data) is for CEO Watcher Premium subscribers only. To see an example of the Premium email, click here.

Upgrade to CEO Watcher Premium at ceowatcher.com to unlock:

The Premium daily emails

Full access to the website, which has all insider trades back to 2009. It includes search/filters and the returns of every trade and every insider to help you find the top insider trades

Full access to the CEO Watcher Premium Discord where I share my notes and holdings in the CEO Watcher Portfolio

The Premium Dashboard, which has a bunch of charts/tables with insider trading data that is updated each day

If CEO Watcher Premium is not for you, I give full refunds with no questions asked.

Reply