- 📈👀 CEO Watcher

- Posts

- Top insider trades (Wed, Nov 19)

Top insider trades (Wed, Nov 19)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

We found 254 new insider trades.

CEO at Sonos (SONO) bought $1M of the stock (increasing his listed holdings by 25%)

CEO at TransMedics (TMDX) bought $1M

Continued insider buying at Arbor Realty (ABR)

A director at Simon Property Group (SPG) bought the stock for the first time

10b5-1 sales at Cisco (CSCO) have ramped up with $72M in sales today. The CEO sold $47M, which is over 4x higher than any previous sale.

Co-COO at TransDigm (TDG) sold $5.2M (largest sale ever)

A director at Trump Media & Technology Group (DJT) sold the stock

and more…

I go into more depth on these companies in the Today’s Top Trades and Other Trade Notes sections.

Commentary

A very interesting (and unfortunate) morning for Wix (WIX), the stock I shared with CEO Watcher Premium members last week because it appeared that the CEO of Wix and Founder of Base44 (an AI website building platform that Wix bought) were both hinting at massive growth from Base44 and a solid earnings update.

Here’s a quick recap (Premium subs can skip this recap):

-

(recap start)

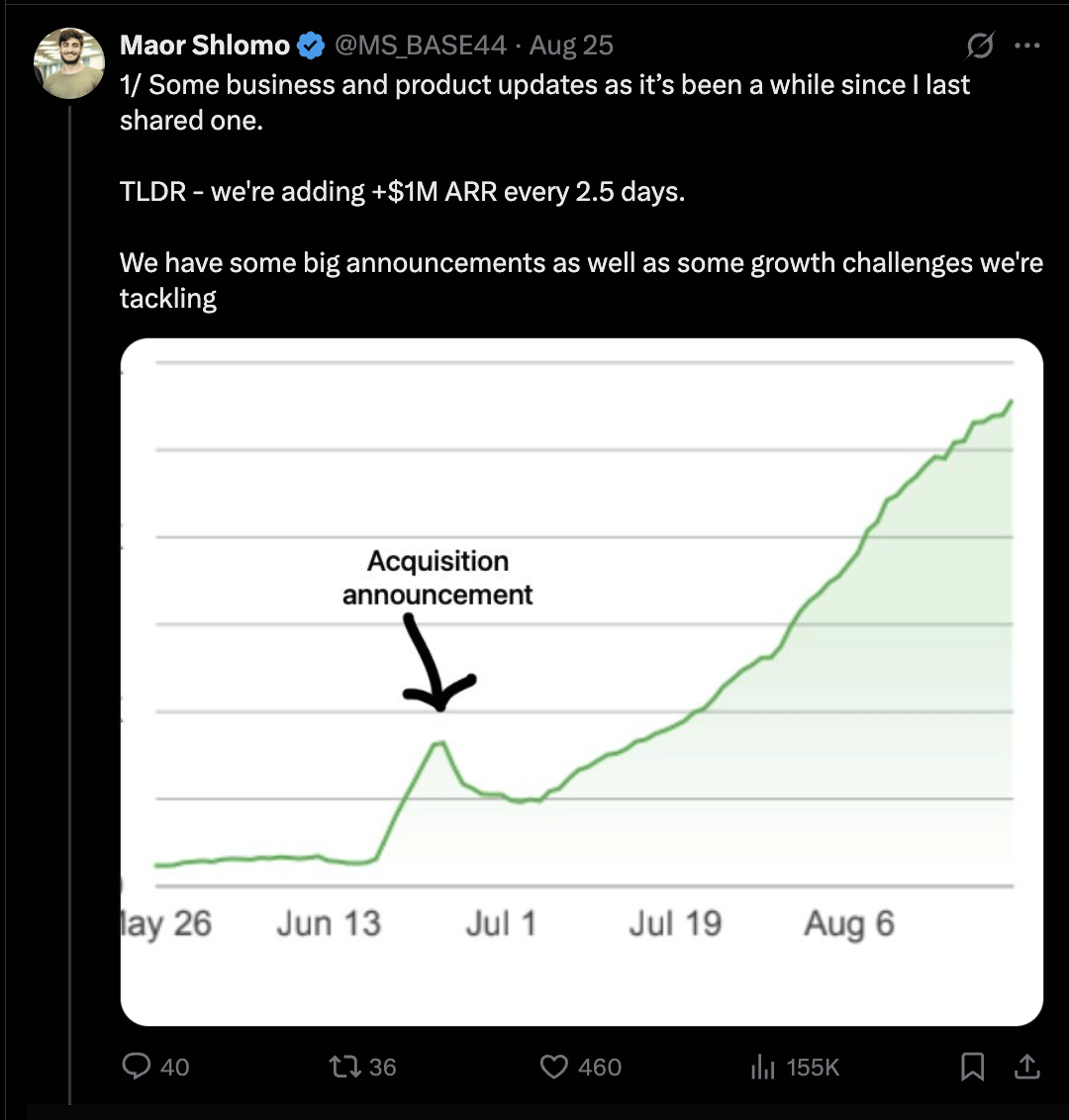

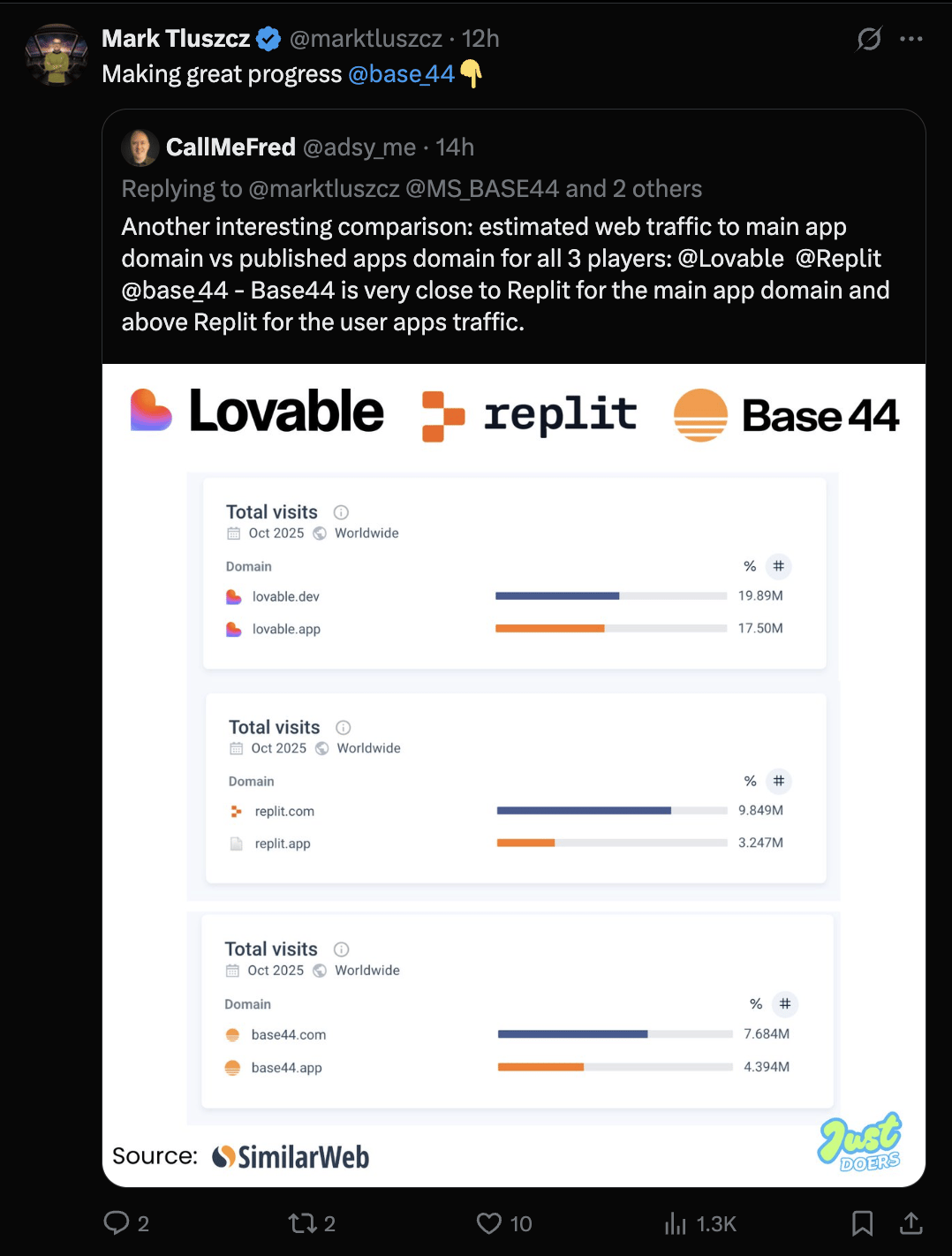

Wix acquired AI site maker Base 44 back in June. On August 31, the founder/CEO of Base 44 tweeted the below, showing a graph of Base 44 usage since the acquisition. He also mentioned that they are adding $1M ARR every 2.5 days, which is certainly notable for Wix, which does ~$2B in rev/year.

This caused the WIX stock to go on a tear, up over 30% in the next month. However, it gave all of those gains back in the following month.

And then, just before earnings, we had the CEO of Wix tweeting this out…

and posting cheery pics with the Base 44 founder.

It seems like Wix is very happy with Base44's progress, and this doesn’t look like a CEO who is about to report poor earnings.

(recap end)

-

As we expected, Wix crushed earnings and focused heavily on Base44 and its growth in the earnings report. EPS beat by 23%, rev beat by 0.5%, and guidance was raised. However, the stock still fell 8% after earnings were released! (note: I wrote this at 7:15am EST, and the stock is down even more now)

They mentioned increased costs and lower margins due to increased AI and marketing costs because Base44 is growing so fast. This is exactly what a company should do when they are trying to put “gas on the fire” and grow, but the market is much less friendly to AI costs (and non-Google AI companies in general) than it was even just a few weeks ago.

In fact, based on a quick listen of the earnings call, it seems like there is a lot of concern that vibe coding is a flash in the pan and the revenue is short-lived. Clearly, there has been a big shift in sentiment around AI storylines. If this earnings report had come out a month ago, when AI sentiment was still through the roof, I think the reaction would be completely different.

Unfortunately, we got hit with the unusual scenario of a “beat-and-raise” quarter, but with the stock still falling. As per my own rules laid out yesterday, I always sell earnings plays immediately after the earnings are released, and got out for around -10%. I may take a separate stab at buying the dip here, just because the earnings reaction seems a little insane to me, but that’s a totally separate trade (and unrelated to insider trades).

Our three public CEO Watcher Premium earnings calls had results of:

+8% for Shift4 (FOUR) after a slight beat on both EPS and Revenue

+11% for CorMedix (CRMD) after crushing earnings and raising guidance

-10% for Wix (WIX) after beating earnings and raising guidance

We were 3/3 on whether the companies would beat earnings and still came out ahead overall (while the market was down meaningfully over this stretch), but the returns would have been significantly better in a stronger market. Both Shift4 and CorMedix gave back their gains throughout the day (which is why we don’t hold onto earnings plays throughout the day), which is just another indicator of how brutal this market was for earnings season (and potentially a hint to lay off the earnings plays during tough markets).

Oh well. We march forward!

I did have one person mention that instead of buying the stock, they just placed a bet on Polymarket that Wix would beat earnings and made money that way. There’s not enough volume on Polymarket for it to be useful to me (yet), but it's a very interesting strategy for smaller bets.

keep scrolling. more data below

🔒 Today’s Top Trades

This section is for premium subscribers only. Upgrade at ceowatcher.com to unlock all of the premium sections + full access to the CEO Watcher website + access to the CEO Watcher Discord.

🔒 Other Trade Notes

This section is for premium subscribers only. Upgrade at ceowatcher.com to unlock all of the premium sections + full access to the CEO Watcher website + access to the CEO Watcher Discord.

🔒 Data Dump

This section is for premium subscribers only. Upgrade at ceowatcher.com to unlock all of the premium sections + full access to the CEO Watcher website + access to the CEO Watcher Discord.

Reply