- 📈👀 CEO Watcher

- Posts

- Top insider trades (Thu, Nov 20)

Top insider trades (Thu, Nov 20)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

Looks like NVDA saved the market for now! Let’s see if it lasts.

We found 299 new insider trades, and it was the third day in a row where over 50% of the unscheduled insider trades were buys, which is way above the median of 33%.

A bunch of insiders at Marriott Vacations (VAC) are buying the post-earnings dip. They also fired their CEO and the President of Vacations, so clearly an attempt at a turnaround is going on there

The CEO at Blue Owl Capital Group (OBDC) bought $1M of the stock

A director at CNH Industrial bought $500k of the stock (first purchase ever)

The Exec Chairman at Sunrise Realty Trust (SUNS) bought $300k. Real Estate continues to be the sector with the most bullish insider buying

The CEO at CervoMed (CRVO) bought $182k (largest purchase ever). A director also bought the stock

A director at TheRealReal (REAL) sold their entire $100M stake after the company’s 150% run-up in the last 6 months

The CEO at Nextpower (NXT) sold the stock for the first time

A director at TransDigm (TDG) sold $10M

and more…

I go into more depth on these companies in the CEO Watcher Premium section of this email.

Commentary

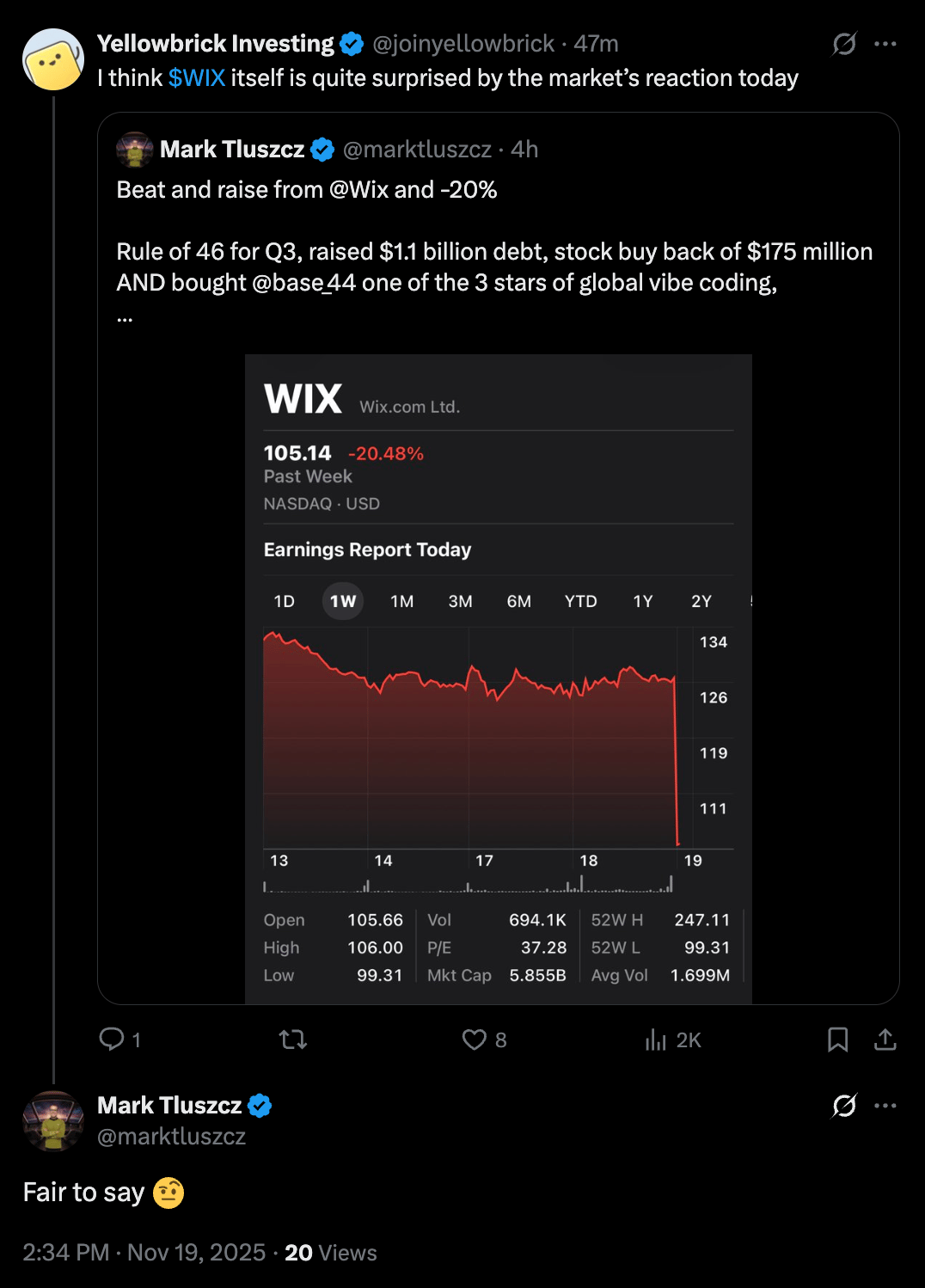

One last note on Wix from yesterday. It looks like even the WIX insiders themselves are very surprised by the market’s reaction to their earnings report (the tweet below is from their Chairman). It doesn’t change the fact that the trade didn’t work out for us, but it is encouraging to know that we properly read the insider signals. I bet similar setups would have positive results 90% of the time. We just got caught in a transition from a market that cared solely about AI company growth to one that is much more concerned about costs.

CEO Watcher Premium Dashboard

I just opened up the CEO Watcher Premium Dashboard to premium subscribers. It’s a Google sheet with a bunch of charts and tables tracking all of the most important insider trading data. The link will always be in the Data Dump section of this email/ Let’s take a look at some of the data.

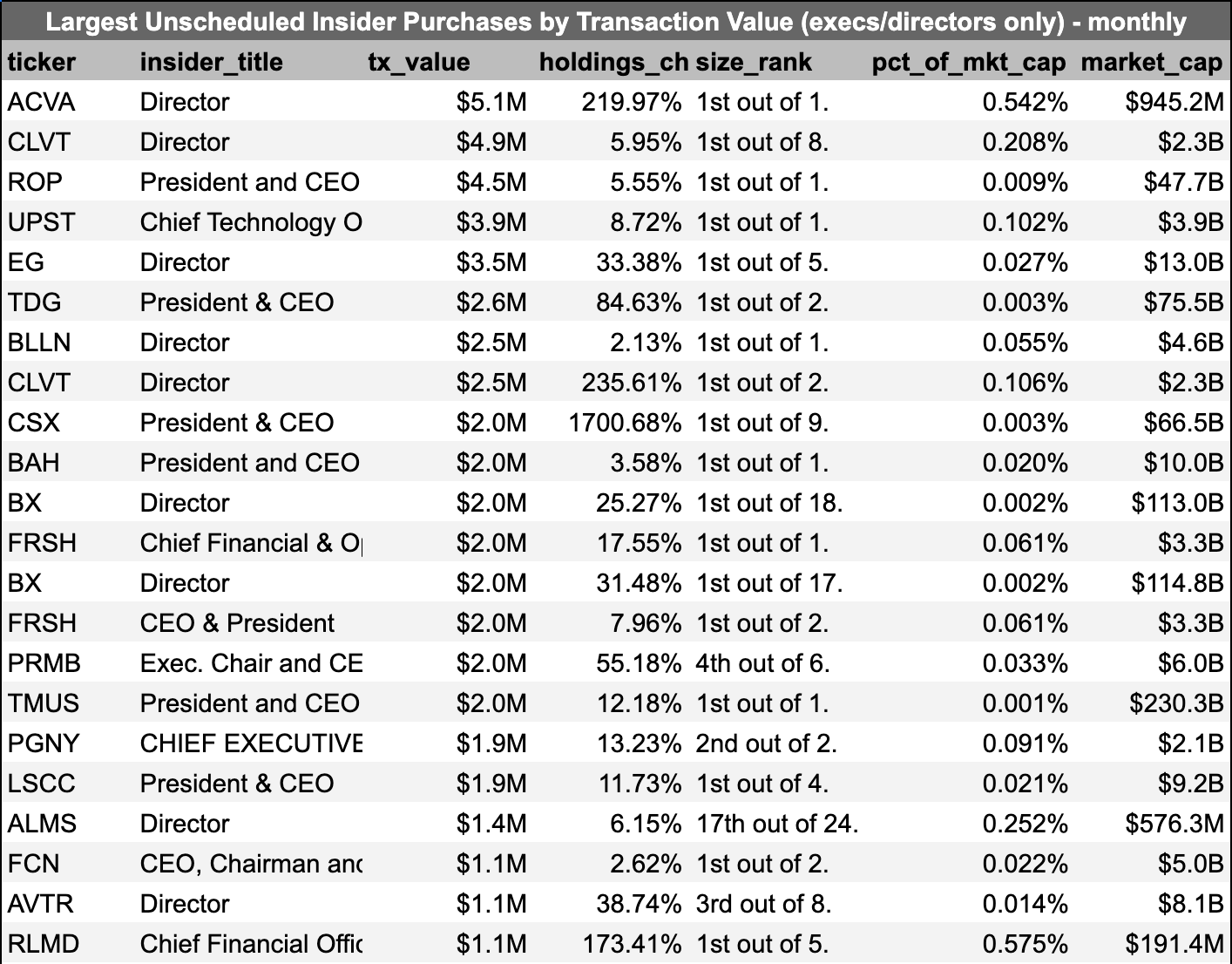

Largest unscheduled buys/sells

Quickly see the largest unscheduled daily/weekly/monthly buys/sells from execs/directors sorted by transaction value, the change in the insider’s holdings, and the size of the trade relative to the company’s market cap.

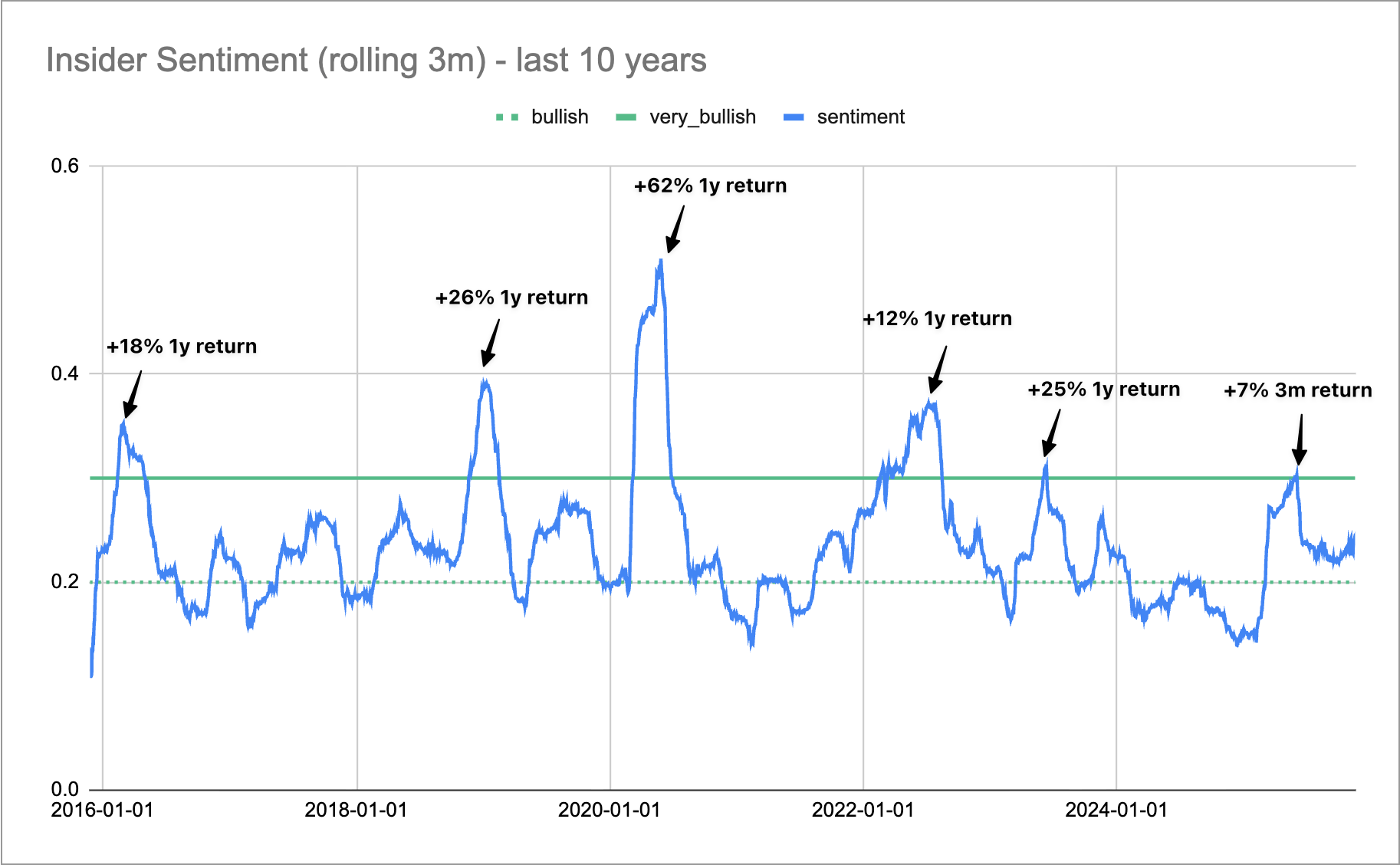

Insider Sentiment Score

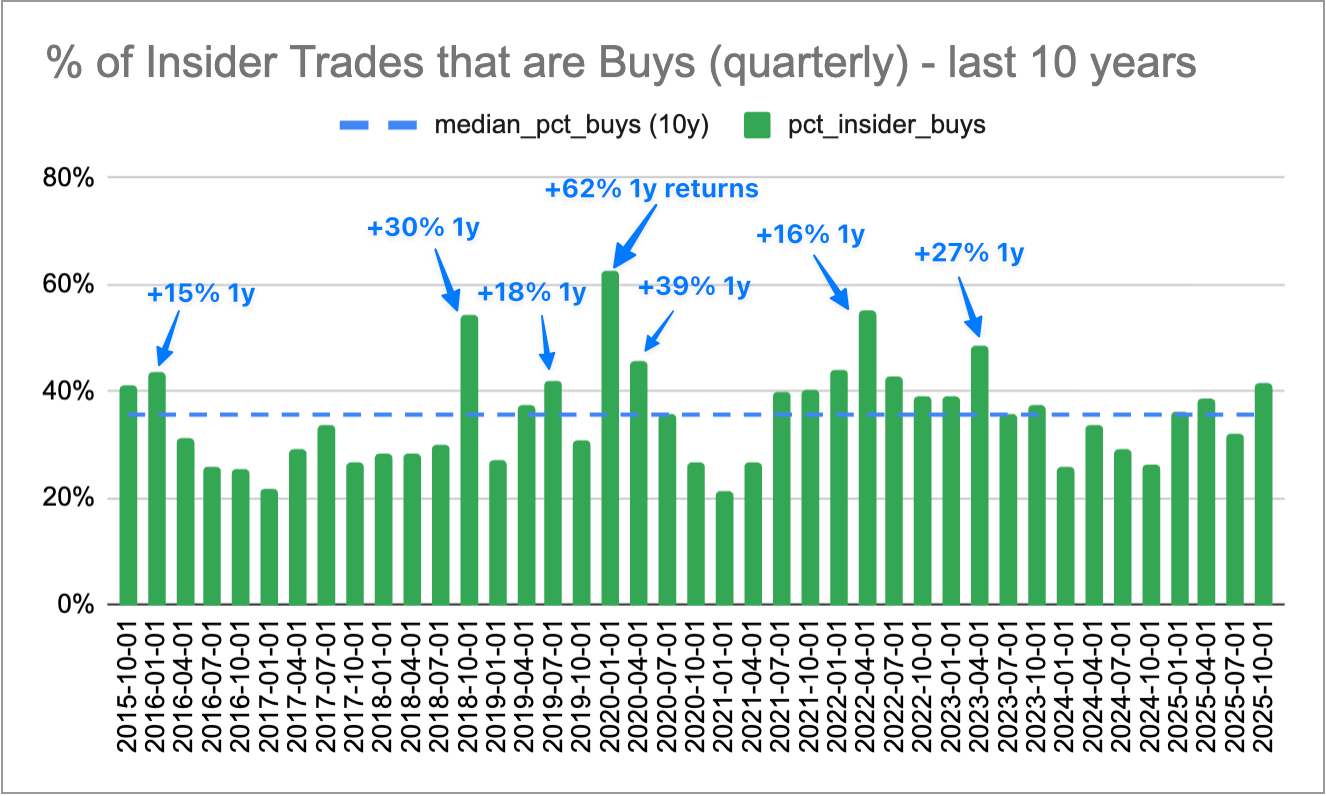

We created an Insider Sentiment Score that tracks the ratio of unscheduled insider buying by execs/directors over the previous three months. You’ll notice that the large spikes in insider sentiment correlate with market periods with very strong forward returns.

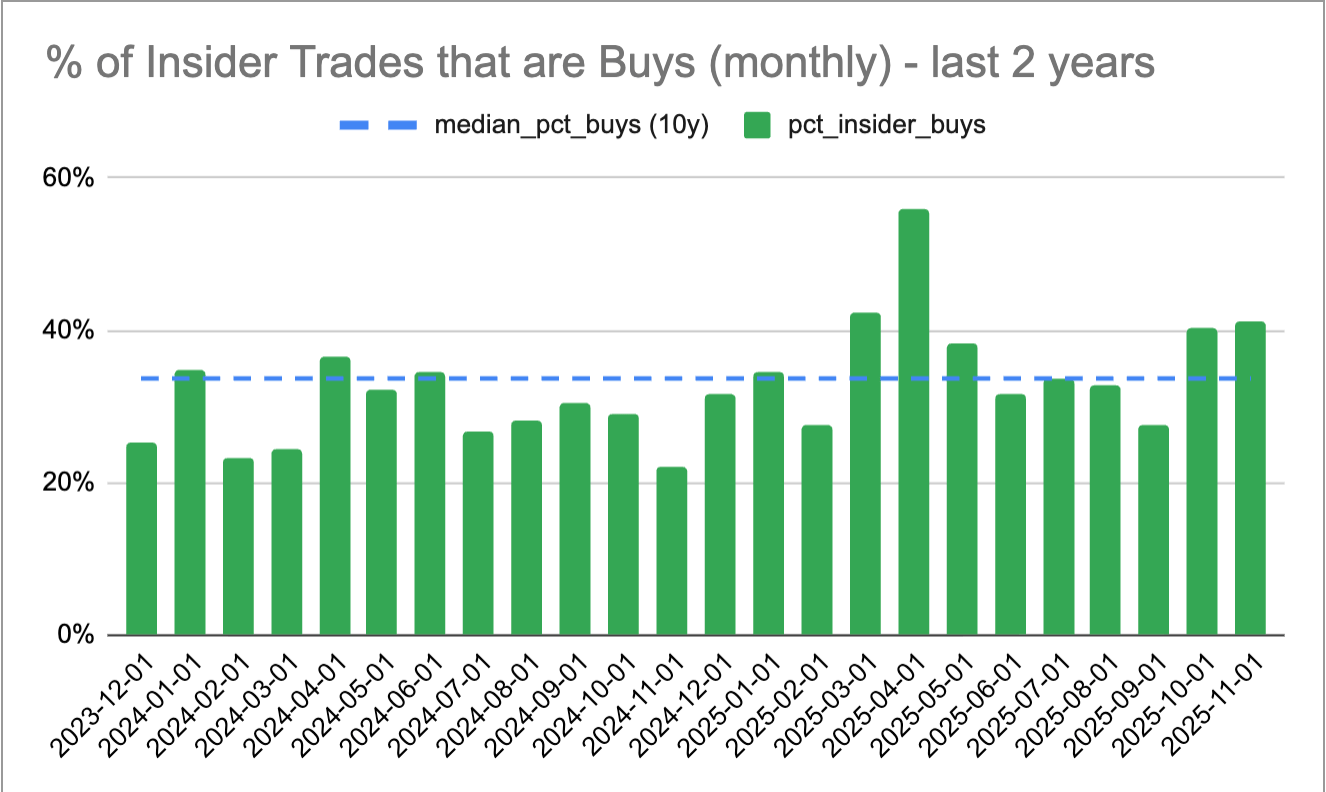

% of Unscheduled Insider Trades that are Buys

This is basically a more granular version of the Insider Sentiment Score chart. We calculate the daily, weekly, monthly, and quarterly scores.

You’ll notice that October/November have been the most bullish months since the April market dip.

And, just like with the Insider Sentiment Score chart, the periods with abnormally high insider buying correlate with very strong forward returns.

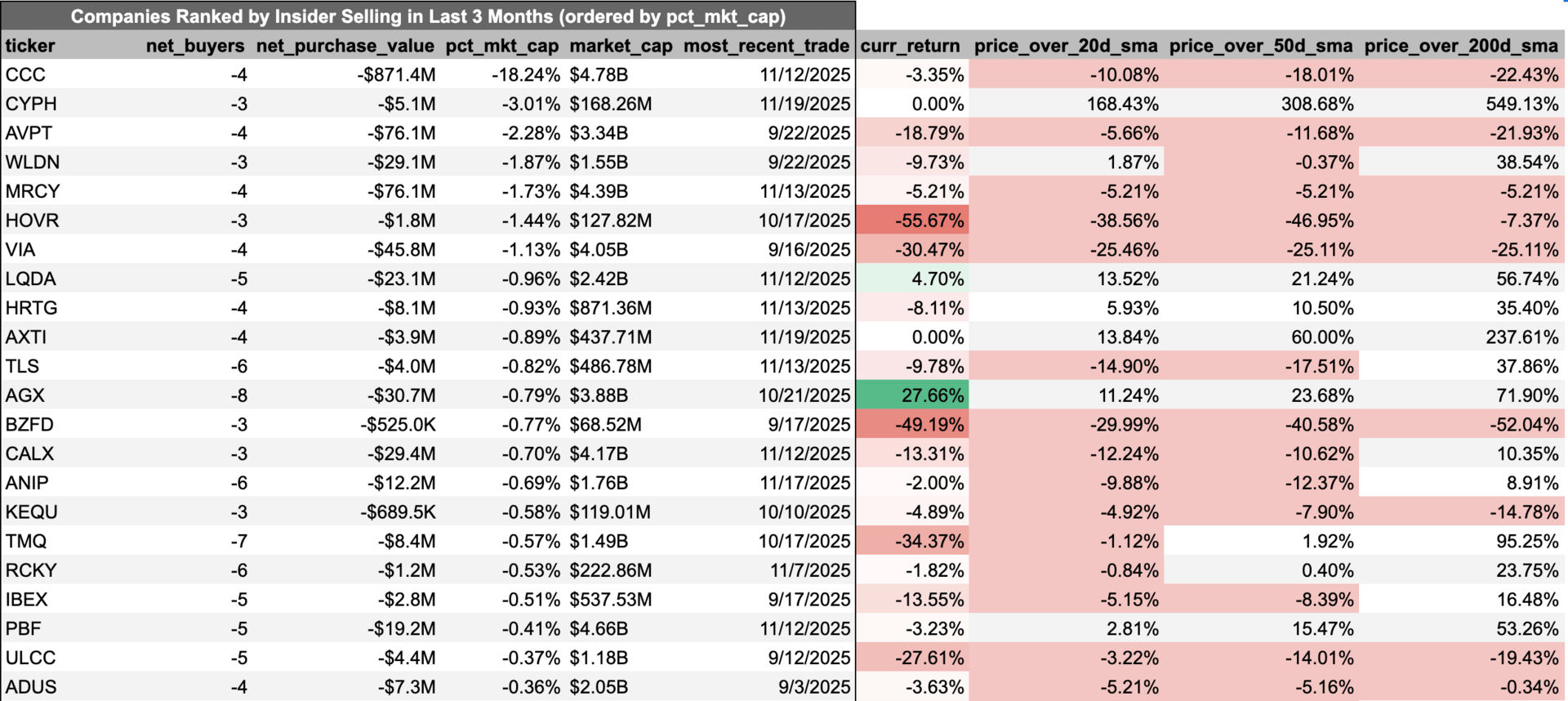

Companies with the most unscheduled insider buying/selling

We group all unscheduled insider buys/sells per company and then calculate which company’s insiders have sold the largest amount of the company (relative to the company’s market cap) in the last three months.

As the image below shows, the companies with the most insider selling in the last three months have terrible returns (calculated from their most recent sale).

You’ll also notice that we include the moving averages to identify when the price action aligns with the insider sentiment, and it might be a good time to short a company (or vice versa for insider buys).

You’ll hear me mention it regularly, but insiders most resemble value investors. They buy their stock when it appears cheap and sell when it appears expensive. Like value investors, they also tend to be early. So to avoid catching falling knives or getting our faces ripped off, we can wait for the price action to align with the insider trading.

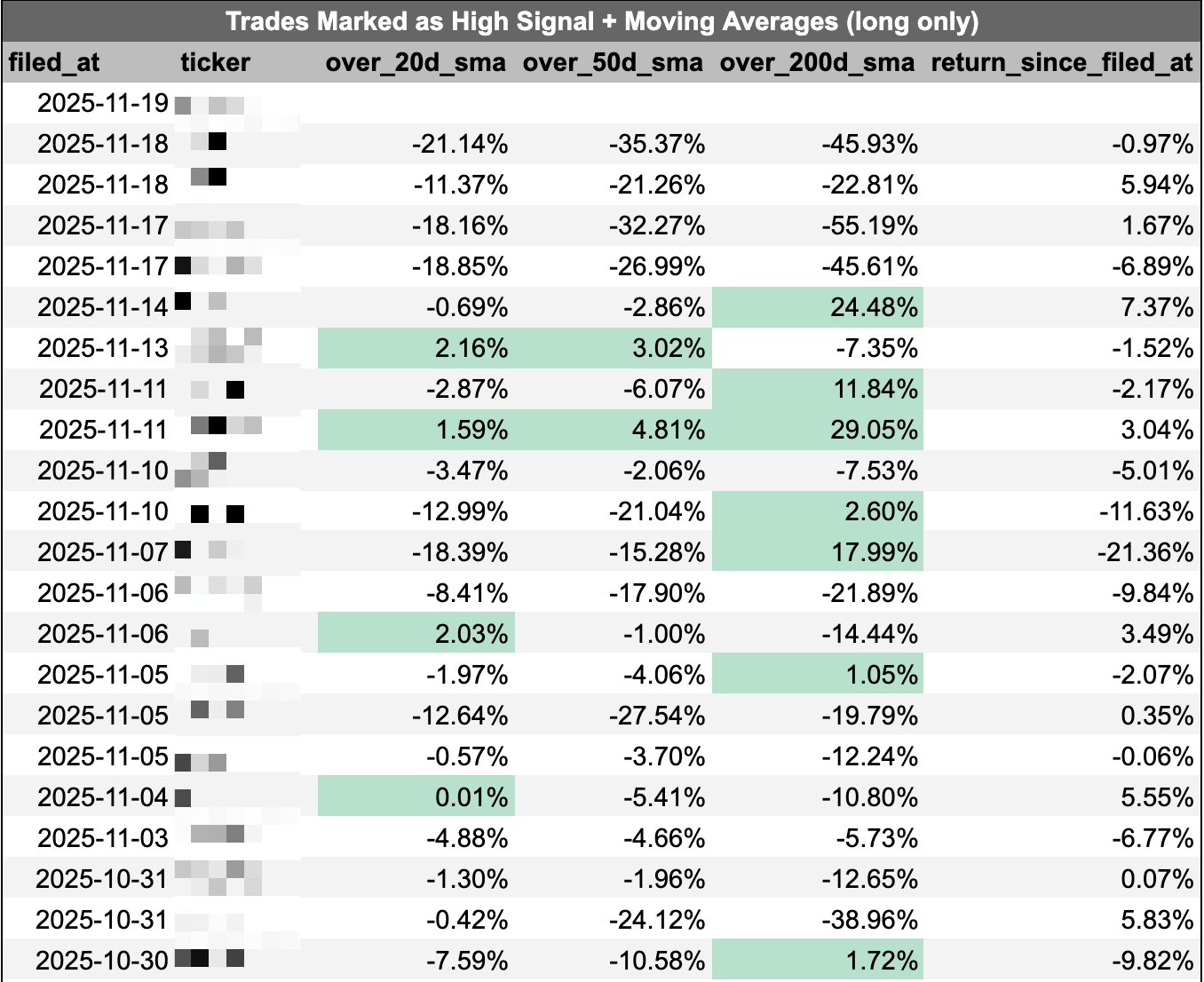

High Signal / More Research Needed

Each morning, I look through all of the insider trades that are made by insiders with strong track records and share the most interesting ones in the CEO Watcher Premium section of this email and the Discord. Now, they are also tracked in the Dashboard, along with the moving averages, so we can track when the price action becomes favorable and it’s potentially time to buy/short the stocks.

Obviously, since the market has been very weak, only a few of the high signal insider buys are trading above their 20d and 50d moving averages, so we are staying away from most of them for now. Though that may be changing soon after the NVDA print last night.

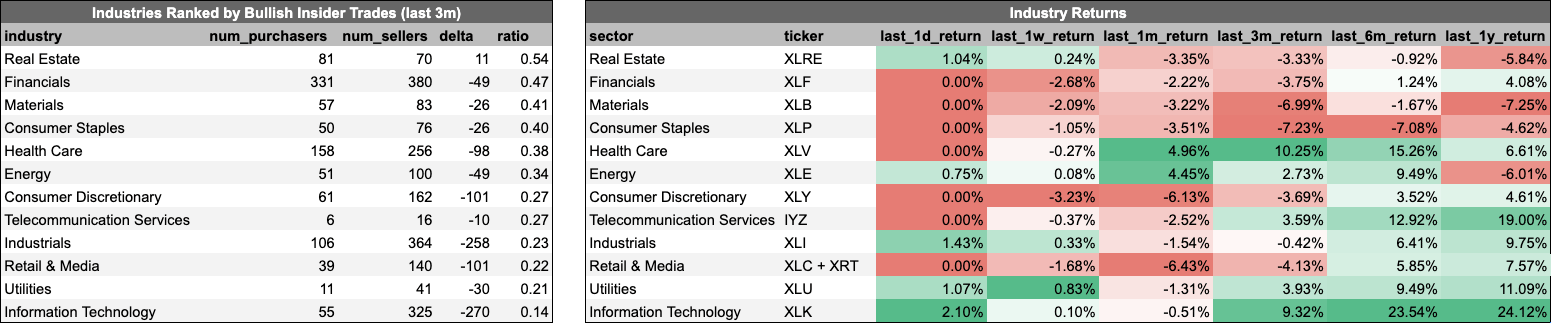

Industry Rankings

We also track the ratio of insider buying/selling by industry. It’s another example of how insiders are value investors, as you’ll notice the industries with the best returns over the last year have the least amount of insider buying, while the industries that struggled the most have the most amount of insider buying.

keep scrolling. more data below

🔒 Today’s Top Trades

This section is for premium subscribers only. Upgrade at ceowatcher.com to unlock all of the premium sections + full access to the CEO Watcher website + access to the CEO Watcher Discord.

🔒 Other Trade Notes

This section is for premium subscribers only. Upgrade at ceowatcher.com to unlock all of the premium sections + full access to the CEO Watcher website + access to the CEO Watcher Discord.

🔒 Data Dump

This section is for premium subscribers only. Upgrade at ceowatcher.com to unlock all of the premium sections + full access to the CEO Watcher website + access to the CEO Watcher Discord.

Reply