- 📈👀 CEO Watcher

- Posts

- Top insider trades (Fri, Nov 14)

Top insider trades (Fri, Nov 14)

Website // Discord // Previous Emails // Contact Me

Connor’s Commentary

There were 283 new insider trades filed. It was a slightly less bullish day (and a slightly less bullish week) than we’ve been having to start November, but nothing too worrisome yet.

The CEO and COO both buy FTAI Aviation (FTAI)

The CEO continues selling Heritage Insurance (HRTG)

A director with a solid track record sells Everspin Technologies (MRAM)

The CEO at Primo Brands (PRMB) buys $2M

The CEO at McCormick (MKC) sells $3.75M

The CTO at Upstart (UPST) buys $3.9M for the first time

The CEO and CFO at Freshworks (FRSH) each buy $2M

and much more…

I go into more depth on these companies in the CEO Watcher Premium sections of this email.

Commentary

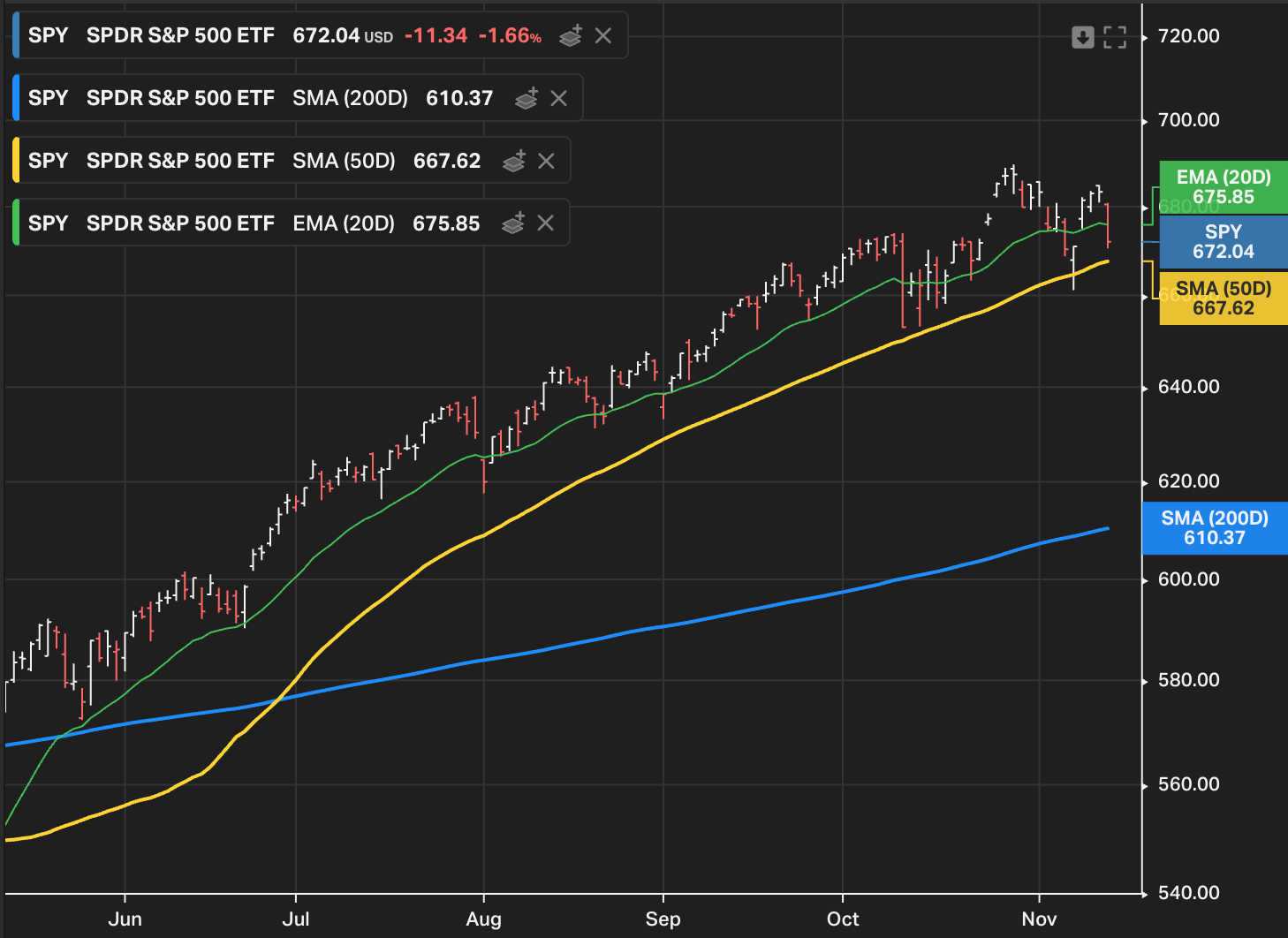

We are in almost the same exact position as last Friday. The S&P will open a bit below the 50d, and everyone will pray for a bounce off of it and a big green day on Monday.

I think most would agree that this dip is a little more concerning than last week's, as we don’t have the government re-opening catalyst and the bounce off of the 50d only lasted one week (and it's now the third time we’ve hit it in the last month).

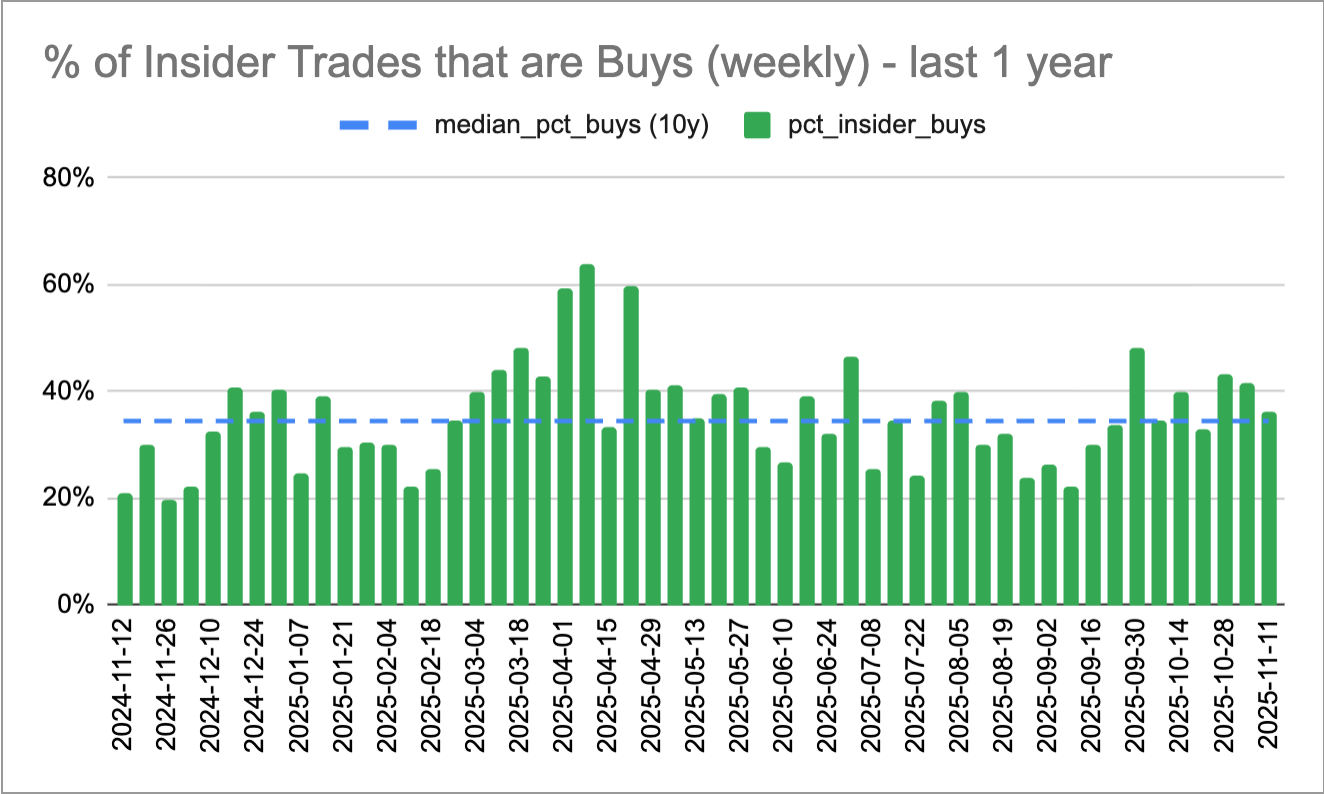

We also had a less bullish week of insider trading than we did for the last two weeks, though it was still slightly above the median.

However, I am not a macro investor. I’m here to talk about insider trading.

One of the very first things you will learn about insider trading is that most insider trades are totally useless.

You can immediately eliminate ~50% of trades simply by ignoring any scheduled trades (10b5-1 plans or an insider that buys/sells on a monthly/quarterly/yearly cadence), tax sales, employee stock purchase plans, dividend reinvestments, and any form of public offering / private placement / purchase agreement. These are all obviously low signal types of trades.

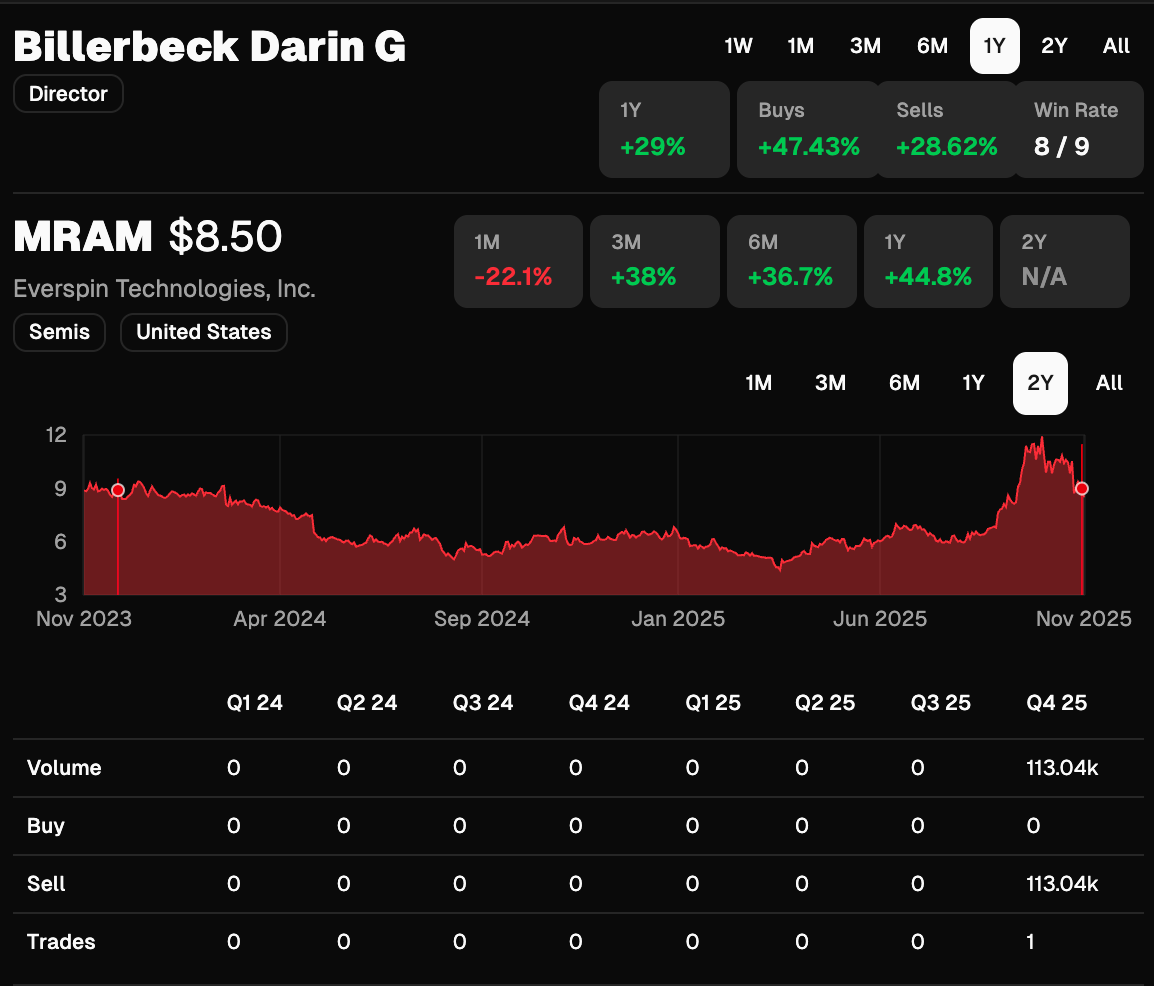

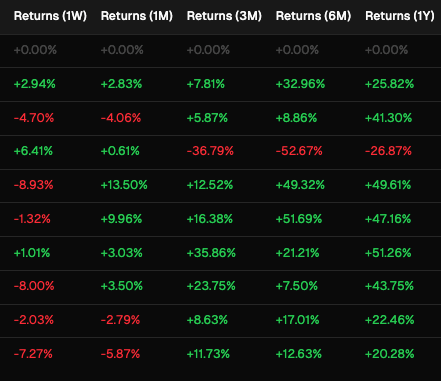

This morning, I came across a great example of this. A director at Everspin Technologies (MRAM) sold $113k of the stock in an unscheduled sale (Form 4 link).

After quickly verifying that the trade is not obviously low signal (using the above criteria), I then check the insider’s track record. Note: one tricky thing about this insider sale is that the director was exercising and selling stock options, which is typically a lower signal. However, you’ll notice that they don’t expire until May 20, 2029, and they likely vested in either 2019 or 2024, giving him either five or ten years until they expire. So he specifically chose to sell them now instead of immediately upon vesting or right before expiration.

On ceowatcher.com, we already calculate an insider’s track record for you, and we remove all of the low signal trades from that calculation. As you can see, he has a very good track record.

However, I still like to quickly look at the individual trade returns just to see if the returns are boosted by an extreme outlier or all clustered together in one time period.

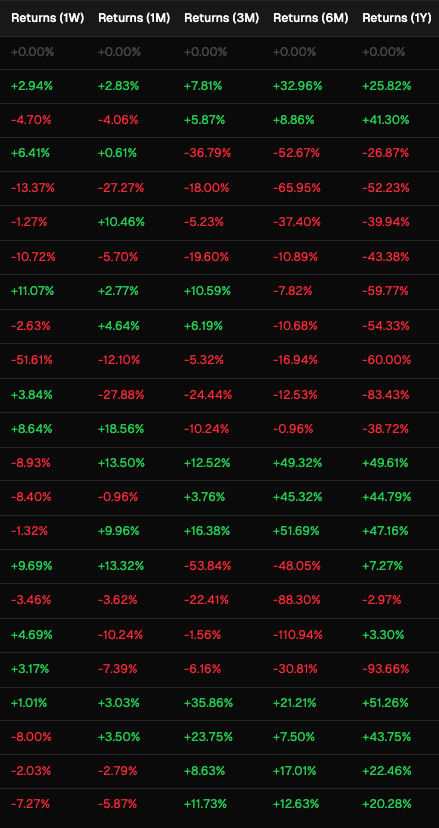

In this case, they were neither boosted by an outlier nor clustered together, but you will see a ton of negative returns (meaning the stock went up after he sold) in the screenshot of the raw data below.

This obviously doesn’t match our calculated returns, and that is because a lot of these trades are tax sales. Once we remove all of the tax sales (which we have an easy filter for on ceowatcher.com), his returns look significantly better (and much more accurately reflect the fact that when he chooses to sell the stock, the stock typically falls significantly in the following year)!

The ability to filter out low signal insider trades, plus the fact that we calculate the track record for all insiders back to 2009, are just two of the reasons why CEO Watcher is the best insider trading tool out there.

If you aren’t using ceowatcher.com, I’d highly recommend it! And please give me any feedback/suggestions you may have.

keep scrolling. more data below

🔒 Today’s Top Trades

This section is for premium subscribers only. Upgrade at ceowatcher.com to unlock all of the premium sections + full access to the CEO Watcher website + access to the CEO Watcher Discord.

🔒 Other Trade Notes

This section is for premium subscribers only. Upgrade at ceowatcher.com to unlock all of the premium sections + full access to the CEO Watcher website + access to the CEO Watcher Discord.

🔒 Data Dump

This section is for premium subscribers only. Upgrade at ceowatcher.com to unlock all of the premium sections + full access to the CEO Watcher website + access to the CEO Watcher Discord.

Reply